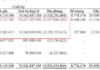

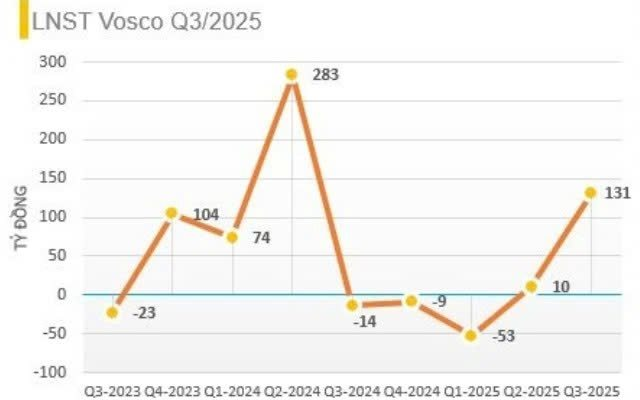

Vietnam Ocean Shipping Joint Stock Company (Vosco, Stock Code: VOS) has released its consolidated financial report for Q3 2025, revealing a revenue of VND 849.7 billion, a 33% decline compared to the same period last year. The post-tax profit reached VND 131.6 billion, a significant turnaround from a loss of VND 14 billion in Q3 2024.

For the first nine months of 2025, Vosco recorded a cumulative revenue of VND 2,147 billion, a 49% decrease year-over-year. Post-tax profit stood at over VND 88 billion, down 74% from the same period in 2024.

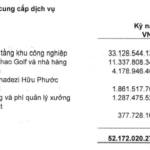

The company attributed the revenue decline in 9M/2025 to the impact on trading activities, with trading revenue reaching only VND 650 billion, compared to VND 2,254 billion in 9M/2024.

Additionally, the revenue drop was influenced by the return of the oil tanker Dai An on March 24, 2025, and the chemical tanker Dai Hung on March 21, 2025, to their owners, as well as the sale of the Vosco Star vessel in late July 2025. In contrast, the same period in 2024 saw the sale of the Dai Minh vessel in May 2024, contributing approximately VND 400 billion in revenue and profit.

Meanwhile, several vessels, including Vosco Sky, Vosco Unity, Vosco Starlight, Dai Thanh, Lucky Star, and Fortune Freighter, underwent extended maintenance or were laid up, generating no revenue while still incurring daily vessel costs.

BAOVIET Bank: Positive Credit Growth in the First Nine Months

With a modern retail banking development strategy deeply rooted in digital transformation, BAOVIET Bank (BAOVIET Bank Joint Stock Commercial Bank) achieved impressive business results in the first nine months of 2025. The bank recorded reasonable credit growth, strengthened risk management efficiency, and positive profit growth compared to the same period last year.

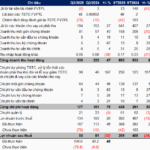

FPTS Reports Q3 Profit of Over VND 55 Billion, Highlighting Continued Success of MSH Investment

In Q3/2025, FPT Securities Corporation (FPTS, HOSE: FTS) reported post-tax profits exceeding 55 billion VND, marking a 32% decline compared to the same period last year. Notably, the realized profit segment exhibited a contrasting trend.