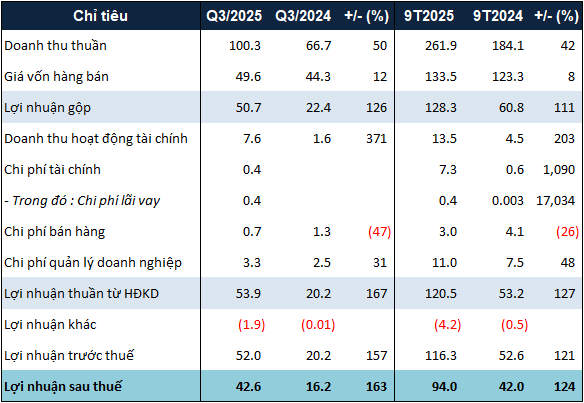

The Tan Lap quarry in Binh Phuoc province contributed nearly VND 94 billion, accounting for approximately 94% of NNC’s total net revenue in Q3. The remaining VND 6 billion came from the Nui Nho quarry.

Not only did net revenue increase, but NNC’s financial revenue also surged to nearly VND 8 billion, a fivefold increase compared to the same period last year, entirely from deposit interest.

NNC’s expenses generally rose during this period, with a 31% increase in management costs and an additional VND 352 million in financial expenses. Conversely, selling expenses decreased significantly by 47% due to reduced outsourcing services.

As a result, NNC reported an after-tax profit of nearly VND 43 billion in Q3/2025, 2.6 times higher than the same period last year, marking the most profitable quarter since Q4/2018.

In the first nine months, NNC’s after-tax profit reached VND 94 billion, 2.2 times higher than the same period last year. Compared to the pre-tax profit target of VND 55 billion set for 2025, NNC’s nine-month result has exceeded the target by 111%.

|

NNC’s 9-month business results in 2025. Unit: Billion VND

Source: VietstockFinance

|

As of September 30, 2025, NNC’s total assets reached over VND 612 billion, a 26% increase from the beginning of the year. Cash holdings and short-term receivables increased by 50% and nearly threefold, respectively, to nearly VND 283 billion and over VND 62 billion.

Liabilities also rose by 97% to nearly VND 128 billion, primarily due to a medium-term loan of nearly VND 26 billion from VietinBank (CTG) for investing in a 750-ton/hour stone crushing production line. In contrast, short-term provisions decreased from nearly VND 20 billion to over VND 3 billion, as no mining rights provisions were recorded for the Nui Nho quarry.

– 09:52 22/10/2025

Safoco Vegetable Noodle Brand Reports Q3 Net Profit of VND 13 Billion

Despite a decline in net revenue, CTCP Lương thực Thực phẩm Safoco (HNX: SAF) maintained its profitability in Q3/2025, demonstrating resilience in a challenging market.

Hương Sơn Hydropower Profits Surge 32% Amid Favorable Weather and New Electricity Rates

Huong Son Hydro Power Joint Stock Company (UPCoM: GSM) has released its Q3/2025 financial report, revealing a 32% year-over-year increase in after-tax profit. This impressive growth is primarily attributed to higher water levels in the reservoir and the implementation of a new electricity pricing mechanism.

West Bus Station’s Short-Term Holdings Approximate 323 Billion VND

Despite soaring cost of goods sold and administrative expenses, Western Bus Station Joint Stock Company (HNX: WCS) maintained a 7% year-over-year growth in after-tax profit for Q3 2025.