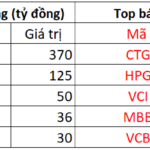

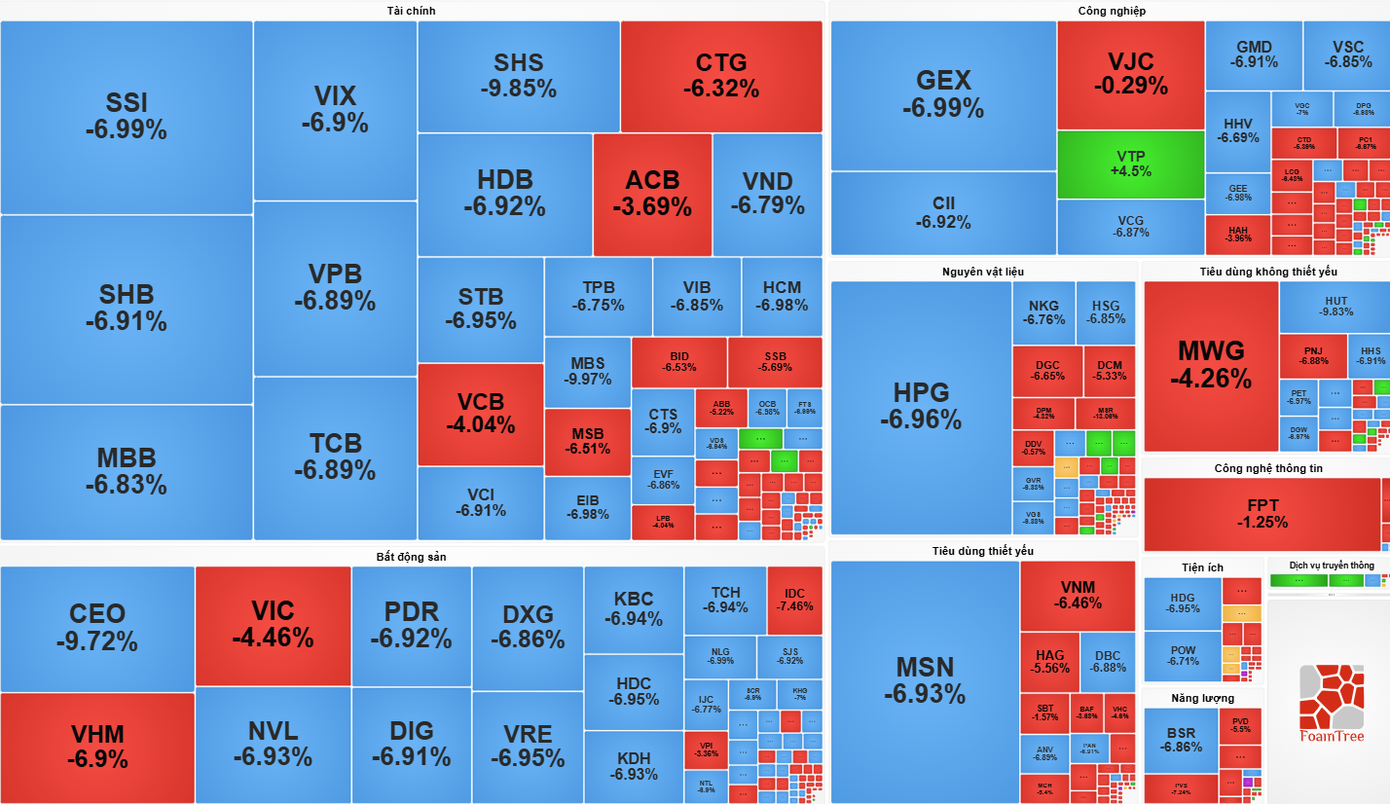

Investors rushed to sell off, causing the VN-Index to plummet towards the end of the session, resulting in a record drop of over 94 points. A vast number of stocks hit the lower limit, with 325 codes on HoSE closing in the red, including 108 stocks at the floor. The market lacked any supportive factors to curb the VN-Index’s decline. By the end of the session, many stocks, particularly in real estate, still had significant sell orders, ranging from millions to tens of millions of units.

