Brokers and Proprietary Traders Thrive in Q3

|

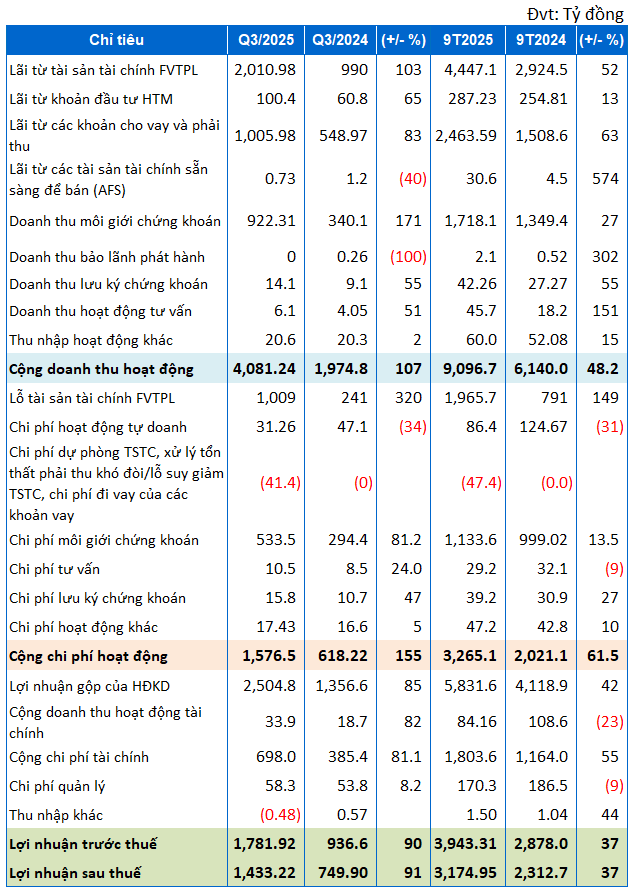

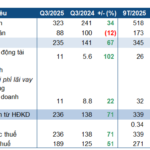

SSI’s Q3/2025 Business Results

Source: VietstockFinance

|

SSI’s operating revenue expanded significantly in Q3/2025, reaching nearly VND 4.1 trillion, double the same period last year. Most major revenue streams saw substantial growth, with brokerage revenue experiencing a remarkable surge.

The company’s profit from financial assets measured at fair value through profit or loss (FVTPL) exceeded VND 2 trillion, doubling from Q3 last year. For held-to-maturity (HTM) investments, the company recorded a profit of VND 100 billion, a 65% increase.

Lending activities also showed positive growth, with interest income from loans and receivables surpassing VND 1 trillion, 83% higher than the same period. Notably, brokerage revenue soared by 170%, reaching over VND 920 billion.

Other activities like securities custody and consulting recorded revenue growth of over 50%, though the revenue scale remained modest at VND 14.1 billion and VND 6.1 billion, respectively.

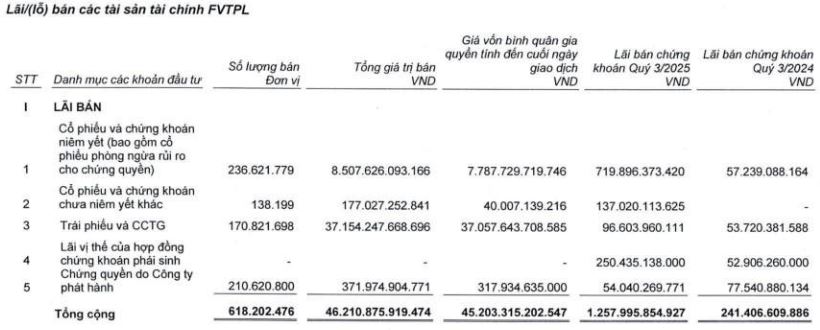

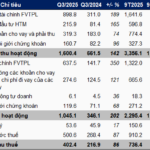

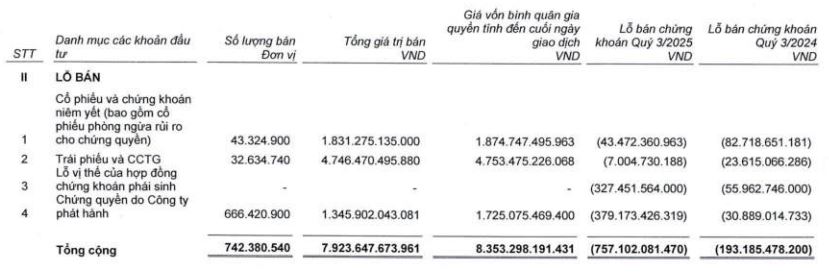

In proprietary trading, corresponding to the increase in profits, losses on FVTPL financial assets quadrupled to VND 1 trillion. Nonetheless, this segment still generated a profit of over VND 970 billion, a 35% year-on-year increase.

The company realized gains of nearly VND 720 billion from listed stocks and securities and VND 137 billion from unlisted ones. Conversely, SSI only incurred a loss of over VND 43 billion on listed stocks and securities, half of the same period last year.

However, warrant trading suffered a gross loss of over VND 320 billion.

Derivatives proprietary trading recorded a gross loss of more than VND 77 billion, with a profit of VND 250 billion from futures contract positions and a corresponding loss of VND 327 billion.

|

SSI’s Profit/Loss from Sale of FVTPL Financial Assets

|

Source: SSI Parent Company’s Financial Statements

|

SSI’s operating expenses rose by over 150% in Q3, primarily due to increased FVTPL financial asset losses and an 80% surge in brokerage expenses to VND 533.5 billion.

