I. MARKET ANALYSIS OF THE BASE STOCK MARKET ON OCTOBER 23, 2025

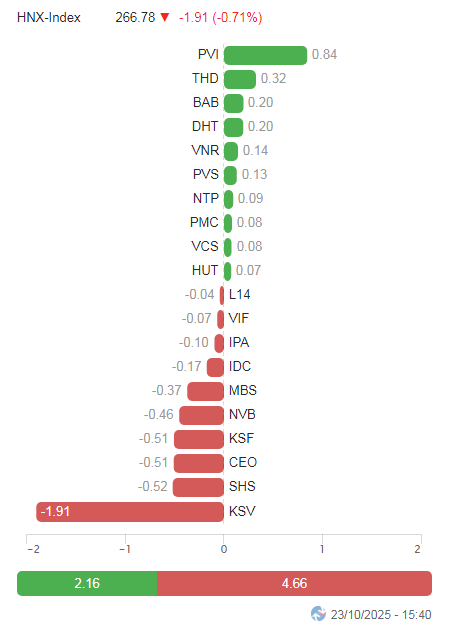

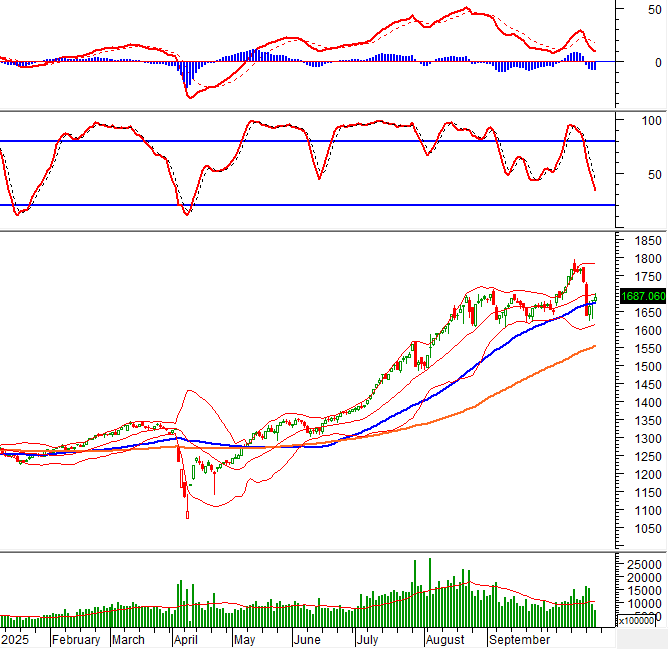

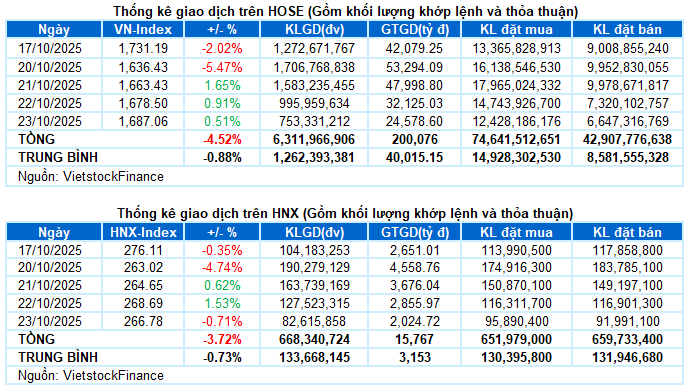

– Key indices showed mixed movements during the October 23 trading session. Specifically, the VN-Index rose by 0.51%, reaching 1,687.06 points, while the HNX-Index declined by 0.71%, closing at 266.78 points.

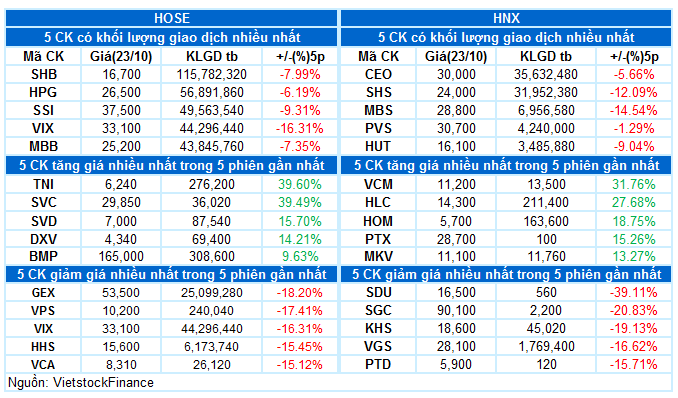

– Trading volume on the HOSE floor decreased by 23.2%, totaling nearly 700 million units. Similarly, the HNX floor recorded over 81 million matched units, a 24.6% drop compared to the previous session.

