|

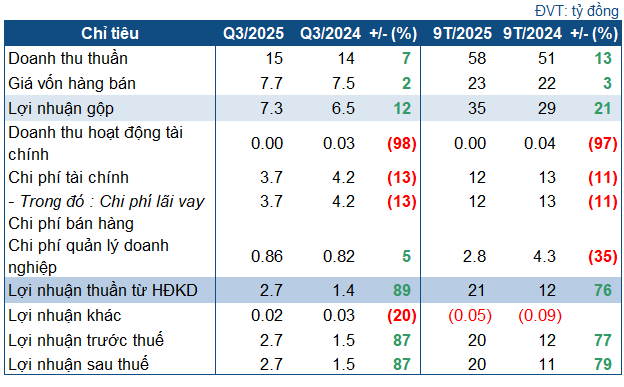

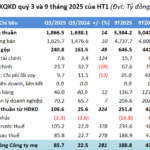

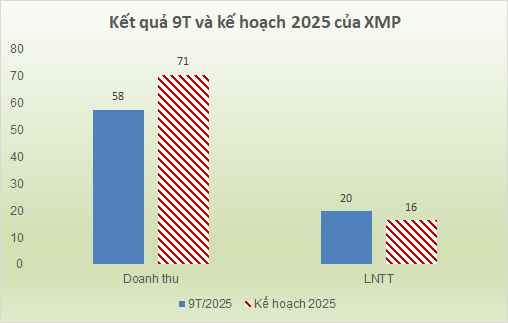

XMP’s Q3/2025 Business Targets

Source: VietstockFinance

|

In Q3, XMP’s commercial electricity output reached 21.27 million kWh, a 7% increase year-over-year. This drove a 7% rise in net revenue to nearly VND 15 billion. Cost of goods sold increased marginally by 2.4%, resulting in a 12% growth in gross profit to approximately VND 7.3 billion.

Financial expenses decreased significantly by 13% to nearly VND 3.7 billion, primarily due to lower interest costs. Operating expenses rose slightly by 4.6% to VND 859 million. Consequently, XMP’s post-tax profit surged by 87% to VND 2.7 billion compared to the same period last year.

For the first nine months of 2025, XMP’s net revenue reached VND 58 billion, a 13% increase year-over-year, with post-tax profit nearing VND 20 billion, up 79%. The strong Q3 performance helped the company exceed its annual plan, achieving 81% of its revenue target and surpassing its post-tax profit goal by 20%, as approved by the 2025 Annual General Meeting.

Source: VietstockFinance

|

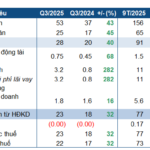

As of Q3-end, XMP’s total assets stood at VND 371 billion, slightly lower than the beginning of the year, primarily comprising fixed assets (95%). Cash on hand increased by 28% to nearly VND 2.3 billion.

On the liabilities side, total debt decreased by 8% to VND 193 billion. Notably, short-term loans declined by 15% to VND 54 billion, and long-term loans dropped by 13% to VND 122 billion.

– 13:00 21/10/2025

Hương Sơn Hydropower Profits Surge 32% Amid Favorable Weather and New Electricity Rates

Huong Son Hydro Power Joint Stock Company (UPCoM: GSM) has released its Q3/2025 financial report, revealing a 32% year-over-year increase in after-tax profit. This impressive growth is primarily attributed to higher water levels in the reservoir and the implementation of a new electricity pricing mechanism.

Cement Consumption Surges, HT1 Surpasses 9-Month Profit Targets

With an 18% surge in cement consumption and improved profit margins, HT1 achieved a net profit of nearly VND 90 billion in Q3, nearly quadrupling year-on-year results and surpassing its full-year 2025 profit target within just nine months.

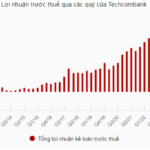

Techcombank Sets Record Q3 Profit, Sustaining Strong Growth Momentum

Techcombank (HOSE: TCB) has unveiled its Q3 2025 and 9-month financial results, showcasing record-breaking performance and underscoring the success of its comprehensive transformation strategy. The bank reported pre-tax profits of VND 23.4 trillion for the first nine months, with Q3 alone contributing VND 8.3 trillion—a 14.4% year-on-year increase and the highest quarterly profit in its history.

LPBank Surges Ahead in Profit Race, Reporting Over 9.6 Trillion VND in Earnings After 9 Months

LPBank (Loc Phat Bank) has unveiled its financial report for the first nine months of 2025, boasting a pre-tax profit of 9.612 trillion VND—an unprecedented high in the bank’s history. Surging ahead in the profit race, LPBank is setting new benchmarks, solidifying its sustainable growth foundation, and striving toward long-term objectives.

Unusual Trends in Hanoi’s Villa and Townhouse Market

According to CBRE, the majority of new land-attached real estate supply in Q3 was concentrated in projects located farther from city centers. This shift resulted in an average primary market selling price of approximately VND 186 million per square meter of land during the quarter—a 19% decrease from the previous quarter and 21% lower than the same period last year.