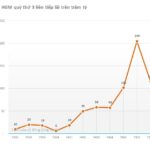

Nam Tan Uyen Industrial Park Joint Stock Company (Stock Code: NTC) has released its Q3/2025 financial report, showcasing impressive business results and positive growth ahead of its official listing on HoSE.

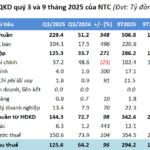

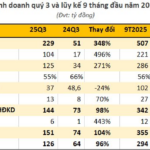

In Q3/2025, Nam Tan Uyen recorded a net revenue of over VND 229.4 billion, a 4.5-fold increase compared to the same period last year. After deducting the cost of goods sold, gross profit reached VND 125.3 billion, up by 270.7%.

According to the company’s explanation, the revenue surge is primarily attributed to the recognition of infrastructure lease revenue from the allocation of contract values over the lease term, as opposed to the previous one-time recognition of the entire contract value for a land sublease agreement.

Illustrative image

Additionally, Nam Tan Uyen generated nearly VND 37.2 billion in financial revenue, a 23.5% decrease year-over-year. Conversely, financial expenses rose from over VND 1 billion to more than VND 4 billion.

During the period, selling expenses totaled VND 772.2 million, an 11% increase year-over-year, while administrative expenses climbed from VND 7.9 billion to over VND 13.4 billion.

Despite higher expenses, Nam Tan Uyen reported a 95.7% rise in net profit, reaching nearly VND 125.6 billion.

For the first nine months of 2025, the company achieved a net revenue of nearly VND 506.8 billion, 2.9 times higher than the same period in 2024. Post-tax profit reached over VND 294.2 billion, a 50.8% increase.

This year, Nam Tan Uyen set a business target of VND 793 billion in revenue and VND 284 billion in post-tax profit. As of now, the company has fulfilled 63.9% of its revenue goal and 103.6% of its profit target.

As of September 30, 2025, total assets decreased by 21.6% from the beginning of the year to nearly VND 5,767.5 billion, primarily due to an 85.1% drop in short-term financial investments to VND 266.6 billion.

However, long-term work-in-progress assets doubled to nearly VND 60.6 billion, mainly comprising VND 47.2 billion in construction costs for Phase 2 of the Nam Tan Uyen Industrial Park expansion project.

On the liabilities side, total payables stood at over VND 4,509.9 billion, down 27.8% year-to-date. Short-term financial leases and loans decreased from nearly VND 2,529.7 billion to VND 138 billion.

Nevertheless, unearned revenue remained significant at over VND 4,224.8 billion, accounting for 93.7% of total liabilities.

Regarding shares, on October 28, 2025, nearly 24 million NTC shares will debut on HoSE with a reference price of VND 161,470 per share. The price will fluctuate within a ±20% range on the first trading day.

Vietnamese Company Exploits Globally Sought-After Mineral, Reports Third Consecutive Quarter of Hundred-Billion-Dong Profits

Post-expense and tax deductions, net profit reached nearly VND 116 billion, marking a 97% surge compared to the VND 59 billion recorded in the same period last year.

FPTS Reports Pre-Tax Profit of VND 167 Billion in Q3/2025 from Proprietary Trading

Despite booking profits from the sale of MSH shares, FPTS still reported a proprietary trading loss in Q3/2025. As a result, the company announced pre-tax profits of VND 167 billion.