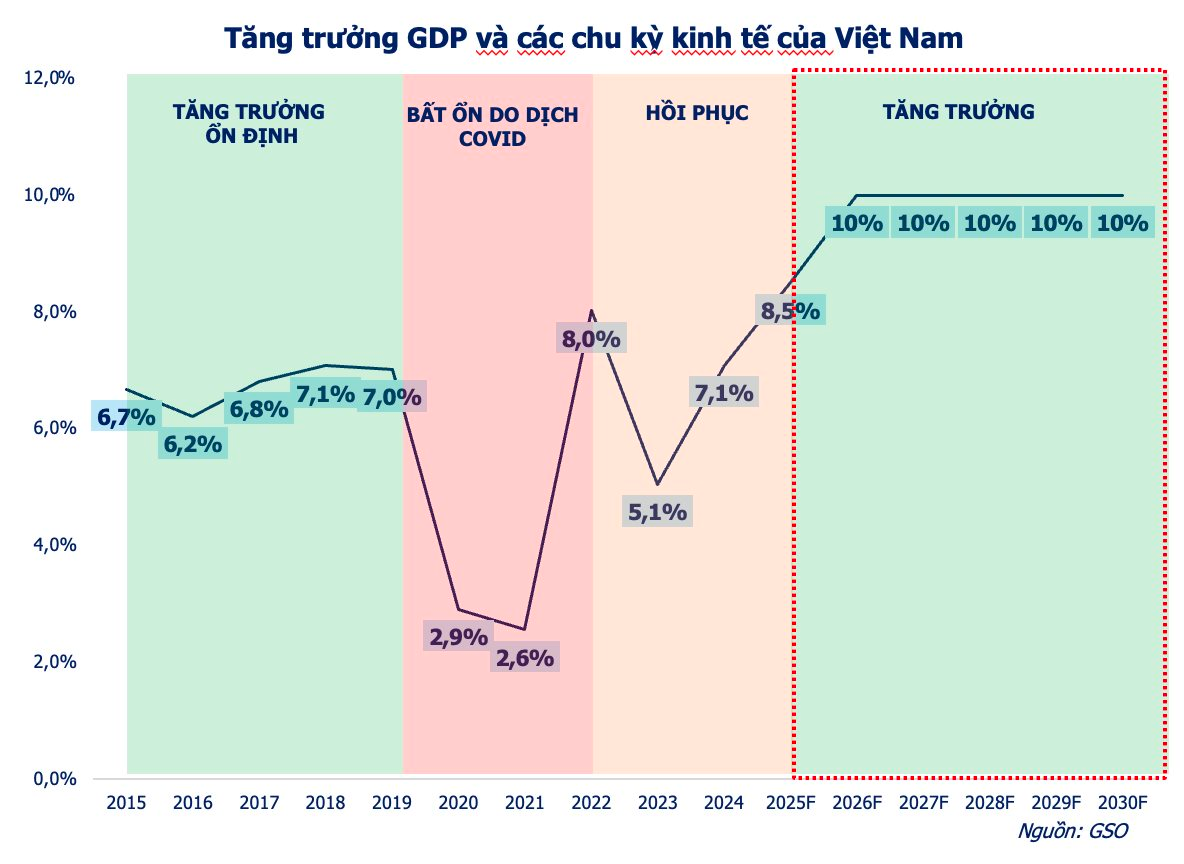

A New Era of Economic Growth

At the 2026 Business Forum “New Growth Spaces: Opportunities and Strategies,” organized by BizLIVE on October 22, Mr. Huynh Minh Tuan, Founder of FIDT, stated that Vietnam’s economy is entering a phase of exceptional growth, marked by positive macroeconomic indicators. Notably, the GDP growth target for 2026-2030 is set to reach double digits, the highest in a decade.

According to Mr. Tuan, this growth is fueled by a surge in credit expansion amidst record-low lending rates. Additionally, the government’s plan to boost public investment from 2025 to 2030 further supports this growth. Favorable tariff negotiations with the U.S. are also expected to stimulate FDI and enhance production and exports.

The private sector is identified as the primary driver for achieving the double-digit economic growth target in 2026-2030 and 2030-2045. Resolution 68-NQ/TW (April 2025) underscores this sector as a key national economic driver. To realize this strategy, specific documents have been issued, including Resolution 138/NQ-CP (Government Action Plan) and Resolution 198/2025/QH15 (May 17, 2025) by the National Assembly, focusing on digital transformation and innovation.

