According to preliminary statistics from the General Department of Vietnam Customs, Vietnam’s exports of computers, electronic products, and components reached over $10.5 billion in September, marking an increase from the previous month. In the first nine months of 2025, this category brought in nearly $77.5 billion, a surge of nearly 46% compared to the same period last year.

This group continues to lead in export turnover, accounting for 22% of the country’s total exports, significantly outpacing other major export categories.

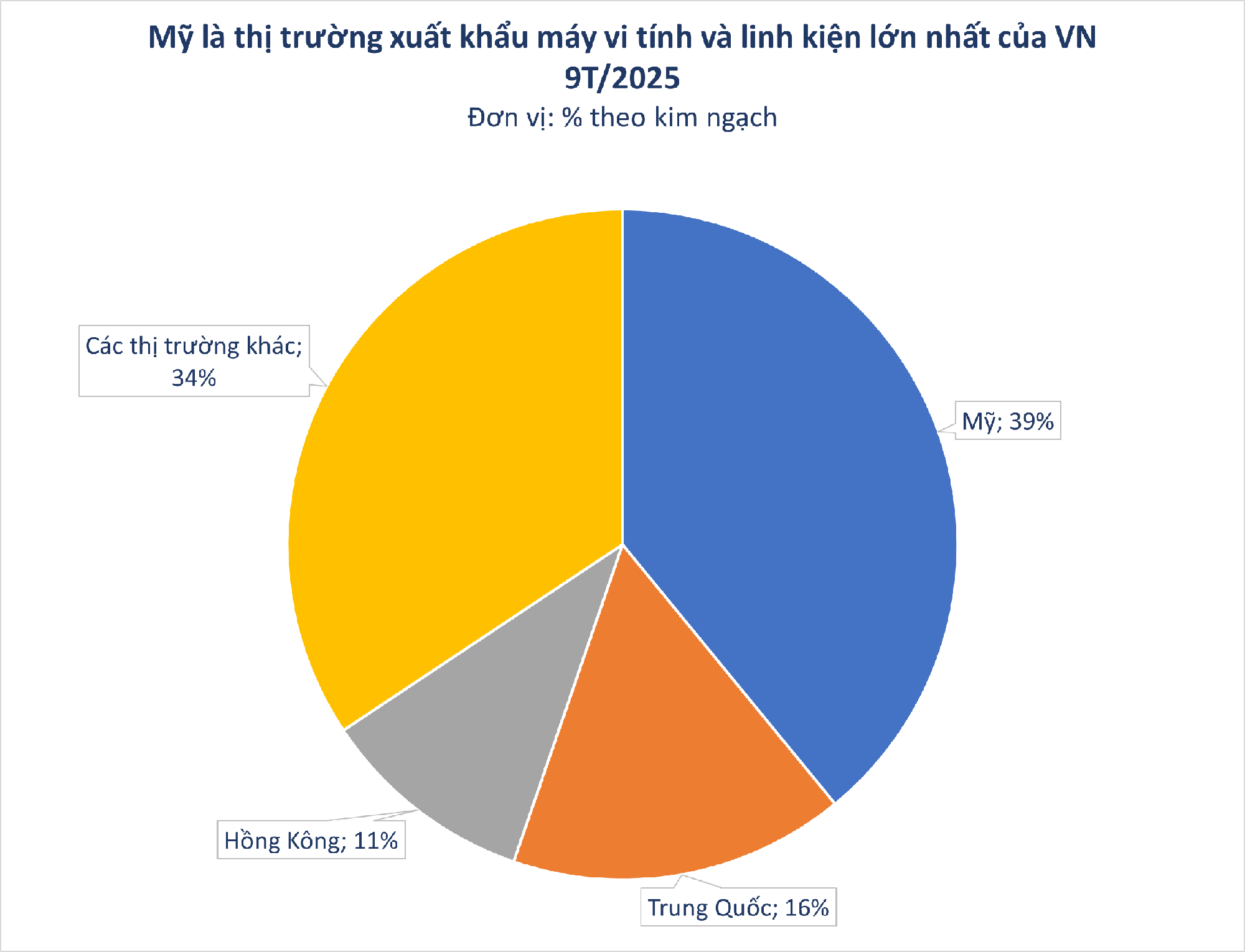

The United States played a pivotal role in this robust growth, maintaining its position as Vietnam’s largest export market. In the first nine months, exports to the U.S. totaled $30 billion, a remarkable 75% increase compared to the same period in 2024.

China followed as the second-largest market, with exports reaching $12.5 billion, an increase of over $3 billion year-on-year. Hong Kong (China) ranked third, with exports exceeding $8 billion, up by nearly $2 billion.

Vietnam’s exports to the U.S. in the first nine months of 2025 surpassed $112 billion, with a trade surplus of $99 billion. These figures highlight the positive growth in Vietnam’s exports to the U.S., particularly after the corresponding tariff imposed by President Donald Trump was reduced to 20%.

According to the White House and U.S. Customs, Vietnamese computer and component exports face a 9.1% tariff, compared to the average 10.2% tariff applied to other countries exporting to the U.S.

Over the past decade, the electronics, computer, and component sector has emerged as one of the largest pillars of Vietnam’s economy, significantly contributing to annual export revenue and creating numerous job opportunities.

The impressive growth in electronics, computer, and component exports and imports is driven by four key factors: stable FDI inflows, global supply chain shifts, expanded export markets, and improved production and logistics infrastructure. Vietnam’s competitive labor costs, strategic geographic location, and favorable tax policies have made it an attractive destination for foreign investment. The U.S.-China trade war has accelerated the relocation of manufacturing facilities from China to Vietnam.

Free trade agreements such as EVFTA, CPTPP, and RCEP have facilitated deeper penetration of Vietnamese electronics into Europe, the Americas, and Asia. Upgrades to industrial zones and major seaports (Hai Phong, Cat Lai, Cai Mep – Thi Vai) have further streamlined export and import processes.

Despite challenges, Vietnam’s electronics export structure is gradually shifting from components and semi-finished products to finished goods. Domestic companies like Viettel, Bkav, FPT, and Vingroup (VinES, VinSmart) are increasingly involved in designing and manufacturing smart devices and high-tech components, boosting local value addition. The development of the semiconductor, IoT devices, battery, and electric vehicle component industries also presents new opportunities, especially with the government’s push for a national strategy on electronics and semiconductors by 2030.

Global tech giants such as Samsung, LG, Foxconn, Fukang Technology, Canon, Intel, Compal, Pegatron, and Luxshare have established multi-billion-dollar manufacturing facilities in Vietnam, significantly enhancing production capacity and positioning the country as a critical link in the global electronics value chain.

The future growth potential of the electronics and technology sector remains substantial, despite global economic fluctuations, trade tensions, and geopolitical conflicts impacting supply chains and logistics. If current export orders are maintained, Vietnam’s import turnover of computers, electronic products, and components is likely to reach $100 billion.

Vietnamese Leaf Once Dirt Cheap Now Commands Premium Prices Abroad: Sought After in European and American Gourmet Cuisine

Once considered a mere garnish, lime leaves have now emerged as a high-value export commodity, captivating global markets with their unique flavor and versatility.

Vietnam’s Trade Set to Hit $900 Billion: Spotlight on the Top 7 Shining Stars

Over the first nine months, the total import-export turnover reached $680.6 billion, with projections indicating a potential new record of approximately $900 billion for the full year 2025.