Financial costs also expanded by over 80%, reaching nearly VND 700 billion.

By the end of Q3, SSI reported pre-tax profit of nearly VND 1.8 trillion and post-tax profit of VND 1.4 trillion, a 90% year-on-year increase.

This profit boosted the company’s 9-month results. For the first nine months, the company achieved pre-tax profit of nearly VND 4 trillion and post-tax profit of nearly VND 3.2 trillion, a 37% increase, fulfilling 93% of its 2025 pre-tax profit plan.

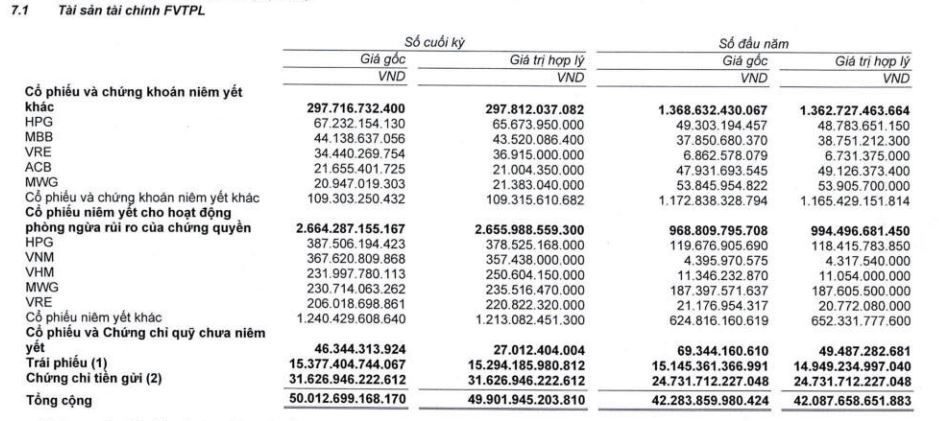

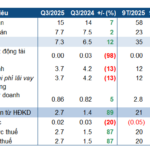

Total Assets Approach VND 100 Trillion, Half in FVTPL Financial Assets

By Q3’s end, SSI’s total assets reached nearly VND 100 trillion, a 37% increase from the year’s start. These assets primarily consist of FVTPL financial assets and loan balances, at VND 49.9 trillion and VND 39.2 trillion, respectively. Both are at record levels, with SSI’s loan portfolio growing nearly 80% in 2025.

|

SSI’s FVTPL Asset Portfolio in Q3/2025

Source: SSI Parent Company’s Financial Statements

|

Additionally, SSI holds over VND 6 trillion in HTM investments.

| Scale of FVTPL Financial Assets, HTM Investments, and SSI’s Loan Balances |

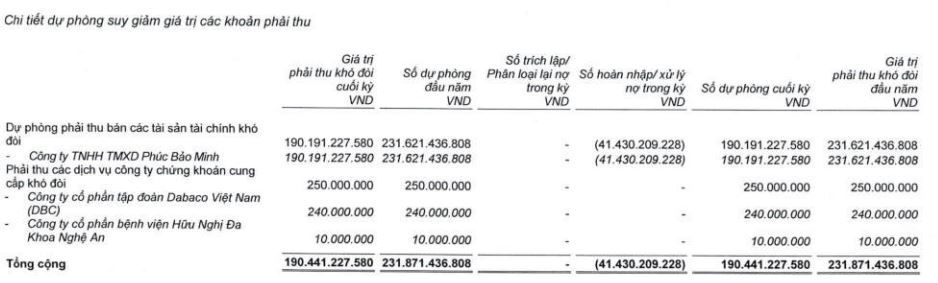

A notable point in this quarter’s balance sheet is the VND 40 billion reduction in provisions for impaired receivables, now at VND 190.4 billion. This is due to the recovery of receivables from Phuc Bao Minh Construction and Trading LLC. This bad debt, nearly VND 300 billion, appeared in SSI’s financial statements from Q4/2018. Thus, after nearly 7 years, SSI has recovered one-third of this non-performing loan.

| SSI’s Provisions for Impaired Receivables |

|

Explanation of SSI’s Impaired Receivables Provision in Q3/2025 Report

Source: Q3/2025 Parent Company’s Financial Statements

|

SSI’s capital structure leans toward debt financing. With liabilities nearing VND 70 trillion, up nearly 50% from the year’s start, the debt-to-equity ratio stands at nearly 2.3 times.

– 10:10 22/10/2025

Soaring Electricity Output Propels Song Ba Ha Hydropower Plant to Record Profits

According to the Q3/2025 financial report, Song Ba Ha Hydropower Joint Stock Company (UPCoM: SBH) saw a 51% surge in post-tax profit compared to the same period last year. This remarkable growth is attributed to favorable hydrological conditions, which significantly boosted commercial electricity output.

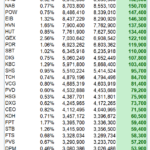

ACBS Reports Over 736 Billion VND in Net Profit for 9 Months, with Q3 Contributing Half

Amidst the favorable market conditions of Q3, ACB Securities Company (ACBS) reported a remarkable net profit of over 402 billion VND, marking an 86% surge compared to the same period last year. This outstanding performance propelled the company’s nine-month net profit to exceed 736 billion VND, reflecting a 35% year-on-year growth.

HSC Securities Reports Q3 Profits Double Year-on-Year

HSC Securities (HOSE: HCM) has announced its Q3 2025 business results, reporting pre-tax profits of VND 550 billion. This performance underscores sustained growth across its core business segments.