These measures are expected to invigorate investment channels such as stocks, real estate, precious metals, and digital assets.

Forum Overview

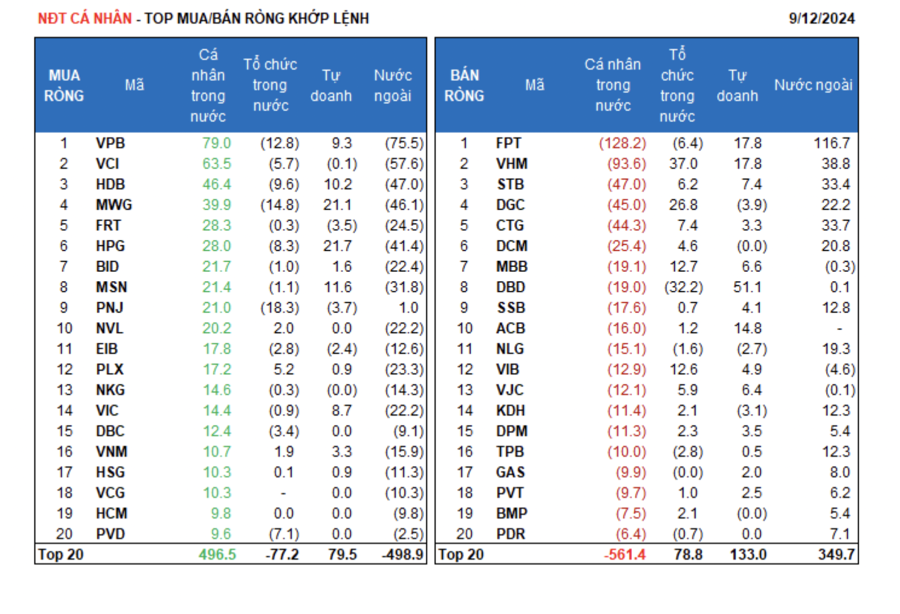

Three Key Drivers for the Stock Market

Mr. Huynh Minh Tuan highlights three key factors supporting Vietnam’s stock market in the medium to long term: (1) Post-upgrade prospects, (2) IPO wave, and (3) High economic growth with reasonable valuations.

First, the upgrade to Secondary Emerging status by FTSE Russell enhances market perception and attracts significant passive capital from global ETFs, leading to a notable revaluation.

This milestone signifies Vietnam’s progress toward system standardization and transparency, paving the way for MSCI inclusion in 2027-2028 and reinforcing its status as an emerging financial hub. Improved governance will attract both foreign and domestic investors.

