|

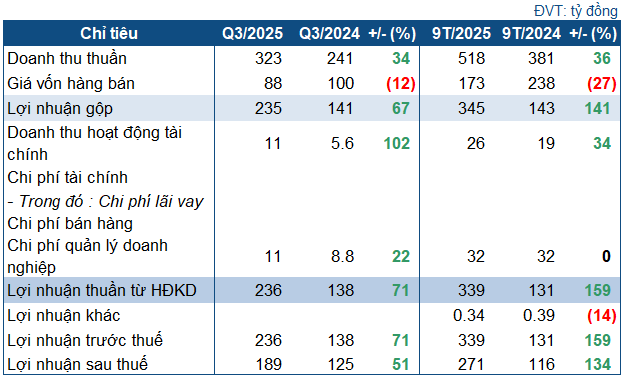

SBH’s Q3/2025 Business Targets

Source: VietstockFinance

|

In Q3, SBH reported net revenue exceeding 323 billion VND, a 34% increase year-over-year. This growth was primarily driven by a nearly 47% surge in commercial electricity output, reaching 290 million kWh.

Conversely, the cost of goods sold decreased by 12% to 88 billion VND, resulting in a 67% rise in gross profit to 235 billion VND.

The most notable metric for the quarter was financial revenue, which more than doubled to over 11 billion VND, thanks to interest earnings from deposits. Administrative expenses rose by 22% to 11 billion VND. Ultimately, SBH’s post-tax profit reached nearly 189 billion VND, a 51% increase.

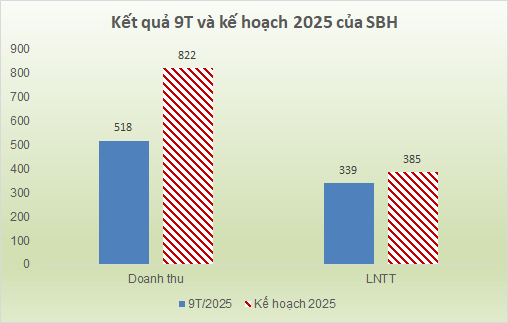

The impressive Q3 performance significantly enhanced SBH’s year-to-date results. Over the first nine months, SBH recorded revenue of 518 billion VND, up 36%, and post-tax profit of 271 billion VND, 2.3 times higher than the same period last year. Based on the plan approved by the 2025 Annual General Meeting, the company has achieved 63% of its revenue target and over 88% of its pre-tax profit goal for the year.

Source: VietstockFinance

|

As of September 30, 2025, SBH’s total assets reached over 2 trillion VND, a 14% increase from the beginning of the year, with nearly 1.4 trillion VND in current assets, up 29%. This growth was primarily attributed to cash and cash equivalents. Cash and cash equivalents soared by more than 86 billion VND (from just 6.9 billion VND at the start of the year), while investments held to maturity (mainly term deposits) increased by 10% to 836 billion VND. Combined, cash and various deposits totaled 922 billion VND, accounting for 45% of total assets.

Short-term receivables also rose sharply by 50% to 455 billion VND, mainly due to increased customer receivables (over 434 billion VND).

On the liabilities side, total payables increased by 84% since the beginning of the year to 245 billion VND. The company has no financial debt.

SBH’s cash flow remained robust at 199 billion VND, utilized to increase term deposits and pay dividends to shareholders.

– 11:28 21/10/2025

Phan Thiet – Phu Quy Route Drives SKG’s Q3 Profit Turnaround

Superdong – Kien Giang JSC (HOSE: SKG) reported a Q3 profit of over VND 7.3 billion, a significant turnaround from the loss incurred in the same period last year. This impressive result was driven by a substantial increase in revenue across multiple routes, most notably the Phan Thiet – Phu Quy line.

Hương Sơn Hydropower Profits Surge 32% Amid Favorable Weather and New Electricity Rates

Huong Son Hydro Power Joint Stock Company (UPCoM: GSM) has released its Q3/2025 financial report, revealing a 32% year-over-year increase in after-tax profit. This impressive growth is primarily attributed to higher water levels in the reservoir and the implementation of a new electricity pricing mechanism.

Techcombank Sets Record Q3 Profit, Sustaining Strong Growth Momentum

Techcombank (HOSE: TCB) has unveiled its Q3 2025 and 9-month financial results, showcasing record-breaking performance and underscoring the success of its comprehensive transformation strategy. The bank reported pre-tax profits of VND 23.4 trillion for the first nine months, with Q3 alone contributing VND 8.3 trillion—a 14.4% year-on-year increase and the highest quarterly profit in its history.