In the latest update, Mrs. Cao Thị Ngọc Sương, wife of Mr. Bùi Thành Nhơn, Chairman of NVL’s Board of Directors, has registered to sell over 17.2 million NVL shares from October 28 to November 26 via order matching and/or negotiated transactions.

Currently, Mrs. Sương holds nearly 50.5 million NVL shares. If the transaction is successful, her ownership in Novaland will decrease to 1.6%, equivalent to over 33.2 million shares.

Previously, Diamond Properties Joint Stock Company also registered to sell 2.15 million shares from October 17, 2025, to October 31, 2025. If successful, Diamond Properties’ ownership of NVL shares will decrease from over 165.4 million shares to approximately 163.3 million shares, reducing its stake from 8.079% to 7.974% of Novaland’s capital.

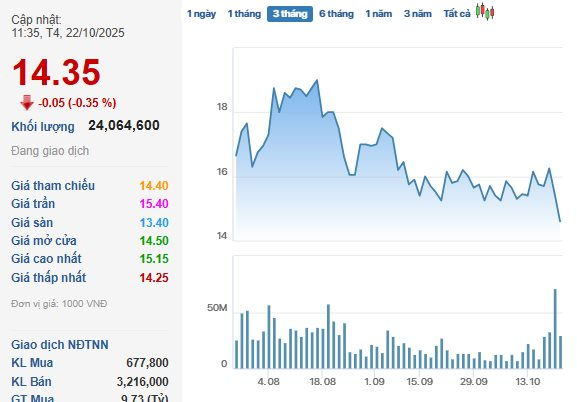

The leadership’s spouse is reducing holdings while NVL shares are experiencing a sharp decline. After two sessions of hitting the floor, NVL continued to drop by 0.38% in the October 22 session to VND 14,350 per share, marking a 15% decline over the past two months.

The shares experienced a sharp decline immediately after the Government Inspectorate announced the Inspection Conclusion on October 17, regarding compliance with legal regulations on the issuance and use of capital from private corporate bonds (TPDN) by 67 organizations from January 1, 2015, to June 30, 2023. The market recorded a significant drop.

Among the named entities, NVL, along with its subsidiaries and related companies, was alleged to have violated several regulations, including: incomplete documentation when issuing bonds; indications of misusing capital raised from TPDN; and failure to fulfill information disclosure obligations as required by law.

In response, NVL stated that it has submitted explanatory documents to the Government Inspectorate, requesting the authorities to reconsider certain aspects of the conclusion. The company also updated its current debt status and provided a specific plan for settling outstanding bond payments.

Cash Flow Monitoring: Revitalizing the Bond Market

The bond market thrives only when trust, knowledge, and discipline converge. When businesses treat transparency as a cornerstone, investors wield understanding as their greatest asset, and regulators harness data as a precision oversight tool, we create a market that is both secure and dynamic—one that fuels sustainable economic growth.

Novaland Defers Nearly VND 95 Billion in Bond Principal Repayments

Novaland has deferred nearly VND 94.6 billion in principal payments for its NVLH2123003 bond issuance due to insufficient payment arrangements.

Government Inspectors Uncover Series of Bond Issuance Violations by Multiple Banks and Companies

Government inspectors have uncovered a series of bond issuance violations involving 5 banks, 37 joint-stock companies, and 25 limited liability companies.