Khang Dien Investment and Trading Joint Stock Company (Stock Code: KDH, HoSE) has recently submitted a report detailing the utilization of capital raised from its 2024 Employee Stock Ownership Plan (ESOP) share offering.

On October 18, 2024, Khang Dien successfully issued 10.8 million ESOP shares to its employees at a price of VND 17,000 per share.

The total proceeds from this offering amounted to VND 183.6 billion, which is earmarked to bolster the company’s operational capital.

As of the reporting date, October 20, 2025, Khang Dien has utilized over VND 89.6 billion, leaving approximately VND 94 billion unspent.

Illustrative image

In related news, VinaCapital Fund Management JSC (VinaCapital) has announced its intention to acquire additional KDH shares of Khang Dien.

Specifically, Hung Thinh VinaCapital Equity Fund, a member of VinaCapital, has registered to purchase 900,000 KDH shares to optimize its investment portfolio. The transaction is expected to take place via order matching and/or negotiated deals between October 8, 2025, and November 6, 2025.

If successful, the fund’s KDH holdings will increase from 616,410 shares to over 1.5 million shares, raising its ownership stake from 0.0549% to 0.135% of Khang Dien’s total capital.

Previously, during the trading period from August 12, 2025, to September 10, 2025, the fund failed to acquire the intended 850,000 shares due to unfavorable market conditions.

Regarding financial performance, Khang Dien’s audited consolidated financial report for the first half of 2025 reveals a net revenue of over VND 1,759.2 billion, a 79.8% increase compared to the same period in 2024.

However, after deducting taxes and fees, the company’s net profit stood at more than VND 314.9 billion, reflecting an 8.5% decline.

For 2025, Khang Dien aims to achieve a post-tax profit of VND 1,000 billion. By the end of the first two quarters, the company has fulfilled 31.5% of its annual profit target.

As of June 30, 2025, Khang Dien’s total assets reached over VND 31,254.5 billion, an increase of VND 496.8 billion from the beginning of the year. Inventory accounted for VND 23,007.4 billion, or 73.6% of total assets.

On the liabilities side, total payables amounted to nearly VND 11,546.2 billion, up by approximately VND 242 billion year-to-date. Short-term and long-term loans totaled VND 9,142.4 billion, representing 79.2% of total liabilities.

Khang Dien Real Estate Has Yet to Fully Utilize Capital Raised from 2024 ESOP Share Offering

As of October 20, 2025, Khang Dien House has utilized over VND 89.6 billion out of the total VND 183.6 billion raised from the 2024 ESOP share offering, leaving nearly VND 94 billion yet to be allocated.

Soaring Electricity Output Propels Song Ba Ha Hydropower Plant to Record Profits

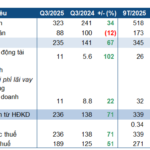

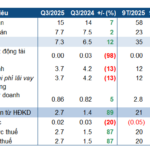

According to the Q3/2025 financial report, Song Ba Ha Hydropower Joint Stock Company (UPCoM: SBH) saw a 51% surge in post-tax profit compared to the same period last year. This remarkable growth is attributed to favorable hydrological conditions, which significantly boosted commercial electricity output.