In Q3, VOS recorded VND 850 billion in revenue, a 33% decline compared to the same period last year. However, gross profit surged to over VND 82 billion, a 3.4-fold increase. The company attributed the higher revenue to the inclusion of the trading segment, which typically has lower profit margins.

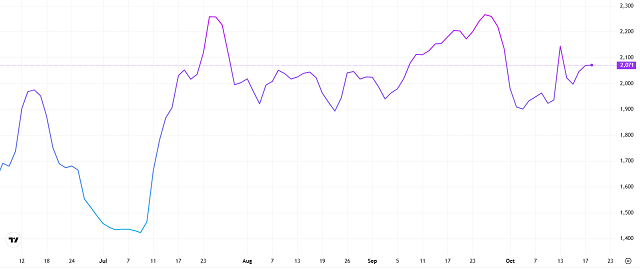

After a sluggish first half, the maritime transport market rebounded in Q3. The Baltic Dry Index (BDI) reached 2,265 points at the end of July and remained around 2,000 points until the end of September, significantly higher than the average for the first six months. In the product tanker segment, freight rates from South Korea and Singapore also increased, facilitating smoother operations. As a result, VOS generated net profit from its core business, compared to previous losses. Coupled with the proceeds from the sale of the Vosco Star vessel, the company achieved its highest profit in the last five quarters.

The Baltic Dry Index (BDI) remained high in Q3. Source: tradingeconomics.com

|

| VOS profits significantly from the sale of Vosco Star |

Despite the market recovery, VOS has yet to regain its growth momentum in the first nine months. The report shows a loss of over VND 17 billion from business operations, with cumulative net profit reaching only VND 88 billion, a 74% decrease compared to the VND 344 billion recorded in the same period in 2024. During that time, VOS had earned over VND 400 billion from the sale of the Dai Minh vessel.

Nine-month revenue totaled VND 2.1 trillion, a 50% decline year-over-year, primarily due to a 70% drop in the trading segment to VND 650 billion. The return of the Dai An oil tanker and Dai Hung chemical tanker to their owners, along with the sale of the Vosco Star at the end of July, significantly reduced revenue. Additionally, several vessels underwent extended repairs, increasing costs without generating revenue, pushing gross profit to its lowest level since 2020.

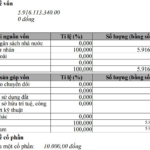

By the end of Q3, VOS‘s total assets increased by over VND 1 trillion to approximately VND 4 trillion, mainly due to additional vessel investments, which boosted fixed asset value by more than VND 1.3 trillion. Debt also rose sharply to VND 856 billion from zero at the beginning of the year. Consequently, nine-month interest expenses soared to nearly VND 20 billion, compared to just over VND 60 million in the same period last year.

| Gross profit from VOS‘s core operations at a five-year low |

On November 7th, VOS will hold an extraordinary shareholders’ meeting to approve additional investment and vessel disposal plans for 2025, including the sale of the Vosco Unity, a 53,000 DWT bulk carrier built in Japan in 2004. Management stated that the sale is necessary to fund expansion strategies, fleet rejuvenation, and the completion of annual plans. VOS aims for a pre-tax profit of VND 376 billion in 2025, but has achieved less than one-third of this target so far.

This year, the company has taken delivery of three Supramax bulk carriers—Vosco Starlight, Vosco Sunlight, and Vosco Jubilant—and two chartered vessels, Vosco Prosper and Vosco Defender (expected in November). VOS is also monitoring the market to implement plans to purchase or build four MR product tankers under eight years old, with a maximum value of USD 52 million each. Two chemical tankers, Dai Quang and Dai Vinh, with a capacity of approximately 13,500 DWT, were chartered in January and September, respectively.

With plans to invest in four Ultramax bulk carriers, VOS noted that current vessel prices are high, so the company will carefully consider the timing and cash flow. Beyond transportation, the company is also venturing into new vessel construction, conversion, and repairs to reduce reliance on external shipyards, save maintenance costs, and enhance technical autonomy.

VOS plans to add two new business lines—”shipbuilding and floating structures” and “construction of sports and recreational boats”—to its charter. According to management, this expansion will create a closed value chain, from transportation to technical services, enhancing competitiveness when working with international partners.

Simultaneously, VOS is considering selling or selling and leasing back 1-3 Supramax bulk carriers to boost cash flow. The “sale and leaseback” model allows for capital recovery, reduces debt pressure, and maintains transport capacity by continuing to operate the same vessels.

Combining vessel sales, leasebacks, and new investments will help the company rejuvenate its fleet, expand into larger oil, container, and bulk carriers, and strengthen its position in the highly competitive maritime transport industry.

VOS will propose to shareholders the sale of the over 20-year-old Vosco Unity. Photo: VOS

|

– 11:24 21/10/2025

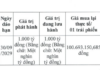

Vinaship Announces 6% Cash Dividend Payout

Vinaship is set to distribute nearly VND 20.4 billion in cash dividends at a rate of 6%, with VIMC and Viconship expected to receive the largest share of the dividend payout.

Lightning-Fast Delivery: Giao Hàng Nhanh Invests $14.5M in 309 New Trucks

On September 19th, Giao Hàng Nhanh finalized the delivery of the last trucks in its new batch of 309 vehicles, representing a significant investment of 330 billion VND. With this addition, Giao Hàng Nhanh now boasts an impressive fleet of nearly 1,500 trucks, offering a wide range of load capacities.

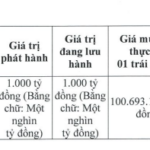

“Vietjet Completes Capital Increase to $246 Million, Expanding into Aircraft Maintenance and Repair”

On August 19th, Vietjet inaugurated its state-of-the-art Aircraft Maintenance Center in Long Thanh, comprising Hangars 3 and 4. With an impressive capacity to simultaneously accommodate up to ten aircraft, this new facility is set to revolutionize aircraft maintenance services, adhering to the most stringent international standards.