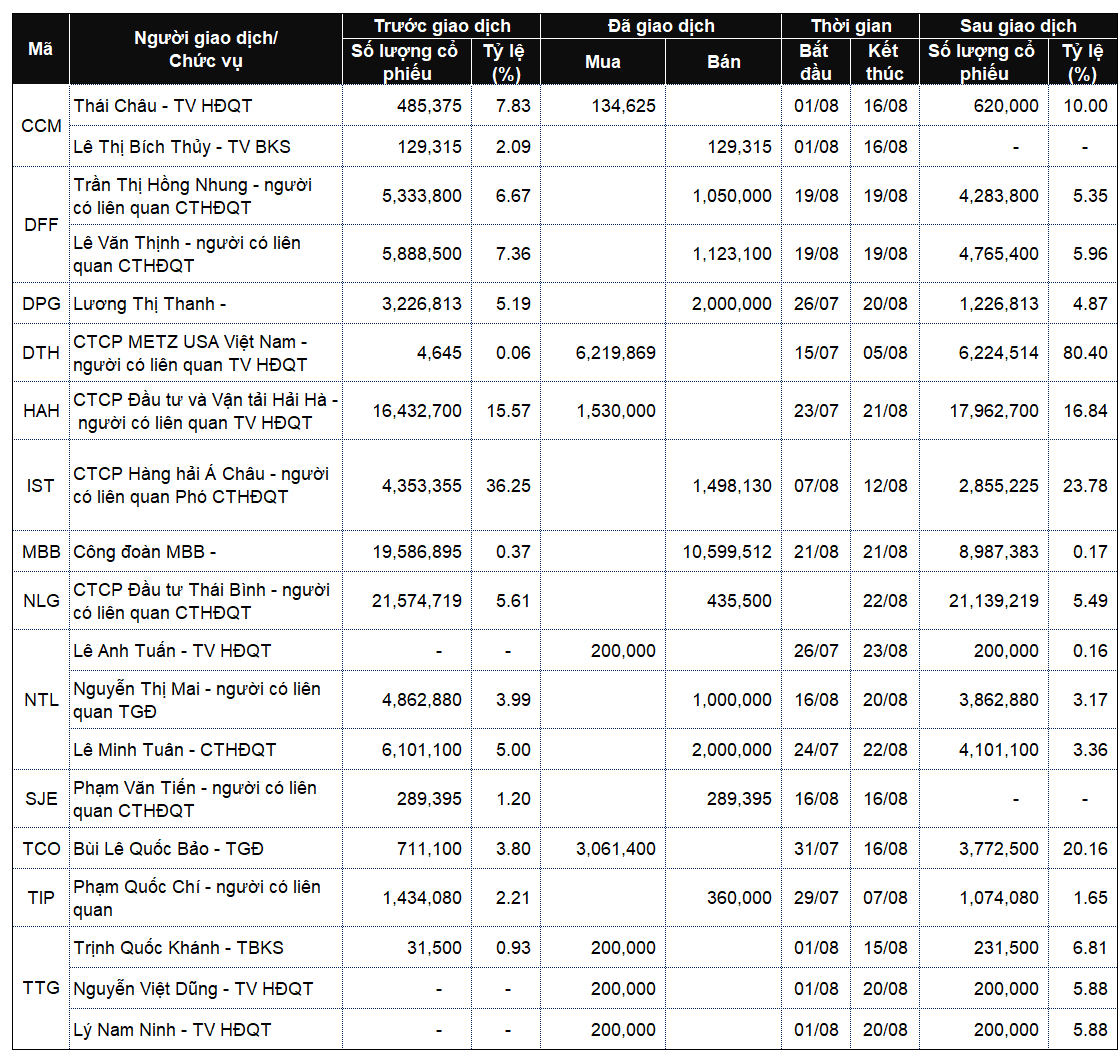

Second, a wave of IPOs from major companies is set to enhance market diversity and depth. By 2027, listings from prominent firms like VPBankS, TCBS, VPS (financial sector), and Nong Nghiep Hoa Phat, Highlands Coffee, and Bach Hoa Xanh will offer high-quality investment options.

Additionally, the SSC launched three new indices on November 3, 2025: VNMITECH (technology), VN50 Growth (large-cap growth), and VNDIVIDEND (dividend stocks), diversifying investment options.

Third, the market will benefit from macroeconomic stability and stimulus measures, including public investment and monetary policies, fostering corporate profit growth. Institutional reforms and improved governance will further enhance market quality.

The corporate bond market’s recovery in 2025, with a 35% issuance increase to VND 425 trillion, complements the stock market and offers attractive investment opportunities. FIDT forecasts continued growth, targeting a 25% corporate bond-to-GDP ratio by 2030.

