Ha Giang Mechanical & Mineral Joint Stock Company (stock code: HGM) has released its Q3/2025 financial report, revealing a net revenue of over 173 billion VND, a 54% increase compared to the same period last year.

Gross profit reached 148 billion VND, marking a 78% surge year-over-year.

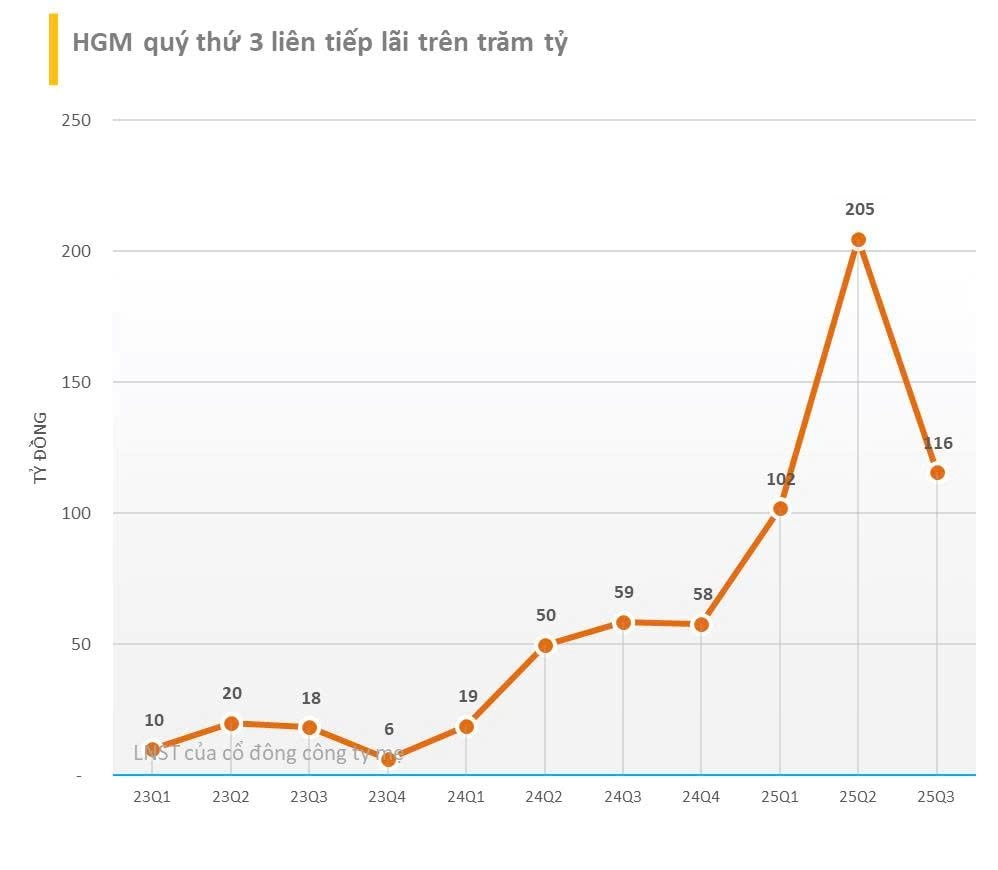

After deducting expenses, net profit after tax stood at nearly 116 billion VND, a 97% jump from the 59 billion VND recorded in Q3/2024. This marks the third consecutive quarter the company has reported profits exceeding 100 billion VND, a significant improvement from previous periods.

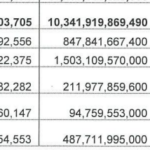

For the first nine months of 2025, net revenue totaled 606 billion VND, a 144% increase from the same period in 2024 (248 billion VND). Net profit after tax reached 422 billion VND, a 231% rise compared to the 127 billion VND recorded in the first nine months of 2024.

During this period, revenue was primarily driven by Antimony metal exports, which contributed 597 billion VND, a 156% increase year-over-year. Domestic Antimony sales amounted to 9.1 billion VND, a 39% decline compared to the same period last year.

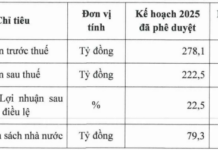

Compared to the annual plan, the company has already surpassed its revenue target by over 50% and doubled its pre-tax profit.

Antimony is a critical mineral highly sought after by Canada, the United States, the European Union, the United Kingdom, and other nations worldwide. This strategic metal is used in military applications such as ammunition and missiles, as well as in lead-acid storage batteries for automobiles and brake linings due to its heat-resistant properties.

This vital resource is also extensively used in high-tech industries, serving as a key component in semiconductors, circuit boards, electrical switches, fluorescent lighting, high-quality transparent glass, and lithium-ion batteries. Everyday products like smartphones, high-definition TVs, modern kitchen appliances, and even digital circuit-equipped vehicles rely on Antimony.

On the stock market, as of October 22, 2025, HGM shares were priced at 299,000 VND per share, with a market capitalization exceeding 3.7 trillion VND.

FPTS Reports Pre-Tax Profit of VND 167 Billion in Q3/2025 from Proprietary Trading

Despite booking profits from the sale of MSH shares, FPTS still reported a proprietary trading loss in Q3/2025. As a result, the company announced pre-tax profits of VND 167 billion.

KienlongBank Surges Ahead with Strategic Milestones, Shattering 30-Year Profit Records and Leading Market Momentum

KienlongBank (Kien Long Commercial Joint Stock Bank; UPCoM: KLB) has recently unveiled its Q3 2025 business results, reporting a consolidated pre-tax profit of VND 616 billion. Key performance indicators, including total assets, mobilized capital, and outstanding loans, have all surged significantly, nearing annual targets. This impressive growth underscores the bank’s robust management capabilities and clear strategic direction.

Vietcap Securities Reports Billion-Dollar Profit After Q3, Struggles with Tech Stock Losses

Over the first nine months, Vietcap Securities reported pre-tax profits of VND 1.086 trillion. Within its investment portfolio, VCI is currently holding FPT shares at a loss.