Quarterly Revenue Peaks, But Gross Margin Narrows

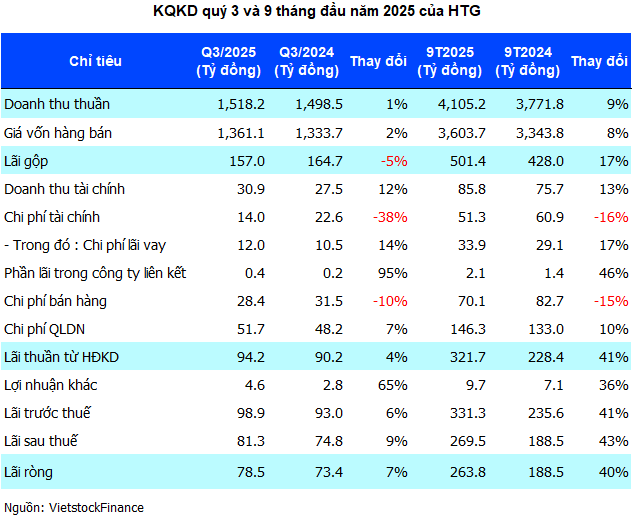

Hòa Thọ Textile Joint Stock Company (HOSE: HTG) recorded a revenue of over 1.518 trillion VND in Q3/2025, a slight 1% increase year-over-year and the highest quarterly figure to date. However, net profit reached only 78.5 billion VND, up 7% year-over-year but down 39% from Q2/2025, which peaked at 129 billion VND. The primary reason is the faster rise in cost of goods sold compared to revenue, narrowing the gross margin to 10.3% from 11% in the same period last year.

|

Nine-Month Revenue and Profit Hit Record Highs

In the first nine months of 2025, Hòa Thọ achieved a revenue of over 4.105 trillion VND and a net profit of nearly 264 billion VND, up 9% and 40% year-over-year, respectively. These are the highest figures for the company in any nine-month period since its establishment. The company has fulfilled 81% of its annual revenue target and 73% of its profit goal.

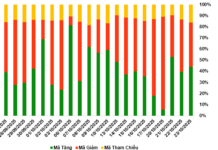

| HTG’s Nine-Month Business Results Over the Years |

By segment, the garment sector remains the core, accounting for 85% of total revenue, with the remainder from the fiber segment. In terms of markets, China leads with 1.364 trillion VND in revenue (up 9%), followed by the U.S. with nearly 821 billion VND (up 5%), and Japan in third place with nearly 465 billion VND, recording the highest growth rate at over 52%. The domestic market contributed 301 billion VND, a slight 2% decline.

Increased Deposits Alongside Higher Borrowing

By the end of September 2025, HTG significantly increased its bank deposits to 1.370 trillion VND, nearly doubling from the beginning of the year and representing almost 40% of total assets. Interest income from deposits in the first nine months reached 26.5 billion VND, up 64% year-over-year.

Simultaneously, the company increased its borrowing, with total loans reaching 1.437 trillion VND. Short-term loans account for over 85%, totaling nearly 1.226 trillion VND, a 32% increase from the start of the year. Interest expenses for the nine months rose 16% to nearly 34 billion VND.

On October 7, the HTG Board of Directors approved a short-term credit limit of 300 billion VND from BIDV Đà Nẵng for 12 months to meet working capital needs for production and business activities.

Expectations for Continued Growth in the Final Quarter

The company plans to closely monitor U.S. tax policies, expand partnerships in Canada, Japan, the EU, and South Korea, focus on technological innovation, cost control, and ensure product traceability while leveraging tax benefits from FTAs. Hòa Thọ projects an additional 1.023 trillion VND in revenue and 71 billion VND in pre-tax profit for the final quarter.

On the HOSE, HTG shares are trading around 44,850 VND per share, up 5% over the past year with an average liquidity of over 35,000 shares per session.

| HTG Share Price Performance Over the Past Year |

– 13:18 22/10/2025