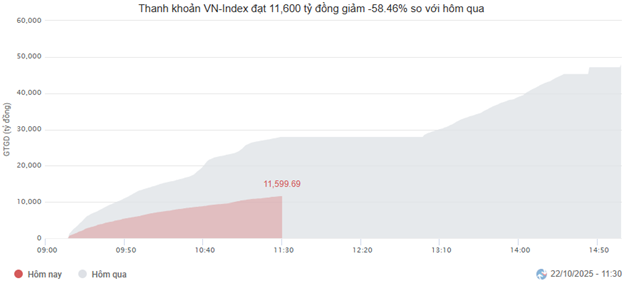

Market liquidity decreased compared to the previous session, with the order-matching volume of the VN-Index reaching over 379 million shares, equivalent to a value of more than 15.2 trillion VND; the HNX-Index reached over 107.6 million shares, equivalent to a value of more than 2.5 trillion VND.

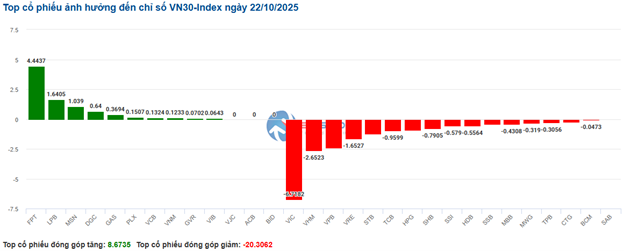

The VN-Index opened the afternoon session with selling pressure still dominant in the first half, but buyers unexpectedly reappeared, helping the index quickly recover to the 1,665-point mark and closing in a fairly positive green at the end of the session. In terms of influence, VPL, VHM, GAS, and FPT were the most positively influential stocks on the VN-Index, with over 7.3 points gained. On the opposite side, TCX, VIC, SHB, and CRV were still under selling pressure, losing 1.4 points.

| Top 10 stocks with the strongest impact on the VN-Index on October 22, 2025 (calculated in points) |

Similarly, the HNX-Index also showed a fairly optimistic trend, with positive influences from stocks like CEO (+9.79%), HUT (+5.96%), PVS (+4.48%), PVI (+3.96%), and others.

| Top 10 stocks with the strongest impact on the HNX-Index on October 22, 2025 (calculated in points) |

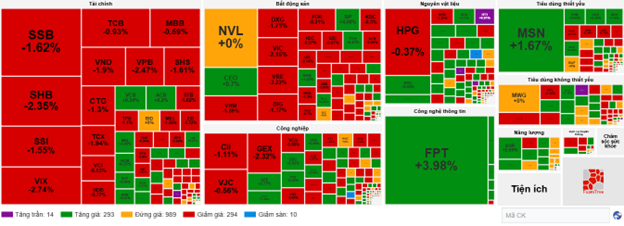

At the close, the market rose with green covering most sectors. Notably, the information technology sector led the market with a 4.04% increase, primarily driven by FPT (+4.3%), CMG (+0.26%), ELC (+1.18%), and DLG (+6.88%). Following closely were the non-essential consumer goods and energy sectors, with gains of 3.42% and 2.89%, respectively. Conversely, the communication services sector was the only one to record a significant decline, falling 1.39%, mainly due to VGI (-2.27%), VNZ (-0.59%), and CTR (-1.15%).

In terms of foreign trading, foreign investors returned to net selling over 1.515 trillion VND on the HOSE, concentrated in stocks like CTG (184.02 billion), HPG (165.55 billion), VCI (149.82 billion), and MBB (144.43 billion). On the HNX, foreign investors net sold over 199 billion VND, focusing on SHS (138.56 billion), CEO (38.78 billion), IDC (30.07 billion), and NTP (9.09 billion).

| Foreign net buying and selling trends |

Morning Session: Sluggish Liquidity, Foreign Investors Return to Net Selling

Pressure from real estate and finance sectors kept the main index from gaining traction. At the midday break, the VN-Index fell nearly 6 points (-0.36%), to 1,657.48 points; the HNX-Index dropped to 264.05 points, down 0.23%. The number of declining stocks gradually gained dominance, with 353 stocks falling and 310 rising.

Market liquidity showed no signs of improvement. The trading value of the HOSE this morning reached nearly 11.6 trillion VND, down 58.46% from the previous session and nearly 27% from the one-month average at the same time. The HNX recorded only about 42 million units, equivalent to over 863 billion VND.

Source: VietstockFinance

|

Among the top 10 stocks influencing the VN-Index, VIC had the most negative impact, losing 2.5 points. VHM and VPB also took away nearly 2 points from the main index. Conversely, FPT and GAS contributed significantly, adding nearly 3 points to the index.