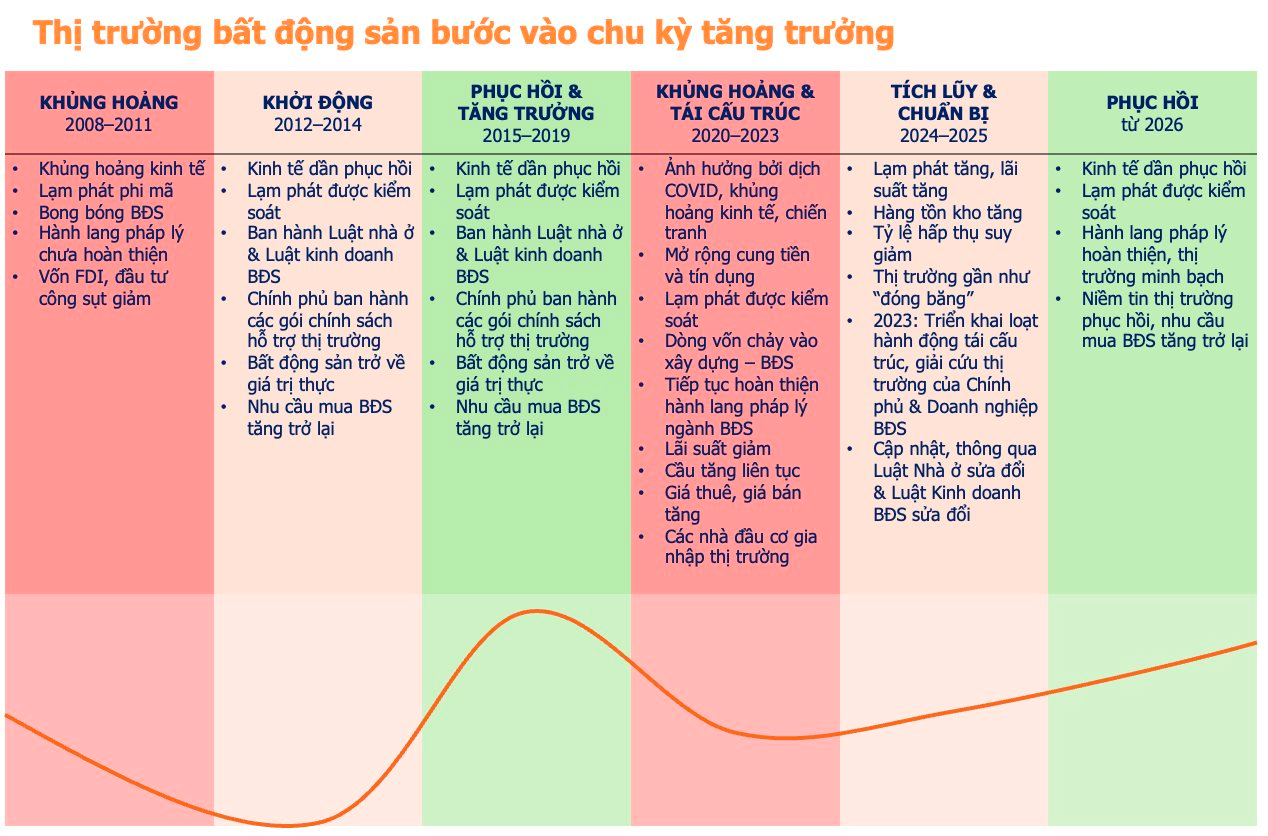

Real Estate Enters Growth Phase in Late 2025

Mr. Tuan predicts a robust real estate market from late 2025, driven by demographic trends and urbanization. Over the next decade, these factors will sustain housing demand and long-term market growth.

Gold Shines Amid Macroeconomic Uncertainty

Gold prices surged 56% in 2025 due to slower Fed rate cuts, economic risks, and central bank demand. Gold remains a safe-haven asset, while silver is more suited for short-term speculation.

Mr. Huynh Minh Tuan, Founder of FIDT

Policy changes in 2025, including ending the gold monopoly and introducing income tax, aim to enhance market transparency and combat illicit activities.

Regulated Openness in Digital Assets

Vietnam’s digital asset market, valued at $100 billion, is formalized under the Digital Technology Industry Law (effective January 1, 2026). Resolution 05/2025/NQ-CP establishes a regulated framework, balancing innovation with investor protection.

“This controlled pilot mechanism ensures transparency and risk management, treating digital assets like securities for tax purposes,” Mr. Tuan explained.

In diversifying portfolios, Mr. Tuan recommends increasing allocations to gold, stocks, bonds, and digital assets, while maintaining real estate exposure and reducing cash holdings.

Lumière Midtown: Sustainable Living at the Heart of Ho Chi Minh City

Lumière Midtown stands as the quintessential choice for elite living, offering not just a home but a lifestyle defined by unparalleled growth potential. Strategically located, this project seamlessly integrates prime positioning, cutting-edge infrastructure, world-class amenities, and the exceptional craftsmanship of Masterise Homes, setting a new benchmark for luxury and value appreciation.

Emerging Trends: Shifting Investment Focus Towards New Asset Classes

Hyundai Minh Tuan forecasts a diversification in asset allocation trends, with an increased focus on emerging asset classes. The anticipated shift in Vietnamese asset composition includes: a reduction in cash deposits, a rise in equities, bonds, and digital assets; real estate maintaining its dominance, and stable holdings in gold and precious metals.

Gold Price Surge Leaves Couples Struggling to Afford Wedding Rings, Says Delegate Nguyen Lam Thanh

Amidst soaring gold prices, members of the National Assembly have voiced significant concerns, urging the government to implement robust and effective regulatory measures to address the issue.