Alongside gold, a symbol of stored wealth, silver is gradually establishing its unique position in global investment portfolios. This is due to its dual role as both a store of value and a material with practical applications in production. At the 2026 Business Forum – New Growth Spaces: Opportunities and Strategies, organized by Business Pulse – BizLIVE on October 22, silver investment emerged as a notable topic of discussion. This comes amid silver’s recent record-breaking international prices.

Experts suggest that silver’s surge is not merely speculative but reflects a structural shift in the global economy toward green energy. Silver is an essential material in the production of solar panels, electric vehicle batteries, and electronic components—sectors that nations are vigorously promoting to achieve net-zero emissions. According to the Silver Institute, over 55% of global silver demand in 2024 stems from industrial uses, with the solar energy sector alone accounting for nearly 15%.

Market analyst Chu Phương, specializing in gold and silver, notes, “Silver’s annual profit margins far exceed those of gold. When the USD weakens, silver prices surge. During peak periods—such as when surpassing $50/ounce—the London market nearly depletes its spot silver, while the U.S. COMEX exchange still holds reserves but classifies silver as a strategic mineral.”

Major investment firms have increased their silver holdings. In Q3/2025 alone, silver ETFs acquired an additional 20 million ounces (over 620 tons), creating a short-term scarcity effect and triggering FOMO in the market.

“If the U.S. government remains shut down and the Federal Reserve lacks economic data to guide interest rate decisions, investors will continue to seek refuge in gold or silver,” predicts Ms. Phương.

In Vietnam, a physical silver investment boom is emerging. Leading companies like the Phú Quý Jewelry Corporation are pioneering the distribution of silver bars and ingots to individual investors. Ms. Chu Phương notes that due to exchange rate disparities and market volatility, domestic silver prices currently exceed international levels by 7–8%.

Huỳnh Minh Tuấn, Founder of FIDT and Vice Chairman of APG Securities, predicts sustained silver demand as the green industrial trend expands.

Mr. Tuấn observes that physical silver has gained attention as prices have risen 64% since the year’s start. Silver, alongside gold, constitutes 5–7% of precious metal asset allocations.

“Over the past 2–3 years, particularly during President Donald Trump’s tenure, gold and silver prices have moved in near-perfect tandem. As global gold supplies tighten, asset allocation is shifting toward silver. Long-term, silver demand will grow alongside the 30–40-year Net Zero transition, representing a sustainable growth trend.”

Despite its price potential, experts agree that Vietnam’s silver market remains nascent. Dr. Võ Trí Thành, a member of the National Financial and Monetary Policy Advisory Council, remarks, “Silver lacks policy attention or a legal framework, a key distinction from gold.”

Economist Ngô Trí Long speaks at the 2026 Business Forum – New Growth Spaces: Opportunities and Strategies.

Amid global uncertainty, with volatile stocks and stagnant real estate, safe-haven assets like gold and silver are regaining prominence. While gold represents safety, silver—integral to green industries—may bridge financial investment and real production.

Assoc. Prof. Ngô Trí Long likens gold and silver to “twins” in precious metals. He advises, “Silver is a new investment avenue requiring thorough research, patience, and avoidance of herd mentality or leveraged purchases.”

“Investing in novelty demands understanding its essence. Silver offers opportunity but only rewards those with knowledge, discipline, and patience,” emphasizes Mr. Long.

Khánh Vy

Expert Insights: Silver Transcends Ornamental Value, Emerging as a Strategic Investment Avenue Alongside Gold

Silver is emerging as a compelling investment avenue, capturing the attention of investors seeking long-term growth and portfolio diversification. Renowned experts highlight its dual appeal as both a defensive asset and a store of value, mirroring gold’s traditional role. Additionally, silver’s critical role as a raw material in green energy production ensures its demand will continue to rise, solidifying its position as a forward-looking investment opportunity.

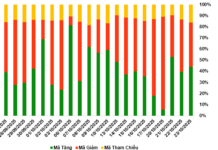

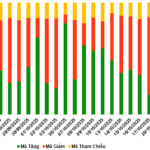

October 22, 2025: Optimism Returns to the Warrant Market

As the trading session closed on October 21, 2025, the market witnessed 138 stocks advancing, 99 declining, and 24 remaining unchanged. Foreign investors continued their net selling streak, offloading a total of VND 8.55 billion worth of shares.