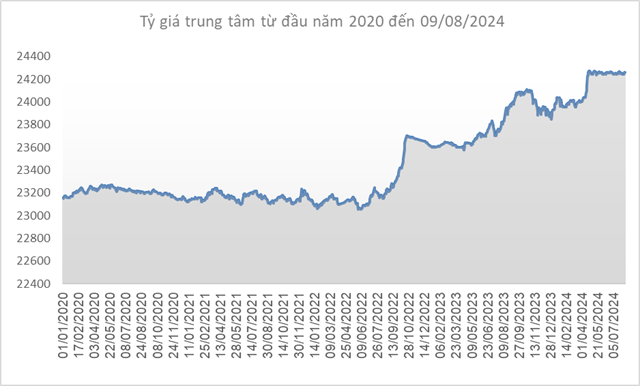

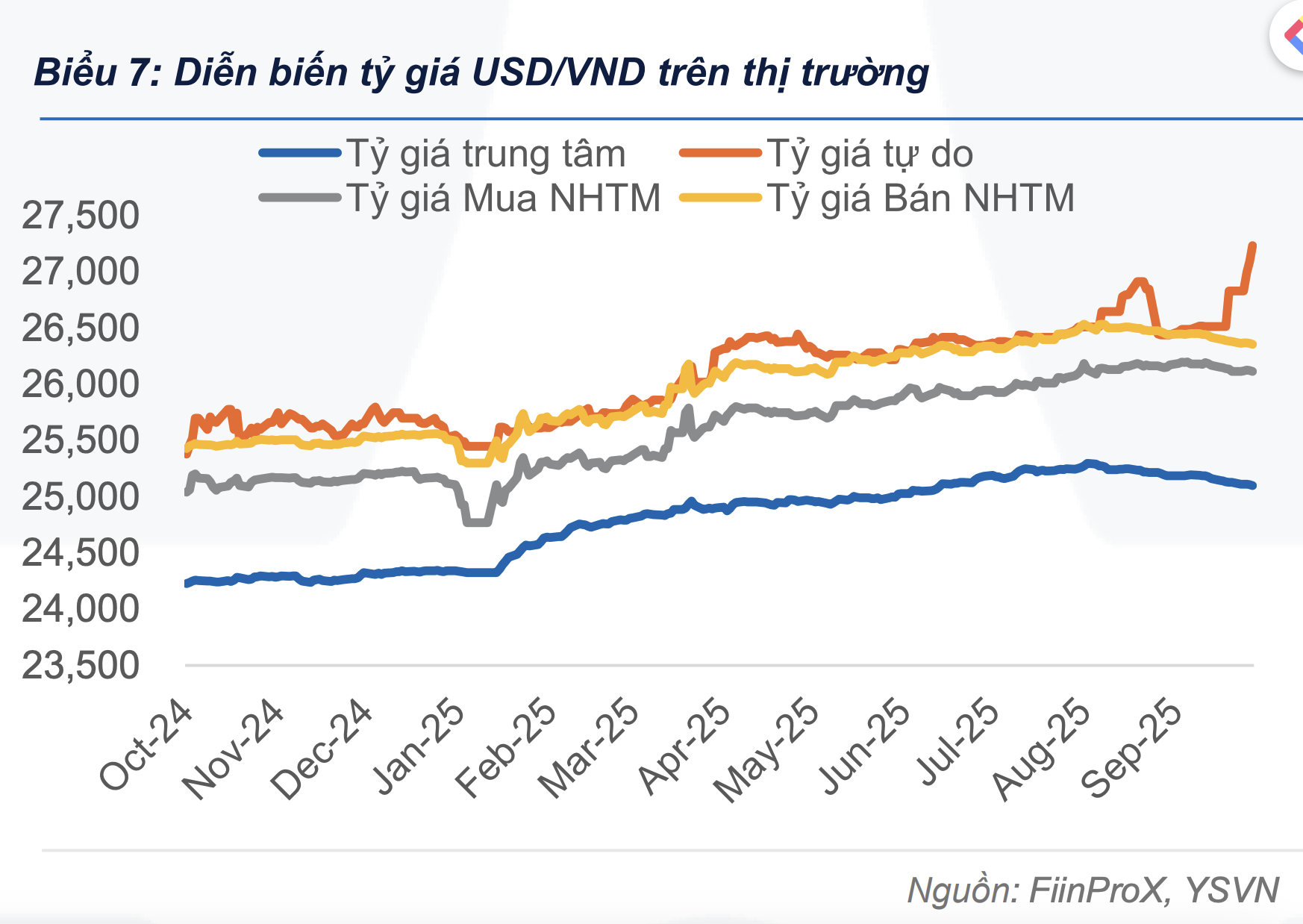

On October 22, the State Bank of Vietnam set the central exchange rate at 25,099 VND/USD, unchanged from the previous day. Commercial banks also maintained stable USD rates: Vietcombank bought at 26,153 VND and sold at 26,353 VND/USD; Eximbank quoted 26,160 – 26,353 VND; and BIDV matched at 26,153 – 26,353 VND/USD.

However, an unexpected shift occurred in the free market. By the afternoon, several currency exchange points in Ho Chi Minh City reported buying rates at 27,146 VND/USD and selling at 27,342 VND/USD, a 50 VND increase from the previous day.

This marks the highest USD rate in over a month, nearly 1,000 VND higher than bank rates. The last time the free market USD rate surpassed 27,000 VND was in early September.

Free Market USD Rate Surpasses 27,200 VND

Mr. Nguyen The Minh, Director of Individual Client Analysis at Yuanta Vietnam Securities, attributes the sharp rise in the free market rate to increased USD demand towards year-end, coupled with limited cash supply. Additionally, the gap between free market and bank rates requires time to adjust, despite the State Bank’s recent sale of term USD twice.

Forecasts suggest the USD/VND rate may stabilize or slightly increase this week due to rising foreign currency demand and the strengthening US Dollar Index (DXY), currently at 98.9 points, its highest since early August.

Recent Uptick in Free Market USD Rates

USD Freely Traded Rates Surge Unexpectedly on October 22nd Afternoon

The USD exchange rate in the open market has surged past the 27,000 VND mark, significantly outpacing the rates offered by commercial banks.

Unified Banking Framework Launched to Combat Card and Account Fraud

To combat credit card and account fraud, banks have established a unified framework, outlining specific procedures to address and mitigate fraudulent activities upon detection.

Central Bank Reverses Course with Net Injection into Open Market

During the week of October 13–20, 2025, the State Bank of Vietnam (SBV) reversed its stance, resuming net injections into the open market after two consecutive weeks of net withdrawals. This shift occurred amid fluctuating liquidity in the banking system, as evidenced by a sharp rise in overnight interest rates.