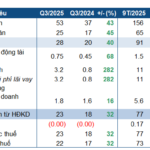

Specifically, L14 recorded just over 1 billion VND in net revenue during Q3/2025, a 95% decline compared to the same period last year, primarily due to reduced revenue from goods exchange activities. Gross profit consequently dropped by 94%, reaching nearly 1 billion VND.

A bright spot for the company came from financial activities, with revenue increasing by 46% to nearly 4 billion VND, driven by higher interest income from deposits and securities investments. Additionally, financial expenses were reversed by nearly 6 billion VND, thanks to a provision reversal of over 6.2 billion VND for investment impairments.

Not only financial expenses but also selling and administrative costs were significantly reduced by L14, by nearly 100% and 64%, respectively. As a result, L14 achieved an after-tax profit of nearly 8 billion VND, a 4% increase.

Combined with the first half-year results, the company’s nine-month after-tax profit reached 21 billion VND, a 31% year-on-year increase. Notably, L14 has surpassed its 2025 target of 20 billion VND in after-tax profit by over 5%.

|

Business results of L14 in the first nine months of 2025. Unit: Billion VND

Source: VietstockFinance

|

As of September 30, 2025, L14‘s total assets reached nearly 644 billion VND, a 3% increase from the beginning of the year. Within this, the value of trading securities rose by 23% to nearly 86 billion VND, while provisions related to this category narrowed from over 18 billion VND to nearly 9 billion VND. Conversely, short-term cash holdings decreased by 4% to 160 billion VND.

|

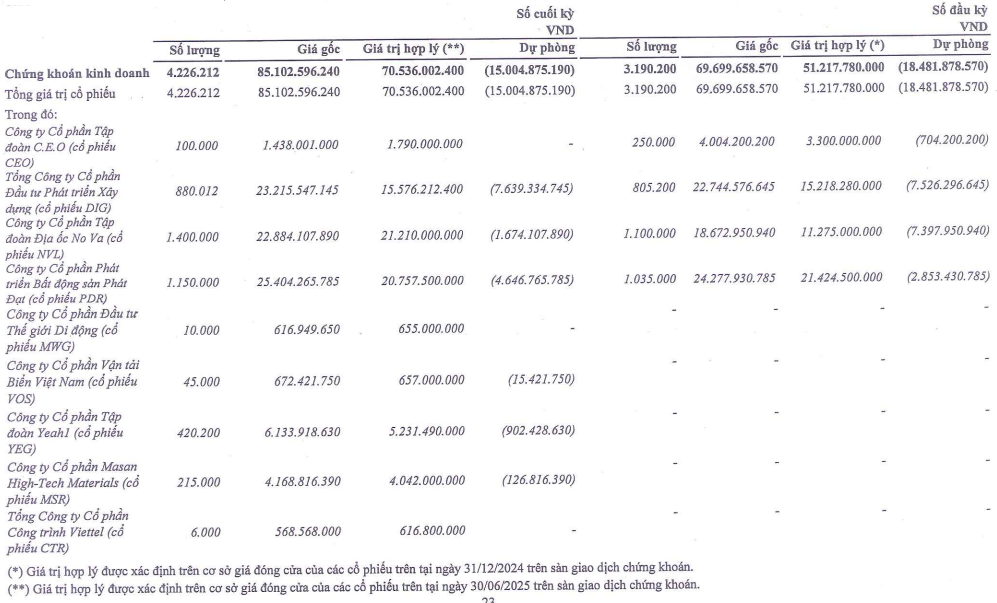

Trading securities portfolio of L14 as of June 30, 2025

Source: 2025 Semi-annual Financial Report

|

Liabilities remained nearly unchanged at approximately 197 billion VND. However, outstanding loans decreased by 53% to over 8 billion VND. In contrast, customer prepayments increased by 32% to more than 68 billion VND.

– 16:58 22/10/2025

Small Mountain Stone Records Highest Q3 Profit in 7 Years on Rising Sales and Prices

Net revenue for Nui Nho Stone Joint Stock Company (HOSE: NNC) surged 50% year-over-year in Q3 2025, surpassing VND 100 billion. The company attributed this growth to increased sales volume and higher selling prices during the period.

Hương Sơn Hydropower Profits Surge 32% Amid Favorable Weather and New Electricity Rates

Huong Son Hydro Power Joint Stock Company (UPCoM: GSM) has released its Q3/2025 financial report, revealing a 32% year-over-year increase in after-tax profit. This impressive growth is primarily attributed to higher water levels in the reservoir and the implementation of a new electricity pricing mechanism.

Bầu Đức Celebrates: Hoàng Anh Gia Lai (HAG) Reports 25% Surge in Q3 Net Profit Despite 80% Revenue Plunge in Pig Farming Sector

In the first nine months of the year, cumulative net revenue surpassed 5.6 trillion VND, marking a 34% increase compared to the same period in 2024. Post-tax profit recorded an impressive 1.312 trillion VND, reflecting a robust 54% growth year-over-year.