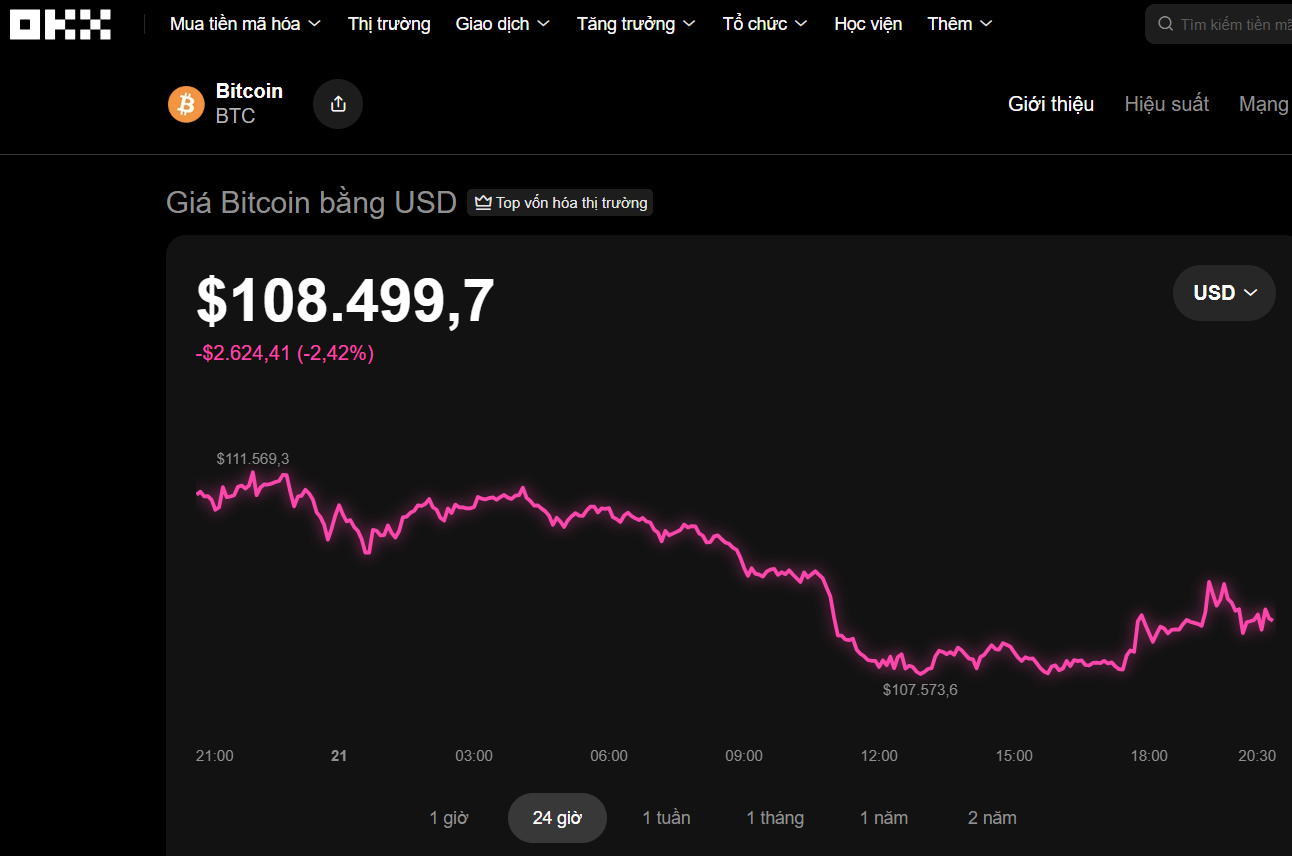

On the evening of October 21, the cryptocurrency market witnessed mixed movements as major coins experienced a collective decline. Data from the OKX exchange revealed that Bitcoin shed over 2% in the past 24 hours, settling at $108,500.

Other altcoins also saw significant drops, with Ethereum (ETH) falling more than 4% to $3,870; BNB dropping nearly 4% to $1,070; XRP decreasing by almost 2% to $2.40; and Solana (SOL) declining over 4% to $184.

According to Cointelegraph, Bitcoin’s price today dipped to $107,460, its lowest point in the week. This downturn occurred due to a “price gap” in futures markets, caused by the disparity between the weekend’s closing price and the week’s opening price.

Experts suggest that Bitcoin often revisits such gaps, indicating a potential price adjustment to around $107,000.

Bitcoin is currently trading around $108,500. Source: OKX

Trader Daan Crypto Trades warned that if Bitcoin falls below this level, the market could weaken significantly.

Long-time cryptocurrency investors like Roman and Crypto Tony predict further declines, potentially reaching $100,000 or even $95,000, unless buying pressure increases.

In Vietnam, the latest entrant to the cryptocurrency exchange arena is Tini Cryptocurrency Asset Trading Company, LLC, headquartered in Tan Hung Ward, Ho Chi Minh City.

According to the National Business Registration Portal, Tini Cryptocurrency Asset Trading Company was formerly known as Global Asset Management Consulting Company, LLC. Its legal representative is Mr. Vu Quoc Thai.

Global Asset Management Consulting Company, LLC was established in late December 2023, primarily engaged in investment consulting (excluding financial, accounting, and legal consulting). Its owner is Global Business Investment and Services Company, LLC.

Today’s Crypto Market, October 20: What Are Experts Saying About Bitcoin’s Recovery After the Crash?

On-chain data reveals that over the past 30 days, the amount of Bitcoin held by institutional investors has surged by 8.4%, reaching a total of 4.04 million Bitcoin.

Money Laundering in the Digital Asset Era: Acquiring Clean Projects with Dirty Money, Then Crashing Them to Erase Traces

Unveiling a sophisticated money laundering scheme, bad actors create seemingly legitimate crypto projects, only to purchase them with illicit cryptocurrency assets. They then transfer the funds back to themselves before ultimately collapsing the project, effectively erasing any trace of their malicious activities.