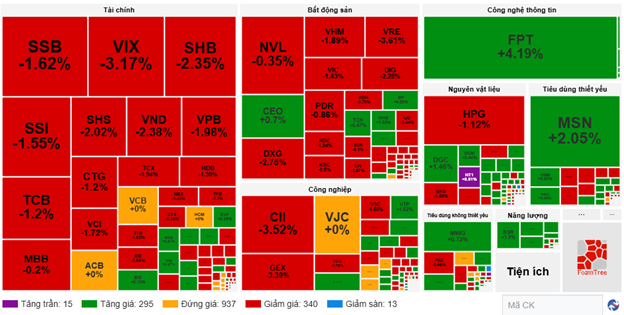

Divergence continued to dominate sector performance. The two largest sectors by capitalization, real estate and finance, weighed heavily on the main index, falling 1.45% and 0.73%, respectively. Most stocks in these sectors were in the red, including VIC (-1.43%), VHM (-1.89%), VRE (-3.61%), DXG (-2.75%), SJS (-1.95%), VPI (-2.67%), TAL (-2.25%), DIG (-2.28%); CTG (-1.2%), TCB (-1.2%), VPB (-1.98%), SHB (-2.35%), SSB (-1.62%), and VIX (-3.17%).

The materials and industrial sectors were affected by negative adjustments in large-cap stocks like HPG (-1.12%), KSV (-4.27%), NKG (-1.89%), HSG (-1.2%); GEX (-3.39%), MVN (-3.48%), CII (-3.52%), and VEF (-3.63%). However, buying interest remained in several stocks, with HT1 hitting its ceiling, GVR (+1.77%), MSR (+2.31%), DGC (+1.46%), TVN (+1.35%), PRT (+4.67%); ACV (+4.7%), GEE (+1.55%), BMP (+3.02%), and VTP (+1.62%).

On the flip side, the information technology sector temporarily led with a remarkable 3.95% increase, primarily driven by FPT (+4.19%), VEC (+5.23%), and DLG (+2.43%).

Source: VietstockFinance

|

Foreign investors returned to net selling with a value of over 1.2 trillion VND across all three exchanges. Selling pressure concentrated on CTG, SHS, and HPG, with values ranging from 87 to 93 billion VND. Conversely, FPT led the net buying list with a value of 222.99 billion VND, far ahead of other stocks.

| Top 10 stocks with the highest foreign net buying and selling in the morning session of October 22, 2025 |

10:40 AM: Cautious Sentiment Prevails, VN-Index Reverses to a Slight Decline

Cautious investor sentiment caused trading volume to drop by more than 50% compared to the mid-morning session, and the main indices continued to hover around the reference level. As of 10:30 AM, the VN-Index reversed to a decline of over 8 points, trading around 1,655 points. The HNX-Index fell slightly, trading around 264 points.

The breadth of stocks in the VN30 basket showed a fairly balanced mix of green and red, but sellers still had the upper hand, notably with VIC losing 6.71 points, VHM losing 2.65 points, VPB losing 2.42 points, and VRE losing 1.65 points. On the positive side, FPT, LPB, MSN, and DGC maintained positive momentum, helping the index retain over 7.7 points.

Source: VietstockFinance

|

Most sectors were covered in green, but the two largest sectors by capitalization, finance and real estate, moved in the opposite direction, falling 0.61% and 1.98%, respectively.

The real estate sector showed strong divergence, with red dominating. Notable decliners included VIC (-1.82%), VHM (-1.89%), VRE (-2.96%), and BCM (-1.72%). Meanwhile, gainers were fewer, including TCH (+0.23%), CEO (+0.35%), and SIP (+4.27%).

Similarly, the finance sector saw a mix of green and red. Selling pressure appeared in stocks like SSB (-2.16%), SHB (-2.35%), TCB (-0.93%), MBB (-0.59%), while a few stocks maintained positive momentum, such as ACB (+0.2%), HCM (+0.41%), EVF (+0.39%), BVB (+3.94%), and others.

Compared to the opening, buyers and sellers were fairly balanced, with 294 gainers and 293 decliners.

Source: VietstockFinance

|

Opening: Green Dominates, VN-Index Continues Recovery

At the start of the October 22 session, as of 9:30 AM, the VN-Index continued its recovery, rising nearly 12 points and trading around 1,675 points. The HNX-Index fell slightly, holding at 264 points.

The information technology sector was among the top performers, with leading stocks like FPT (+5.38%), CMG (+1.69%), ELC (+0.24%), DLG (+0.4%), and others showing strong recovery.

The energy sector also performed well from the opening, driven by significant contributions from oil and gas stocks. Notable gainers included BSR, PVS, PLX, and OIL.

In addition to these sectors, many large-cap stocks also showed positive momentum, including MSN, LPB, VHM, and DGC, which supported the index.

– 15:35 22/10/2025

Vietstock Daily 23/10/2025: Intense Tug-of-War in the Market

The VN-Index has formed a Dragonfly Doji candlestick pattern, accompanied by trading volume dipping below the 20-session average. The 1,605–1,630 point range remains a critical support level that must hold to reinforce short-term recovery expectations.

Foreign Investors Pour Nearly VND 2.5 Trillion into Vietnamese Stocks on October 21, with FPT in the Spotlight

In the afternoon trading session, FPT shares witnessed the most significant net inflow from foreign investors across the entire market, with a remarkable surge in value reaching 529 billion VND.