The State Bank of Vietnam, Branch 2 (SBV Branch 2 – overseeing Ho Chi Minh City and Dong Nai Province), has issued a warning to commercial banks in the region regarding legal and credit risks associated with lending for real estate deposits through “agreement documents” between customers and consulting or brokerage firms.

SBV warns of legal and credit risks related to lending for real estate deposits through “agreement documents.” (Illustrative image: mashvisor)

According to SBV Branch 2, the bank has recently received numerous complaints from citizens regarding banks providing credit for real estate deposits based on “agreement documents” from consulting and brokerage firms.

Many citizens expressed frustration, stating that such lending practices carry significant risks of violations and potential harm to borrowers in case of disputes.

Based on these complaints and information from authorities, SBV Branch 2 concludes that lending for deposits through these “agreement documents” poses substantial legal and credit risks, potentially compromising the safety of commercial banks’ operations.

SBV Branch 2 cites a ruling by the People’s Court of Ward 7 (Ho Chi Minh City), currently under appeal, which states that the deposit terms, payment schedules, and methods outlined in the “agreement documents” violate the Civil Code of 2015.

This warning is further reinforced by the Ho Chi Minh City Department of Construction’s October 7, 2025, decision to fine a consulting and brokerage firm for engaging in real estate transactions without meeting legal requirements, despite signing “agreement documents” with clients.

Recently, the Department of Construction also issued Notice No. 11410/TB-SXD, prohibiting real estate businesses from authorizing individuals or organizations to sign deposit, purchase, transfer, or lease agreements for projects lacking the necessary legal approvals.

Given these developments, SBV Branch 2 warns that commercial banks lending for deposits based on “agreement documents” face severe legal risks. If these documents are deemed invalid, banks may face prolonged disputes and challenges in debt recovery, especially when the collateral is tied to legally incomplete projects.

In addition to legal risks, the regulator highlights the potential for bad debt and financial losses. Loan disbursements for deposits to brokers or consultants are entirely dependent on the project’s progress and legal status. If the project is delayed, suspended, or fails to meet legal requirements, banks risk losing capital.

Furthermore, if banks fail to thoroughly assess the financial capacity of consulting or brokerage firms or do not control the disbursement of funds—such as ensuring deposit refunds as promised—credit risks escalate. This not only leads to bad debt and increased handling costs but also directly impacts the bank’s financial safety and business performance.

Beyond legal and credit risks, SBV Branch 2 also highlights reputational risks. In disputes between buyers and brokers, customers often accuse banks of enabling illegal practices, particularly when projects are delayed or not delivered on time.

There have been instances where citizens gathered at bank headquarters demanding refunds of loans or deposits, causing disruptions and damaging the banks’ reputation and operations. If such incidents persist, reputational risks could spread, negatively affecting customer and investor trust in the entire banking system.

In light of these risks, SBV Branch 2 urges commercial banks in Ho Chi Minh City and Dong Nai Province to rigorously review and manage loans related to real estate deposits.

Banks must closely monitor conclusions from authorities such as courts and construction departments to take appropriate measures and avoid disputes with customers.

For existing loans, banks should proactively engage with borrowers, consulting firms, brokers, and project developers to resolve issues, protect customers’ legal rights, and minimize mass complaints.

Specifically, SBV Branch 2 directs banks to suspend lending for deposits through “agreement documents” or similar arrangements until official conclusions are reached by competent authorities.

If these documents are confirmed legal, banks may resume lending only after establishing specific risk assessment and control procedures.

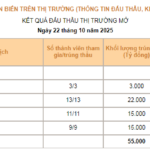

Three Cases of Deposit Insurance Payouts

According to the Governor of the State Bank of Vietnam, Nguyen Thi Hong, one of the significant new provisions in the draft is the regulation of the timing for insurance premium obligations to arise. This enables regulatory authorities to proactively manage risks and enhance protection for depositors.

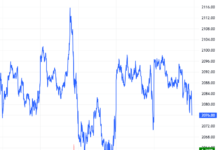

USD Freely Traded Rates Surge Unexpectedly on October 22nd Afternoon

The USD exchange rate in the open market has surged past the 27,000 VND mark, significantly outpacing the rates offered by commercial banks.