A Period of Exceptional Economic Growth

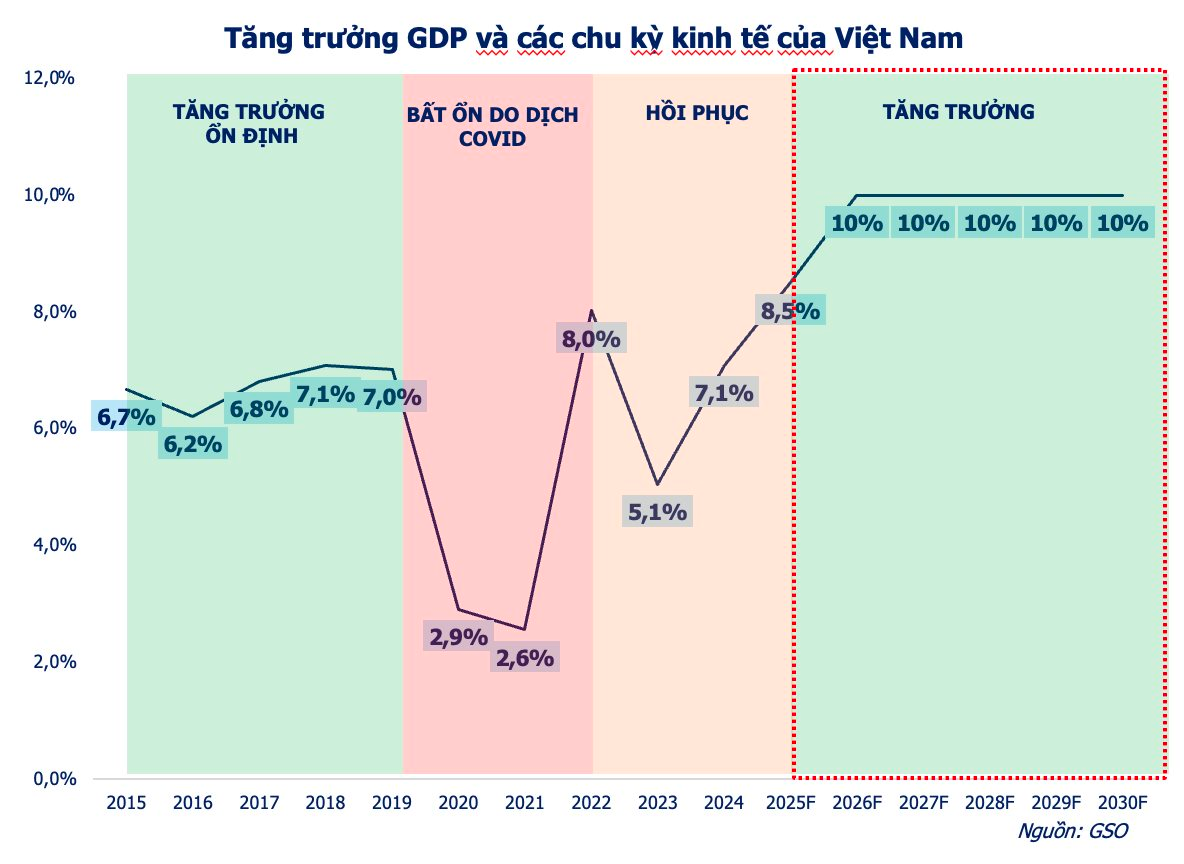

At the 2026 Business Forum “New Growth Spaces: Opportunities and Strategies,” organized by BizLIVE on October 22, Mr. Huynh Minh Tuan – Founder of FIDT – stated that Vietnam’s economy is entering a phase of exceptional growth, marked by numerous positive macroeconomic indicators. Notably, the GDP growth target for 2026–2030 is set to reach double digits, the highest in a decade.

According to Mr. Tuan, the driving forces behind this economic surge include rapid credit growth in a low-interest-rate environment. Additionally, the government’s plan to boost public investment from 2025 to 2030 is expected to further support growth. Favorable outcomes from U.S. tariff negotiations will also stimulate FDI and enhance production and exports.

The private sector is identified as the primary driver for achieving double-digit economic growth in 2026–2030 and 2030–2045. Resolution 68-NQ/TW (April 2025) marks the first time this sector has been recognized as one of the most critical drivers of the national economy.

To realize this strategy, specific documents have been issued, including Resolution No. 138/NQ-CP (Government Action Plan) and Resolution No. 198/2025/QH15 (May 17, 2025) by the National Assembly, outlining special mechanisms. These focus on two key drivers for private sector growth: digital transformation and innovation.

These economic stimulus measures are expected to significantly boost investment channels such as stocks, real estate, precious metals, and digital assets.

