LPBank Securities Joint Stock Company (LPBS) recently announced the results of its share offering to existing shareholders.

By the end of the offering period on October 15, LPBS successfully distributed all 878 million shares to shareholders. Of this, 875.4 billion VND was allocated between September 15 and 10 AM on October 15, 2025.

The remaining 2.59 million shares, which were declined by shareholders, were subsequently allocated to Ms. Do Thi Trang. These shares will be subject to a one-year transfer restriction.

Upon completion of the offering, LPBS increased its outstanding shares to 1.26 billion, equivalent to a charter capital of 12,668 billion VND.

lpbanks.com.vn website interface

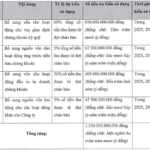

With an offering price of 10,000 VND per share, LPBS raised 8,780 billion VND. The company plans to allocate 60% to investing in securities and deposit certificates, 30% to margin lending activities, and 10% to underwriting and other operations.

The capital utilization is scheduled from 2025 to 2026. Until the funds are used for margin lending, they will be invested in bonds and deposit certificates to ensure efficient capital utilization.

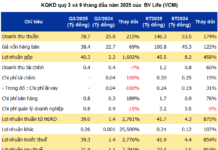

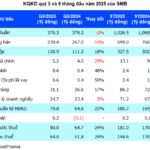

In Q3 2025, LPBS reported 430 billion VND in operating revenue and 123 billion VND in pre-tax profit, up 68% and 33% year-over-year, respectively.

All business segments recorded growth, with the most significant contribution coming from FVTPL financial assets, which surged from 3 billion VND to 187 billion VND.

For the first nine months of 2025, LPBS achieved 976 billion VND in operating revenue, an 887% increase, and over 432 billion VND in pre-tax profit, 8.7 times higher than the same period last year.

LPBS set a 2025 target of 1,015 billion VND in revenue and 503 billion VND in pre-tax profit, both over five times the 2024 results. The company has already achieved 86% of its annual profit goal.

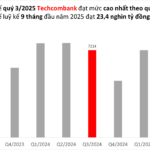

Techcombank Leads Private Banks in Profit for Q1-Q3 2025, Maintains Industry-Top CASA Ratio

Techcombank (TCB) has unveiled its Q3 2025 financial report, showcasing remarkable business performance.

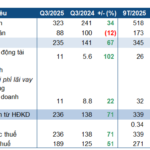

Soaring Electricity Output Propels Song Ba Ha Hydropower Plant to Record Profits

According to the Q3/2025 financial report, Song Ba Ha Hydropower Joint Stock Company (UPCoM: SBH) saw a 51% surge in post-tax profit compared to the same period last year. This remarkable growth is attributed to favorable hydrological conditions, which significantly boosted commercial electricity output.

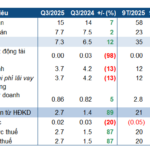

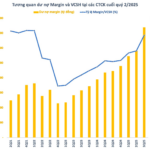

Record-High Margin Debt: Major Brokerages Nearing Lending Limits

Leading the pack in equity capital (VCSH) are firms like TCBS, SSI, VNDirect, VPBankS, and VIX, all of which still have significant lending capacity. In contrast, the margin-to-equity ratio at other securities companies such as HSC, Mirae Asset, MBS, and KIS VN is nearing its maximum limit.