A Pullback with Significant Impact

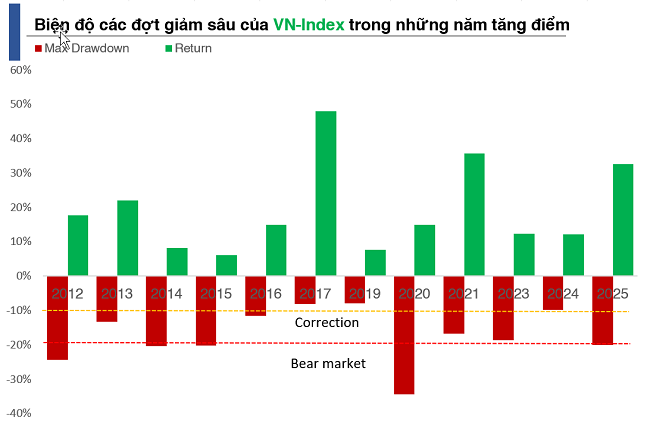

Following two consecutive recovery sessions after a 95-point decline, the maximum drop from the all-time high of the VN-Index halted at 8.88%, corresponding to a pullback state.

The overall index decline is considered moderate when compared to April 2025, a period when the market plummeted over 20% from its peak, nearly entering a bear market phase, causing widespread panic and substantial losses for investors.

However, at present, numerous stocks have fallen more sharply than the market’s average decline, causing investors to quickly lose profits or even incur losses, particularly in shares that had previously surpassed their all-time highs.

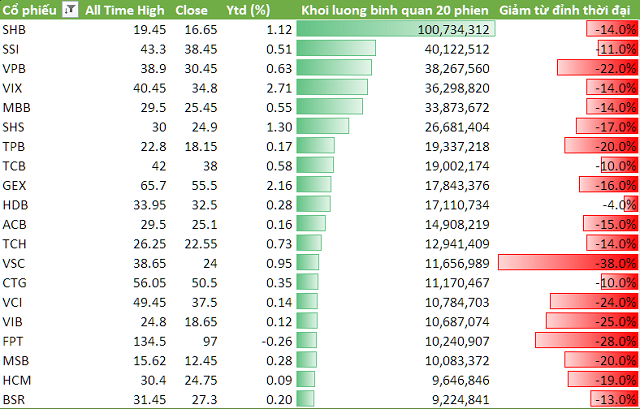

According to statistics, among approximately 380 stocks that exceeded their all-time highs in 2025, the decline from these peaks is around 17%, corresponding to a correction state.

Top 20 most liquid stocks among those breaking all-time records across three exchanges (as of the close of trading on October 22).

|

Within the top 20 most liquid stocks, only HDB, CTG, and TCB have declined by less than 10%, while the remainder have all fallen by more than 10%.

Stocks such as VSC (-38%), FPT (-28%), VIB (-25%), VCI (-24%), VPB (-22%), TPB (-20%), and MSB (-20%) are the most severely affected in this group.

Meanwhile, VIC stock, which is outside the top 20 in liquidity, has only declined by approximately 8% from its peak. Consequently, it maintains its impressive performance, achieving over fivefold growth since the beginning of 2025.

These figures indicate that, despite the VN-Index adjusting by only 9%, the actual impact on many investors’ portfolios is significantly higher, as the index is primarily supported by a few key pillars.

Money Flows into New Sectors: A Notable Sign

In the current landscape, the most positive development is that the market is no longer entirely dependent on the Vingroup or banking sectors. There are signs that capital is spreading to various other sectors.

During the two most recent recovery sessions, numerous Midcap and Bluechip stocks outside the banking sector have shown positive recovery signals.

Most notably, BMP stock swiftly returned to set a new all-time high during the past two sessions. As of now, BMP has grown by 38.63% and is in its sixth consecutive year of price increases.

Hopeful signs are also emerging in some Oil & Gas, Chemical, Real Estate, and Industrial Zone stocks—sectors that were overshadowed during the market’s focus on the previous leading groups.

These could be early indicators that capital is broadening its scope, seeking stocks with strong fundamentals and unique narratives, rather than solely relying on the Bank or Vingroup sectors as in previous phases.

More concrete results will require further validation over time. However, according to Nguyễn Thế Minh, Director of the Research and Individual Client Development Division at Yuanta Securities Vietnam, historical data shows that shocks exceeding 5% in the VN-Index are typically short-lived, often leading to short- and medium-term recovery opportunities.

“The VN-Index closed down 5.5% on October 20, 2025. Since 2014, there have only been 11 instances where the VN-Index fell more than 5% in a single session. In the subsequent five sessions, 6 out of 11 times did not see a decline exceeding 3%, and in 6 out of 11 cases, the index averaged positive growth, with a probability of over 60%,” Mr. Minh added.

Notably, the probability of the VN-Index rising after 5 sessions, 10 sessions, 1 month, and 3 months is high.

Among the 11 instances of sharp declines exceeding 5% mentioned above, only two occurred during the COVID-19 period in 2020 and in April 2025, when the market faced significant shocks from trade tensions and macroeconomic risks.

“Thus, it can be concluded that after such shocks, the Vietnamese market typically regains its upward momentum in the short term, even extending into the medium term,” Mr. Minh emphasized.

Overall, the current adjustment phase does not carry a negative tone. The market is merely experiencing a pullback, with the VN-Index declining less than 9% from its peak after a period of overheating. Capital remains within the system, simply shifting to new sectors rather than exiting the market.

More importantly, the market is no longer reliant on “leading” stocks like Vingroup or banks. The diversification of capital into oil & gas, chemicals, real estate, industrial zones, and certain penny stocks is paving the way for a more diverse and sustainable growth cycle.

– 08:05 23/10/2025

Vietstock Daily 24/10/2025: Cautious Sentiment Persists

The VN-Index extended its recovery streak to a third consecutive session, yet it remains below the Middle line of the Bollinger Bands, setting up a critical short-term test for the index. Trading volume continued to decline, falling below the 20-session average, indicating investors remain cautious amid the current rebound. The August 2025 low (around 1,605–1,630 points) is expected to serve as strong support should selling pressure resume in the near term.

Daily Stock Pick: How Much Profit Can You Make Investing in Bầu Hiển’s SHB?

It took over 11 years for the investment strategy in SHB to start yielding profits, and to date, after 16 years, the returns stand at approximately 326%.

The Steepest Stock Market Plunge in History: Unraveling the Causes Behind the Dramatic Crash

The trading session on October 20th marked the most significant single-day decline in the history of Vietnam’s stock market, with the VN-Index plunging dramatically. Analysts suggest the market’s reaction was unexpectedly severe, surpassing even the most pessimistic forecasts. However, investors should avoid panic; this downturn presents a strategic opportunity for portfolio restructuring, particularly for those who remain calm and hold sufficient cash reserves.