Khang Dien Investment and Trading Joint Stock Company (Stock Code: KDH, HoSE) has recently submitted a progress report on the utilization of capital raised from the 2024 Employee Stock Ownership Plan (ESOP) share offering.

On October 18, 2024, Khang Dien successfully issued 10.8 million ESOP shares to its employees at a price of VND 17,000 per share.

The total proceeds from this offering amounted to VND 183.6 billion, which is earmarked to bolster the company’s operational capital.

As of the reporting date, October 20, 2025, Khang Dien has utilized over VND 89.6 billion, leaving nearly VND 94 billion yet to be allocated.

Illustrative image

In related news, VinaCapital Fund Management JSC (VinaCapital) has announced its intention to purchase KDH shares of Khang Dien.

Specifically, Hung Thinh VinaCapital Equity Fund, a member of VinaCapital, has registered to acquire 900,000 KDH shares to optimize its investment portfolio. The transaction is expected to take place via order matching and/or negotiated deals between October 8, 2025, and November 6, 2025.

If successful, the fund’s KDH holdings will increase from 616,410 shares to over 1.5 million shares, raising its ownership stake from 0.0549% to 0.135% of Khang Dien’s capital.

Previously, during the trading period from August 12, 2025, to September 10, 2025, the fund failed to purchase the registered 850,000 shares due to unfavorable market conditions.

Regarding business performance, Khang Dien’s audited consolidated financial report for the first half of 2025 revealed a net revenue of over VND 1,759.2 billion, a 79.8% increase compared to the same period in 2024.

However, after deducting taxes and fees, the company’s net profit reached more than VND 314.9 billion, an 8.5% decline.

For 2025, Khang Dien aims to achieve a post-tax profit of VND 1,000 billion. By the end of the first two quarters, the company has fulfilled 31.5% of its annual profit target.

As of June 30, 2025, Khang Dien’s total assets rose by VND 496.8 billion from the beginning of the year to exceed VND 31,254.5 billion. Inventory accounted for VND 23,007.4 billion, or 73.6% of total assets.

On the liabilities side, total payables stood at nearly VND 11,546.2 billion, up by approximately VND 242 billion since the year’s start. Short-term and long-term loans totaled VND 9,142.4 billion, representing 79.2% of total liabilities.

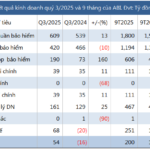

Agribank Insurance Turns Profitable in Q3

Following a third-quarter loss last year due to the impact of Typhoon Yagi, Vietnam Agricultural Bank Insurance Joint Stock Company (UPCoM: ABI) has rebounded to profitability in the third quarter of this year.

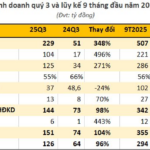

Sao Ta Shrimp Company’s Profits Surge Despite Facing Over 100 Billion VND in Countervailing Duties

Fimex VN (HOSE: FMC), a leading shrimp processor and exporter, has announced its Q3 2025 consolidated net revenue of VND 2.98 trillion, marking a 5% year-on-year increase. The company also reported a net profit of VND 97 billion, reflecting a significant 22% growth compared to the same period last year.

SMB to Distribute Remaining 2025 Dividends, Sabeco Poised for Significant Gains

On October 21, the Board of Directors of Saigon Beer – Central Joint Stock Company (HOSE: SMB) passed a resolution to pay the second dividend installment of 2025 in cash at a rate of 20% (VND 2,000 per share). The ex-dividend date is set for November 13, with the dividend payment scheduled for November 26.