Outstanding Financial Results

On October 20, 2025, Imexpharm Pharmaceutical Corporation announced its Q3 and 9-month business results for 2025. Imexpharm continues to demonstrate positive growth across all key metrics, driven by stringent cost management and robust sales performance.

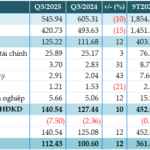

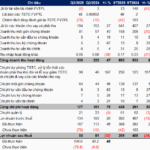

In Q3 2025, the company recorded a 10% increase in gross revenue and a 5% rise in net revenue compared to the same period last year, despite industry challenges. This reflects Imexpharm’s ability to sustain growth in both OTC and ETC channels.

Cost of goods sold increased by only 3%, lower than revenue growth, due to efficient production planning, optimized factory capacity, and cost-saving measures across four manufacturing clusters. In Q3, Imexpharm also launched the final freeze-dried powder production line at its EU-GMP-certified IMP4 facility, further enhancing its EU-standard manufacturing capacity.

Inside Imexpharm’s EU-GMP-certified pharmaceutical manufacturing facility. Photo: Imexpharm.

As a result, gross profit rose by 9% year-on-year, with a stable 40% gross margin.

Operating expenses remained tightly controlled, with selling and administrative costs up only 3%, showcasing disciplined spending amid market expansion and digital transformation investments.

With strong cost control and operational efficiency, net profit before tax (NPT) increased by 11%, and EBITDA grew by 12%, highlighting the company’s focus on profitability.

Quarterly results dipped slightly compared to the high-growth Q2, primarily due to two temporary factors: increased Q2 purchases ahead of July price adjustments and policy changes effective July, including business tax regulations, provincial administrative mergers, and two-tier governance implementation.

After a slower August, sales rebounded strongly in September, with net revenue up 25% month-on-month, NPT surging 101%, and EBITDA rising 48%, underscoring robust market demand.

For the first nine months of 2025, gross revenue reached VND 2,118 billion, up 21% year-on-year, and net revenue hit VND 1,800 billion, a 16% increase. This growth was driven by strong performance in both OTC (up 19%) and ETC (up 21%) channels.

Gross profit increased by 21%, pre-tax profit by 23%, and EBITDA by 18%. The gross margin remained at 40%, while the EBITDA margin rose to 22.3%, reflecting balanced growth and operational efficiency.

As of September, Imexpharm achieved 68% of its full-year net revenue target and 63% of its pre-tax profit goal, staying on track for year-end objectives.

In the first nine months, Imexpharm launched 20 new products, exceeding the annual plan of 16 SKUs, and maintained innovation with 144 ongoing R&D projects.

ESOP Share Issuance

Per the Board Resolution dated September 23, 2025, the company proposed issuing over 1.55 million ESOP shares at VND 5,000 per share, with a one-year transfer restriction. As of September 30, 2025, IMP shares had risen 14% year-to-date.

Transitioning from cash bonuses to ESOP shares preserves cash flow while aligning employee and company long-term interests. Once approved, this program will strengthen workforce development and investor confidence in Imexpharm’s disciplined management and sustainable growth commitment.

Market Outlook

Digital transformation, AI integration, and the rise of specialty and biological drugs are reshaping global R&D. Amid these shifts, high-quality generics and biosimilars remain essential for managing rising healthcare costs.

Part of Imexpharm’s EU-GMP-certified packaging line. Photo: Imexpharm.

Vietnam’s pharmaceutical sector is entering a new growth phase, supported by government initiatives to enhance domestic drug production and digital healthcare transformation. With its EU-GMP leadership and commitment to innovation, Imexpharm is well-positioned to contribute significantly to Vietnam’s healthcare development.

People’s Doctor and Pharmacist Tran Thi Dao, Imexpharm’s CEO, stated, “The market is evolving with opportunities and challenges. Our focus on quality and adaptability underpins our success. We continuously enhance competitiveness through product innovation, market expansion, operational efficiency, and long-term growth investments.”

Khang Dien Has Yet to Fully Utilize Capital Raised from 2024 ESOP Share Offering

As of October 20, 2025, Khang Dien House has utilized over VND 89.6 billion out of the total VND 183.6 billion raised from the 2024 ESOP share offering, leaving nearly VND 94 billion yet to be allocated.

Unveiling the Post-Restructuring Operational Model: How Coteccons Thrives as a Leaderless Corporation

At Coteccons, the operational model is structured around a functional organization led by the Senior Management Committee (SCOM), comprising seven members who collectively assume the responsibilities traditionally held by a CEO. This innovative approach is championed by Ms. Nguyễn Trình Thùy Trang, Deputy CEO of the Operations Division.

Vinacafé Biên Hòa Posts 12% Surge in Q3 Net Profit Following Massive Dividend Payout

Vinacafé Biên Hòa (HOSE: VCF) has reported a 12% year-on-year increase in after-tax profit for Q3 2025, reaching over 112 billion VND. This positive outcome follows the announcement of VCF becoming a wholly-owned subsidiary of Masan and the distribution of a substantial 480% dividend.