Speaking to Tiền Phong’s reporter about today’s sharp decline in the VN-Index, Mr. Vũ Duy Khánh – Director of Analysis at Smart Invest Securities (AAS) – attributed this drop to a technical correction that was anticipated, although the market’s reaction was more negative than expected.

According to Mr. Khánh, a 15-20 point correction is reasonable after a strong rally, and even a retreat to the 1,680 – 1,700 range is within normal expectations. However, the VN-Index’s deep fall to around 1,630 – 1,640 points indicates that investor sentiment was heavily influenced by a widespread negative effect.

Over 100 stocks on HoSE hit the floor.

“Today’s widespread floor-hitting stocks are primarily due to a chain reaction in sentiment. When a few large stocks, especially in real estate and securities, hit the floor, investors tend to reduce their holdings accordingly. This wave of profit-taking spread, causing the entire market to panic,” Mr. Khánh analyzed, emphasizing that there was no new negative information significant enough to explain such a deep decline. Market corrections are necessary, but today’s extent was more psychologically driven rather than fundamentally.

Regarding the market’s focus on the Government Inspectorate’s conclusion about corporate bond issuance and fund usage, Mr. Khánh noted that apart from Novaland, other cases were not referred for investigation, so the impact was mainly psychological.

What should investors do?

According to Mr. Khánh’s statistics, historically, after sessions with over 4% declines, the market often recovers within T+3 to T+5 (3-5 subsequent sessions). Therefore, investors should not be overly pessimistic in the current context. “This is a time to remain calm and observe, without the need to sell off. With a medium-term perspective, this correction could present opportunities to buy at more attractive prices,” Mr. Khánh advised.

Regarding support levels, Mr. Khánh believes the area around 1,600 points will be a favorable zone for accumulation. Some groups with strong fundamentals, particularly securities and finance, still have positive prospects given their promising Q3 business results. Stocks that did not hit the floor or had fewer sell orders today are likely to rebound sooner when the market recovers.

The AAS expert also assessed that margin risk is currently moderate, as the market has not been overly exuberant, with the rally primarily driven by blue-chip stocks. “Many investors are more experienced and react quickly, so the risk is not too high,” Mr. Khánh concluded.

Experts advise staying calm and observing without selling off.

Mr. Nguyễn Trọng Đình Tâm – Deputy Director of the Analysis Division at ASEAN Securities Corporation – noted that sharp declines often occur after a FOMO (fear of missing out) phase. “We can attribute this to existing bond issues or rumors, but technically, a market that has risen significantly needs to decline to absorb supply pressure,” Mr. Tâm said.

Such steep declines often present significant buying opportunities, even for margin positions. Mr. Tâm believes the medium-term upward trend, established since Q2 this year, remains unchanged, supported by positive macro factors and the continued prospect of market upgrades.

For investors holding stocks with high purchase prices and short-term losses, consider reducing holdings partially at the start of the October 21 session, then wait for a rebound to manage the portfolio, but avoid selling at any cost.

Meanwhile, investors with high cash holdings can take advantage of the decline to gradually invest in sectors attracting significant capital, such as banking, securities, and real estate, while avoiding companies with bond issues.

Mr. Tâm advises: “If heavily in the red, reassess purchasing strategies and portfolio management. Given the substantial profits earned over recent months, a single floor drop isn’t overly alarming.”

Market Pulse 22/10: Spectacular Recovery as VN-Index Rebounds to Close at 1,678 Points

At the close of trading, the VN-Index surged by 15.07 points (+0.91%), reaching 1,678.5 points, while the HNX-Index climbed 4.04 points (+1.53%) to 268.69 points. Market breadth favored the bulls, with 448 advancing stocks outpacing 237 decliners. Similarly, the VN30 basket saw a dominant green trend, with 21 gainers, 8 losers, and 1 unchanged stock.