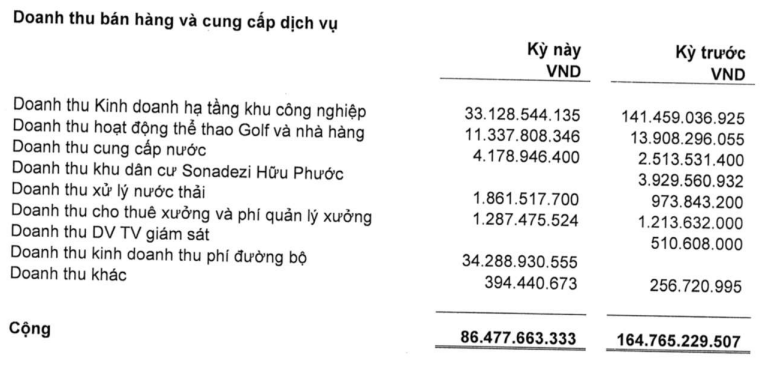

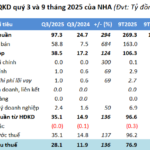

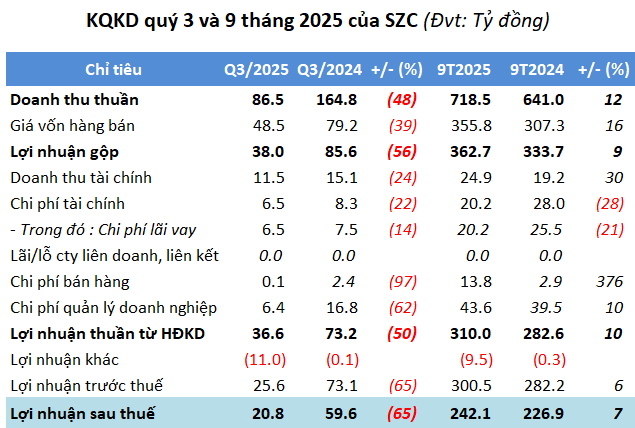

Sonadezi Chau Duc Joint Stock Company (HOSE: SZC) has released its Q3 consolidated financial report, revealing a decline in performance. The company recorded a revenue of over VND 86 billion and a post-tax profit of nearly VND 21 billion, marking a 48% and 65% decrease year-over-year, respectively. This is the lowest result in the past 10 quarters (since Q2/2023).

| SZC’s Business Results from Q1/2023 to Q3/2025 |

The primary reason for this downturn is the underperformance of its core industrial zone infrastructure business, which generated only VND 33 billion, a 77% drop compared to the same period last year. This is despite the VND 34 billion revenue from road tolls.

|

Q3/2025 Revenue Structure of SZC

Source: SZC

|

After nine months, the company’s net revenue reached over VND 718 billion, a 12% increase, with a post-tax profit of more than VND 242 billion, up 7% year-over-year. With these results, SZC has achieved 77% and 80% of its annual targets, respectively.

Source: VietstockFinance

|

Sonadezi Chau Duc owns a vast land bank totaling 2,287 hectares (in the former Ba Ria – Vung Tau province) for the development of industrial zones, urban areas, and a golf course. Additionally, the company is involved in the BOT project for Road 768 and the Sonadezi sports service complex.

The first phase of the Sonadezi Huu Phuoc residential project is currently offering 210 apartments for sale, ranging from 25 to 68.5 square meters per unit. The provisional selling price for phase 1 is between VND 12.4 and 14.2 million per square meter (including 5% VAT but excluding a 2% maintenance fee), depending on the apartment’s location. Phase 2 will feature 1,003 units on a 36,854 square meter plot.

According to Shinhan Securities Vietnam (SSV), the tenants at Sonadezi Chau Duc Industrial Zone (1,556 hectares) are predominantly Vietnamese companies (38%), followed by South Korean (36%), Chinese (17%), and Taiwanese (9%) enterprises.

Source: SSV

|

As of Q3, SZC‘s total assets amounted to nearly VND 8,200 billion, a slight decrease from the beginning of the year. Notably, cash and cash equivalents dropped by 46% to VND 381 billion. Meanwhile, inventory increased by 6% to over VND 1,844 billion, primarily consisting of VND 1,568 billion in work-in-progress costs for the Chau Duc urban area project. Construction in progress also rose by 16% to nearly VND 3,652 billion, mainly attributed to the Chau Duc Industrial Zone project, with VND 3,612 billion allocated for land clearance compensation, construction consulting, and project implementation.

Liabilities stood at over VND 5,058 billion, a 1% decrease; financial debt amounted to more than VND 2,200 billion, down 6% and accounting for 44% of total liabilities. Customer advances and unearned revenue totaled nearly VND 790 billion, a 20% decrease, representing 16% of the liability structure.

– 11:34 21/10/2025

Steel Company Surpasses 58% Profit Target in First Nine Months

Thuduc Steel JSC – VNSTEEL (UPCoM: TDS) has announced robust Q3 2025 financial results, driven by strengthened core operations and additional profit streams.