The stock market witnessed a highly volatile trading session. Intense selling pressure caused the VN-Index to plunge nearly 30 points at one stage, before rebounding strongly towards the close. The VN-Index ended the October 22 session up 15 points (0.91%) at 1,678 points.

Foreign trading activity was a notable negative, with net selling of VND 1,834 billion across the market.

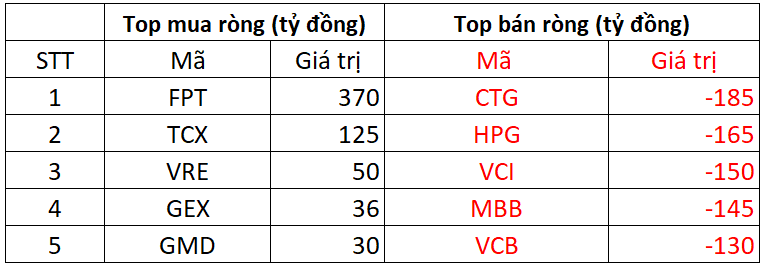

On HOSE, foreign investors net sold VND 1,625 billion

On the buying side, FPT was the most purchased stock by foreign investors on HOSE, with a value of over VND 370 billion. TCX followed closely, with VND 125 billion in purchases. Additionally, VRE and GEX saw buying interest of VND 50 billion and VND 36 billion, respectively.

Conversely, CTG led the selling activity with VND 185 billion in net sales. HPG and VCI followed, with net sales of VND 165 billion and VND 150 billion, respectively.

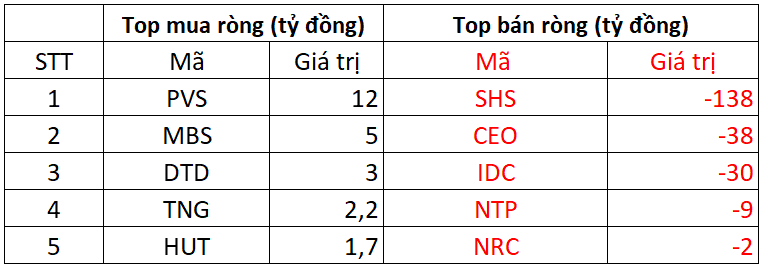

On HNX, foreign investors net sold VND 198 billion

PVS was the most bought stock on HNX, with net purchases of VND 12 billion. MBS was the next most purchased, with VND 5 billion in net buying. Foreign investors also allocated a few billion dong to DTD, TNG, and HUT.

On the selling side, SHS faced the most significant foreign selling pressure, with nearly VND 138 billion in net sales. CEO followed with VND 38 billion in net sales, while IDC and NTP saw net sales ranging from VND 2 billion to VND 9 billion.

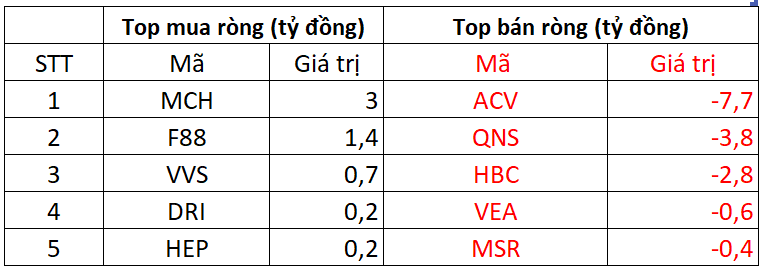

On UPCOM, foreign investors net sold VND 11 billion

MCH was the most purchased stock on UPCOM, with VND 3 billion in net buying. F88 and VVS also saw net buying of a few billion dong each.

In contrast, ACV saw net selling of VND 8 billion by foreign investors. Other stocks like QNS and HBC also experienced net selling.

Mai Chi

October 21st Session: Bank Stocks Rebound, One Stock Hits Upper Limit

At the close of trading on October 21st, the banking sector saw a positive trend with 16 out of 27 stocks ending the day in the green. Notably, HDBank’s HDB stock hit its upper limit, while several others climbed 2-3%.

Market Pulse 22/10: Spectacular Recovery as VN-Index Rebounds to Close at 1,678 Points

At the close of trading, the VN-Index surged by 15.07 points (+0.91%), reaching 1,678.5 points, while the HNX-Index climbed 4.04 points (+1.53%) to 268.69 points. Market breadth favored the bulls, with 448 advancing stocks outpacing 237 decliners. Similarly, the VN30 basket saw a dominant green trend, with 21 gainers, 8 losers, and 1 unchanged stock.

Technical Analysis for the Afternoon Session of October 22: Intense Tug-of-War

The VN-Index opened on a positive note but soon entered a corrective phase. The author anticipates that the August 2025 support level will be tested once again. Meanwhile, the HNX-Index remains anchored to the Lower Band of the Bollinger Bands.