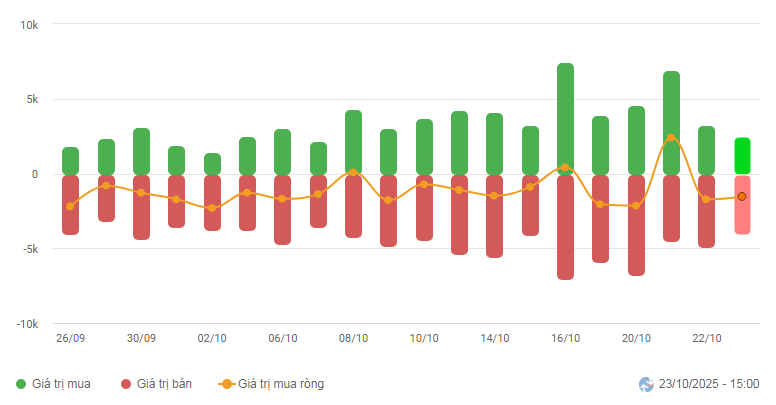

– Foreign investors continued to net sell on both the HOSE and HNX floors, with values exceeding 1.3 trillion VND and 207 billion VND, respectively.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

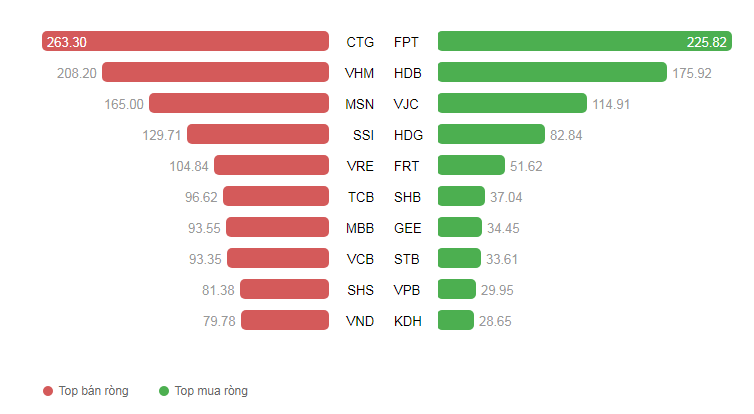

Net Trading Value by Stock Code. Unit: Billion VND

– During the October 23, 2025 trading session, the market opened cautiously as buying momentum remained subdued, causing the VN-Index to hover around the reference level for most of the morning. However, from the end of the morning session, strong capital inflows into large-cap stocks propelled the index upward, maintaining a green trend for the remainder of the session. Despite slight profit-taking pressure toward the close, the VN-Index sustained its upward momentum, closing at 1,687.06 points, up nearly 9 points from the previous session.

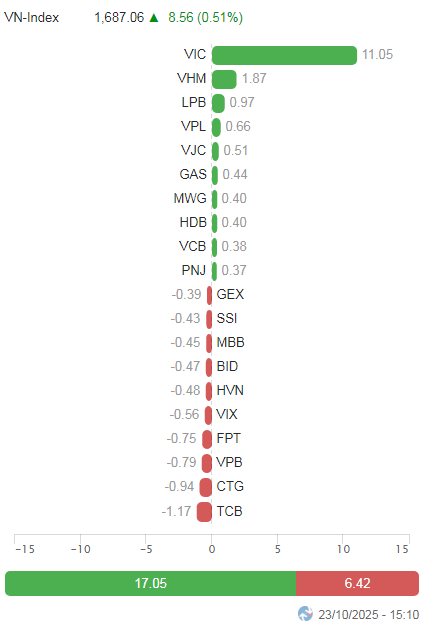

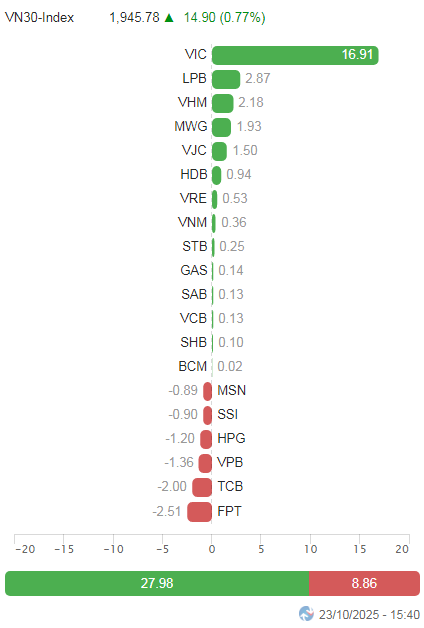

– In terms of influence, VIC was the market’s primary pillar today, contributing 11 points to the VN-Index‘s rise. Additionally, VHM and LPB added a combined 2.8 points. Conversely, TCB, CTG, and VPB exerted significant downward pressure, causing the index to lose nearly 3 points.

Top Stocks Influencing the Index. Unit: Points

– The VN30-Index closed up nearly 15 points at 1,945.78 points. The basket’s breadth was balanced, with 14 gainers, 14 losers, and 2 unchanged stocks. Among the gainers, VIC stood out with a remarkable 5.9% increase. LPB and VJC also rose by over 2%. On the downside, SSI, FPT, and TCB led the declines, adjusting downward by more than 2%.