Forum Overview

Three Key Drivers for the Stock Market

Mr. Huynh Minh Tuan believes Vietnam’s stock market holds significant potential in the medium to long term, supported by three key factors: (1) Post-upgrade prospects, (2) IPO wave, and (3) High economic growth with reasonable valuations.

First, the upgrade to Secondary Emerging status by FTSE Russell enhances market perception and triggers substantial passive capital inflows from global ETFs, leading to a notable revaluation.

More importantly, this milestone signals Vietnam’s progress toward system standardization and transparency, paving the way for MSCI inclusion in 2027–2028 and solidifying its position as an emerging regional financial hub.

Improved governance will enhance market transparency and stability, attracting not only foreign investors but also domestic individual investors.

Second, numerous large enterprises are preparing for listings on HoSE, creating a robust IPO wave. This is expected to increase market attractiveness, fostering diversification and depth in Vietnam’s stock market.

From now until 2027, the market is projected to become more dynamic and diverse due to IPOs from major companies. Listings from prominent brands like VPBankS, TCBS, VPS (financial sector), along with Nong Nghiep Hoa Phat, Highlands Coffee, and Bach Hoa Xanh, will provide high-quality options, significantly enhancing the market’s appeal and depth.

Additionally, the SSC launched three new investment indices on November 3, 2025: VNMITECH (technology focus), VN50 Growth (large-cap growth), and VNDIVIDEND (dividend stocks), diversifying products and offering attractive investment options.

Third, the stock market will be supported by a comprehensive high-growth plan in the medium term. The two main pillars are: (1) Macroeconomic stability and stimulus through increased public investment and reasonable monetary policies to drive corporate profit growth; (2) Institutional reforms and quality enhancements by removing legal barriers, improving transparency, and promoting corporate governance and equitization.

The corporate bond market’s recovery in 2025 further supports the stock market and serves as an attractive investment channel. In the first nine months, corporate bond issuances totaled approximately VND 425 trillion, up 35% year-on-year, with recovery across all sectors.

FIDT forecasts continued recovery and growth in the corporate bond market as capital demand rises and investor confidence returns. The government aims for corporate bond market debt to reach 25% of GDP by 2030, significantly higher than the current 7%.

