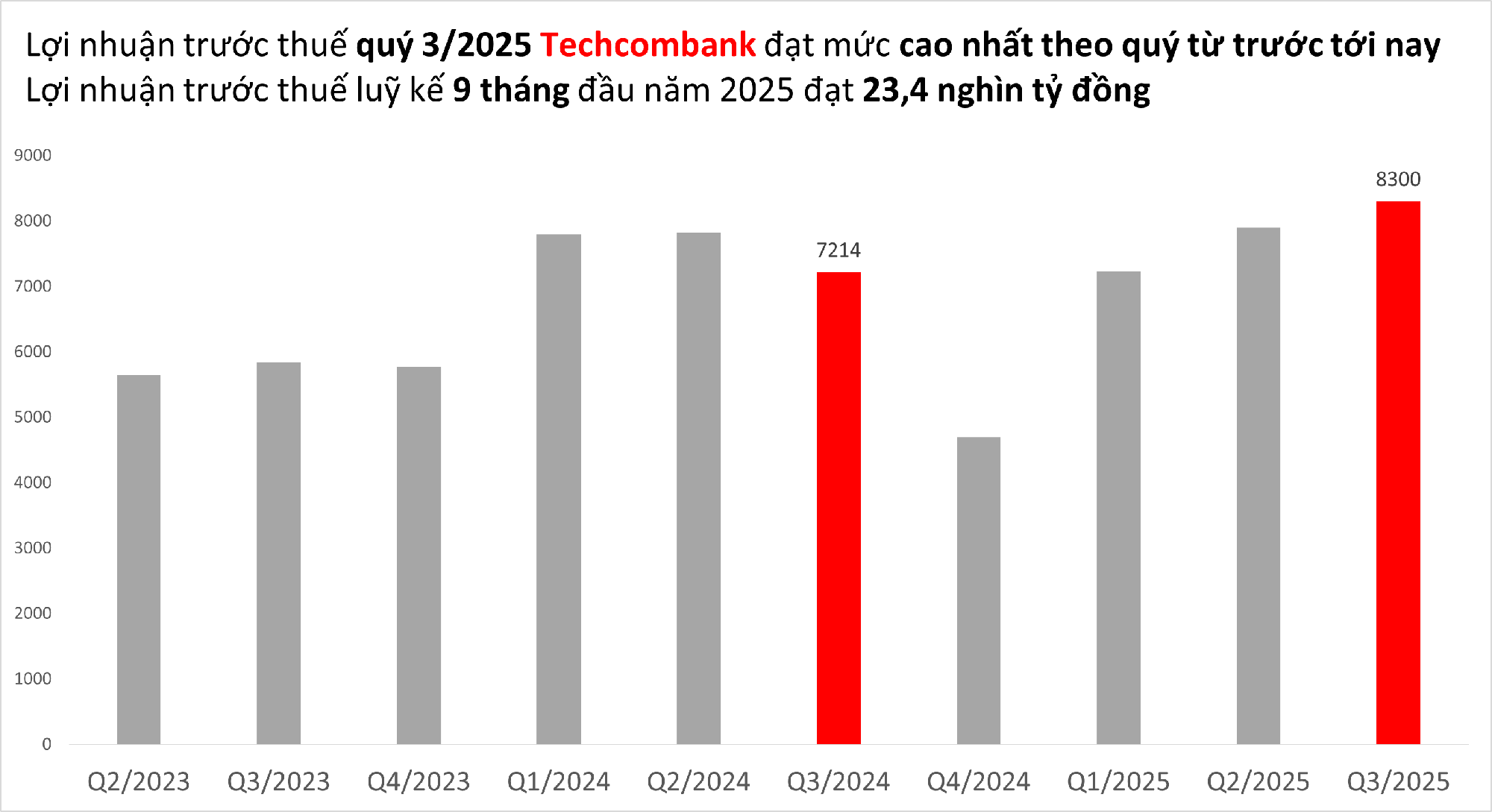

Q3/2025 Profit Reaches Nearly VND 8.3 Trillion, with Significant Growth in Service Revenue Streams

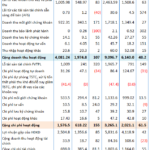

In the first nine months of 2025, Techcombank’s pre-tax profit reached VND 23.4 trillion, a 2.4% increase year-on-year. Specifically, Q3/2025 pre-tax profit hit VND 8.3 trillion, up 14.4%, marking the highest quarterly pre-tax profit in the bank’s history.

Total Operating Income (TOI) reached VND 38.6 trillion, a 3.1% increase compared to the same period last year. Notably, Q3/2025 TOI surged by 21.2% year-on-year, driven by robust growth in interest income, fee-based income, and foreign exchange earnings.

Net Interest Income (NII) for the first nine months stood at VND 27.4 trillion, up 1.7%. The Net Interest Margin (NIM) remained stable at 3.8% quarterly, supported by improved funding costs.

Non-Interest Income (NFI) reached VND 8.4 trillion in the first nine months, a 1.3% increase from the previous year’s high base, maintaining the highest fee income-to-total operating income ratio in the industry. Investment banking (IB) fees remained the largest revenue source at VND 3.4 trillion, up 32.8% year-on-year. Key services such as bond issuance advisory, distribution, and brokerage continued to show strong growth.

Letter of Credit (LC), cash, and payment fees reached VND 2.1 trillion, down 30.7% due to changes in the accounting method for UPAS L/C products. However, Q3 results still showed a positive 9.0% growth quarter-on-quarter, driven by alternative trade finance products catering to diverse customer needs.