Divergent trends continued to dominate industry groups. The real estate sector led the overall uptrend, with standout performers including VIC (+5.91%), VHM (+1.77%), VRE (+1.03%), KDH (+4.19%), NVL (+1.43%), and VPI (+1.82%). However, several real estate stocks faced strong selling pressure, such as KSF (-3%), PDR (-2.68%), CEO (-4.46%), DIG (-2.89%), DXG (-2.2%), TCH (-2.22%), and HDC (-3.5%).

The financial and industrial sector indices fluctuated within a narrow range, with a mix of green and red. While many stocks maintained strong demand, such as HDB (+1.54%), LPB (+2.81%), ORS (+1.37%), ABB (+3.88%), VJC (+2.11%), CTD (+5.52%), HAH (+6.73%), and VSC hitting the ceiling, several others declined by over 1%, including SSI, VIX, TCB, VPB, CTG, SHS, VND, VCI, GEX, VCG, VTP, HHV, and HVN.

Meanwhile, the communication services sector underperformed, declining by 2.23%, primarily due to pressure from stocks like VGI (-2.74%), FOX (-1.39%), CTR (-1.05%), and YEG (-0.8%).

The VN-Index recovered for the third consecutive session but failed to surpass the Middle line of the Bollinger Bands. This will be a critical short-term test for the index. Trading volume continued to decline and remained below the 20-session average, indicating investor caution during the current recovery phase.

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – Third Consecutive Recovery Session

The VN-Index recovered for the third consecutive session but failed to surpass the Middle line of the Bollinger Bands. This will be a critical short-term test for the index.

Trading volume continued to decline and remained below the 20-session average, indicating investor caution during the current recovery phase.

The August 2025 low (equivalent to the 1,605-1,630 point range) will continue to serve as strong support if the downward trend resumes in the near future.

HNX-Index – Trading Volume Below 20-Day Average

The HNX-Index retreated after two previous recovery sessions. Trading volume declined for the third consecutive session and fell below the 20-day average, reflecting investor caution.

The Stochastic Oscillator and MACD indicators continued to weaken after issuing sell signals, suggesting that the short-term outlook remains uncertain.

Capital Flow Analysis

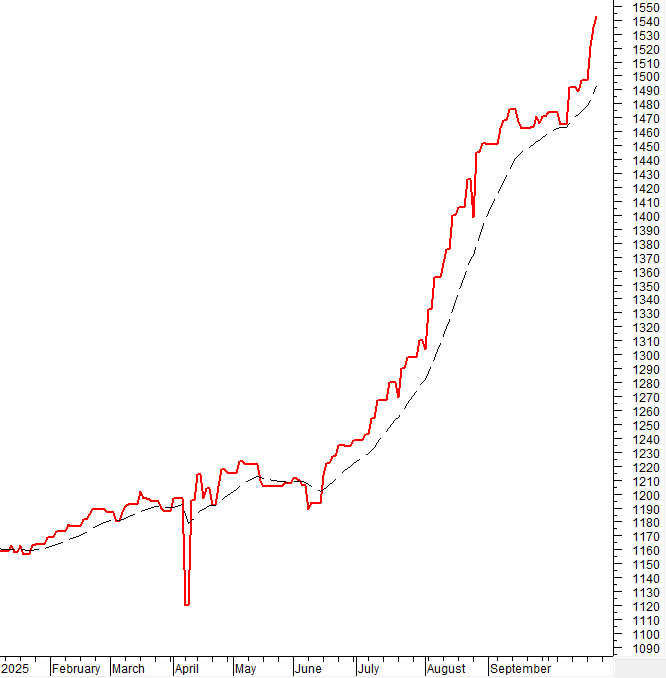

Smart Money Movement: The Negative Volume Index of the VN-Index remains above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Movement: Foreign investors continued to net sell during the October 23, 2025 trading session. If this trend persists in upcoming sessions, market volatility may continue.

III. MARKET STATISTICS FOR OCTOBER 23, 2025

Economic Analysis & Market Strategy Department, Vietstock Advisory Division

– 17:33 October 23, 2025

The Steepest Stock Market Plunge in History: Unraveling the Causes Behind the Dramatic Crash

The trading session on October 20th marked the most significant single-day decline in the history of Vietnam’s stock market, with the VN-Index plunging dramatically. Analysts suggest the market’s reaction was unexpectedly severe, surpassing even the most pessimistic forecasts. However, investors should avoid panic; this downturn presents a strategic opportunity for portfolio restructuring, particularly for those who remain calm and hold sufficient cash reserves.

October 21st Session: Bank Stocks Rebound, One Stock Hits Upper Limit

At the close of trading on October 21st, the banking sector saw a positive trend with 16 out of 27 stocks ending the day in the green. Notably, HDBank’s HDB stock hit its upper limit, while several others climbed 2-3%.

Market Pulse 22/10: Spectacular Recovery as VN-Index Rebounds to Close at 1,678 Points

At the close of trading, the VN-Index surged by 15.07 points (+0.91%), reaching 1,678.5 points, while the HNX-Index climbed 4.04 points (+1.53%) to 268.69 points. Market breadth favored the bulls, with 448 advancing stocks outpacing 237 decliners. Similarly, the VN30 basket saw a dominant green trend, with 21 gainers, 8 losers, and 1 unchanged stock.