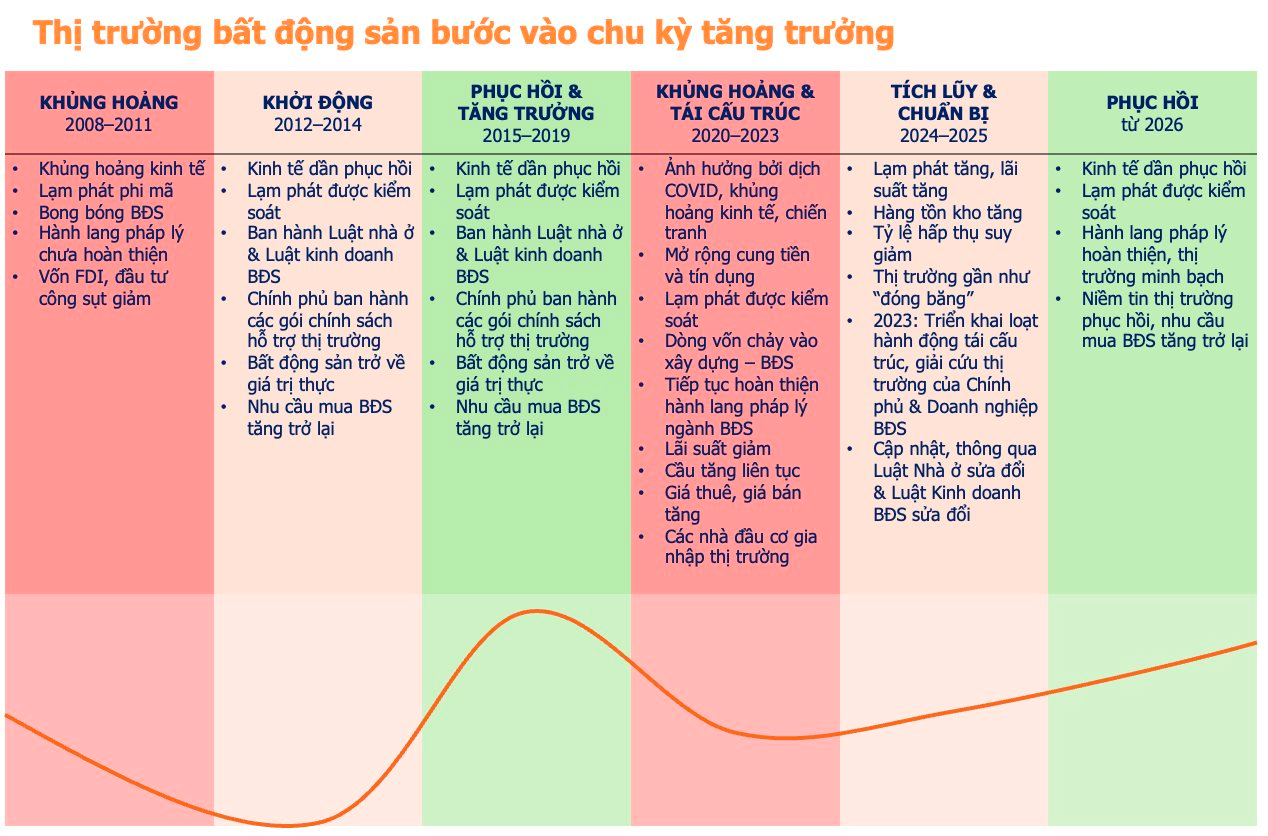

Real Estate Enters Growth Phase in Late 2025

For real estate, Mr. Huynh Minh Tuan noted that the market began to thaw in late 2024 and early 2025. From mid-2025, the market is expected to enter a strong growth phase over the next few years, presenting opportunities for investors with sound strategies to capitalize on the recovery and government support policies.

Housing demand is driven by demographics and urbanization, fueling Vietnam’s real estate expansion. Over the next decade, demographic trends, rapid urbanization, and infrastructure development will sustainably boost housing demand and ensure long-term market growth.

Gold Shines Amid Macroeconomic Volatility

In the first ten months of 2025, gold prices surged 56%, driven by three factors: (1) Interest rate policies, (2) Economic risks. The Federal Reserve’s slower-than-expected rate cuts increased gold’s appeal. Concerns over global economic crises due to trade policies made gold a safe-haven asset.

Strong buying from central banks also boosted demand. Amid ongoing uncertainties, gold is expected to remain a key investment focus.

Physical silver has gained attention recently due to rising prices and investor comparisons with gold. However, Mr. Huynh Minh Tuan believes silver is better suited for short-term speculation, while gold remains a sound choice for long-term investment and asset allocation.

Major precious metals companies like Phu Quy Jewelry and Sacombank – SBJ now offer silver storage products. Phu Quy has partnered with Bao Tin Minh Chau, a longstanding Hanoi-based gold trader, to distribute silver bars and coins, enhancing liquidity through an expanded dealer network.

Mr. Huynh Minh Tuan – Founder of FIDT

2025 saw significant changes in gold market regulations, including the end of the gold monopoly, proposed gold income taxes, and plans for a gold trading platform. These aim to enhance market transparency, support policy-making, and curb irregularities, money laundering, and speculation.

Digital Assets: “Open Yet Regulated”

Before legalization, Vietnam’s digital asset market, valued at around $100 billion, grew rapidly, with a sharp rise in digital asset accounts in recent years. Vietnam consistently ranks among the top globally in digital asset adoption, highlighting the sector’s potential.

The Digital Technology Industry Law, passed in June 2025 and effective from January 1, 2026, recognizes digital assets, opening new business opportunities, protecting users, and fostering industry growth. Supporting decrees and circulars are further refining the legal framework.

According to Mr. Huynh Minh Tuan, Vietnam’s 2025 digital asset policy, outlined in Resolution 05/2025/NQ-CP, adopts an “open yet regulated” approach. This marks the first legal recognition of digital assets as legitimate investment and exchange instruments.

“This controlled pilot mechanism aims to manage risks, requiring organizations to meet high standards for transparency and technology. Transactions will be taxed like securities. The core goal is to protect investors and bring the market under legal oversight,” said the FIDT founder.

In a multi-channel asset allocation trend, Mr. Huynh Minh Tuan recommends increasing exposure to gold, stocks, bonds, and digital assets, maintaining high real estate allocations, and reducing bank deposits.

“Exclusive Insights: Two Investment ‘Sharks’ Discuss Stocks vs. Real Estate Amid VN-Index’s Historic Crash and Year-End Investment Trends”

In just a few months, the investment landscape has witnessed a dramatic shift: stock markets soared to new highs only to plummet nearly 100 points, gold surged exponentially, and real estate began showing signs of recovery. As 2025 draws to a close, amidst the turbulent market waves, investors once again face the age-old question: which asset—gold, stocks, or real estate—truly serves as the safest haven?

Gold Surges Past $152 Million per Tael: Two-Day Purchase Limit Sparks Silver Rush

On the morning of October 17th, gold prices surged dramatically, surpassing 152 million VND per tael. Despite stores temporarily halting sales due to stock depletion, eager buyers continued to queue up early, undeterred by the shortage.