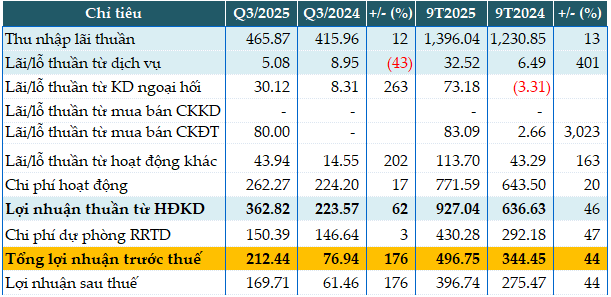

In Q3 alone, PGBank’s net interest income reached nearly VND 466 billion, a 12% increase year-over-year.

While service fee income decreased by 43% to over VND 5 billion, all other non-interest income streams experienced growth. Foreign exchange trading profits tripled to VND 30 billion, and securities investment gains reached nearly VND 80 billion, compared to none in the same period last year.

Notably, intensified debt recovery efforts, particularly principal collection, led to a threefold increase in other operating income to nearly VND 44 billion, thanks to the utilization of loan loss provisions.

Operating expenses rose by 17% to over VND 262 billion. Consequently, net profit from business operations surged by 62% to nearly VND 363 billion.

Furthermore, the bank only slightly increased its loan loss provisions by 3% to VND 150 billion, resulting in pre-tax profit exceeding VND 212 billion, 2.8 times higher than the same period last year.

For the first nine months of the year, PGBank’s pre-tax profit reached nearly VND 497 billion, a 44% increase year-over-year. This equates to 69% of the bank’s full-year 2025 pre-tax profit target of VND 716 billion.

|

PGB’s Q3 and 9M2025 Business Results. Unit: Billion VND

Source: VietstockFinance

|

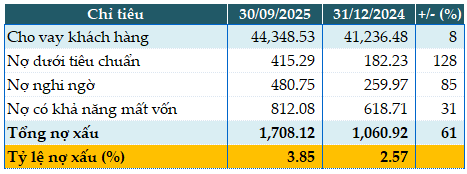

As of the end of Q3, the bank’s total assets increased by 9% from the beginning of the year to over VND 79,838 billion. Customer loans grew by 8% to VND 44,348 billion, while customer deposits rose by only 2% to VND 44,375 billion. At the end of Q3, PGBank’s total non-performing loans stood at over VND 1,708 billion.

|

PGB’s Loan Quality as of 30/09/2025

Source: VietstockFinance

|

– 10:28 23/10/2025

Q3/2025 Financial Report Update: SHB Announces Over 50% Pre-Tax Profit Surge, Multiple Subsidiaries Double Their Earnings

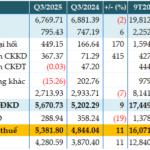

ACB reported a Q3 profit of VND 5,382 billion, an 11% increase year-over-year, with a 9-month cumulative profit of VND 16,072 billion, up 5%. Meanwhile, VEF (Giảng Võ Exhibition) posted a Q3 profit of VND 214 billion, doubling from the same period last year, and a 9-month profit of VND 19,295 billion, a staggering 58-fold increase year-over-year.

Dinh Vu Port’s Q3 Profits Plummet 34%, Threatening Annual Targets

Dinh Vu Port Investment and Development JSC (HOSE: DVP) has released its Q3 2025 financial report, revealing a net revenue of VND 129 billion, marking a 28% decline compared to the same period last year.

ACB Reports 11% Rise in Q3 Pre-Tax Profit as Bad Debt Improves

Asian Commercial Bank (HOSE: ACB) reported a pre-tax profit of nearly VND 5,382 billion in Q3/2025, marking an 11% year-on-year increase. This growth was driven by higher non-interest income and effective cost-cutting measures. Notably, the bank’s non-performing loans (NPLs) decreased by 15% compared to the beginning of the year, reflecting improved asset quality.