Card service fees totaled VND 1.2 trillion, down 21.7% due to industry trends shifting from card payments to QR codes and other digital payment methods.

Foreign exchange services generated VND 896 billion, up 46.8%. Insurance service fees reached VND 800 billion, a 34.8% increase. Notably, Q3 insurance fees surged 66.2% to VND 348 billion. Techcombank maintained its leading position with the highest quarterly Annual Premium Equivalent (APE) in the industry.

Additionally, the bank recorded VND 1.1 trillion in income from non-performing loans (NPLs) recovered through provisions, a 32.7% increase year-on-year.

Operating expenses remained well-controlled at VND 11.6 trillion. The Cost-to-Income Ratio (CIR) stood at 30.1%, among the best in the market.

Provisions for the first nine months decreased by 9.1% to VND 3.6 trillion, reflecting improved asset quality in home loans and credit cards.

CASA Balance Reaches New Record High

As of September 30, 2025, Techcombank’s total assets exceeded VND 1,130 trillion. Credit growth remained stable at 16.8% year-to-date.

On a consolidated basis, both retail and corporate credit grew strongly. Retail credit increased by 20.2%, driven by margin lending (up 61%) and home loans (up 14.4%). Unsecured loans grew 180% year-to-date and 450% year-on-year. Corporate credit rose by 16.2%. The bank diversified its credit portfolio with high growth in Utilities and Telecommunications (up 65.3% year-to-date), followed by FMCG, Retail, and Logistics (up 17.7% year-to-date and 19.8% year-on-year).

Customer deposits reached VND 638.5 trillion by September-end, up 24.1% year-to-date. The CASA ratio (demand deposits + automatic savings) stood at 42.5%, among the industry’s highest. Retail CASA, including automatic savings, grew by 29.5%, while corporate CASA increased by 46%. This growth was driven by customer-centric solutions like Techcombank Auto Savings 2.0, business banking solutions, and comprehensive payment services.

NPL Ratio Declines, Provisions Cover NPLs Above 100% for 8 Consecutive Quarters

Techcombank maintained strong asset quality, with the NPL ratio improving from 1.32% to 1.23%. The NPL coverage ratio (LLC) reached 119.1%, marking the 8th consecutive quarter above 100%.

Liquidity and capital adequacy ratios remained compliant with State Bank regulations. The Capital Adequacy Ratio (CAR) stood at 15.8%, well above the 8% Basel II minimum requirement. The Loan-to-Deposit Ratio (LDR) was 81.2%. The ratio of short-term funding for medium-to-long-term loans decreased from 26.4% (Q2) to 24.1% (Q3).

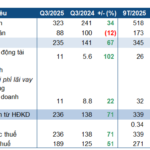

On January 21, Techcombank’s subsidiary, Techcom Securities (HOSE: TCX), officially listed on HOSE with a reference price of VND 46,800 per share. In the first nine months, TCX recorded pre-tax profit of VND 5.067 trillion, up 31% year-on-year, achieving 90% of its annual target.

Techcombank also saw impressive customer growth in 2025. By September-end, the bank served approximately 17 million customers, an increase of nearly 1.7 million year-to-date. Of these, 62.4% were acquired through digital platforms, 30.1% through branch networks, and 7.5% through ecosystem partners. The bank maintained its “primary transaction bank” status, leading in both outgoing (17.3%) and incoming (15.8%) transaction market share in the first nine months of 2025.

According to Jens Lottner, Techcombank’s CEO, the positive results were driven by strong credit demand, a customer-centric strategy, and Vietnam’s economic growth. Additionally, TCX’s successful IPO, with oversubscribed demand, marked a historic milestone for Techcombank and Vietnam’s capital market. This reflects strong investor confidence in the bank’s financial ecosystem and its ability to unlock new growth opportunities, fostering capital market development in the coming years.

SSI Reports Over VND 3.2 Trillion in Profits for Q1-Q3, Total Assets Nearing VND 100 Trillion

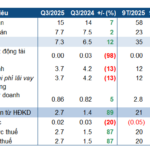

SSI Securities Corporation (HOSE: SSI) has released its Q3 2025 parent company financial report, revealing a post-tax profit of VND 1.4 trillion. For the first nine months of the year, the company’s accumulated post-tax profit stands at VND 3.2 trillion.

Soaring Electricity Output Propels Song Ba Ha Hydropower Plant to Record Profits

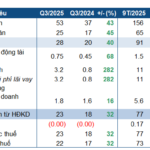

According to the Q3/2025 financial report, Song Ba Ha Hydropower Joint Stock Company (UPCoM: SBH) saw a 51% surge in post-tax profit compared to the same period last year. This remarkable growth is attributed to favorable hydrological conditions, which significantly boosted commercial electricity output.

TCBS (TCX) Lists and Officially Trades Over 2.31 Million Shares on October 21st

On October 21, 2025, the Ho Chi Minh City Stock Exchange (HOSE) hosted the listing ceremony for Technocom Securities Joint Stock Company – TCBS (stock code: TCX), officially launching over 2.31 billion TCX shares for trading on the HOSE platform.

Hương Sơn Hydropower Profits Surge 32% Amid Favorable Weather and New Electricity Rates

Huong Son Hydro Power Joint Stock Company (UPCoM: GSM) has released its Q3/2025 financial report, revealing a 32% year-over-year increase in after-tax profit. This impressive growth is primarily attributed to higher water levels in the reservoir and the implementation of a new electricity pricing mechanism.