Building on this foundation, ACB ensures stable, efficient, and sustainable growth, paving the way for a new strategic development phase.

Pioneering Support for Private Sector: 20% Growth in Corporate Lending

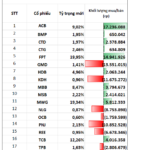

By the end of Q3/2025, ACB’s credit balance reached 669 trillion VND, a 15.2% increase from the beginning of the year, outpacing the industry average. Corporate lending remains the primary growth driver, with a 20% increase, focusing on key economic sectors such as trade and manufacturing.

Simultaneously, the retail lending segment, a core component of ACB’s business strategy, has shown significant recovery. This is attributed to flexible credit programs and tailored financial solutions designed for individual customers, small businesses, and traders.

As a pioneer in supporting private sector development under Resolution 68, ACB demonstrates strategic agility and product innovation. Through selective lending policies and robust risk management, ACB ensures capital flows into profitable, low-risk sectors, fostering sustainable growth without compromising asset quality.

The bank’s non-performing loan ratio has decreased to 1.09%, among the lowest in the industry. This reflects ACB’s stable management and proactive risk governance, maintaining high capital safety and liquidity.

The ratio of short-term funds used for medium- and long-term loans stands at 21.8%, below the State Bank’s regulations, providing ACB with ample flexibility to optimize yields when expanding medium- and long-term lending.

Sustainable CASA Growth, Innovative Products Strengthen Brand Trust

The CASA ratio reached 22.9%, up from 22.1% in Q1 and 22.6% in Q2, driven by flexible mobilization policies and product diversification.

Innovative offerings such as “First Home,” tailored financial solutions for small businesses, Flex Payment Solutions, and the Lotusmiles Pay integrated payment card have expanded ACB’s customer base and strengthened brand loyalty.

Recently, “First Home” was honored as the “Innovative Credit Solution” at the Better Choice Awards 2025, a national award organized by the Ministry of Finance, the National Innovation Center (NIC), and VCCorp.

Additionally, ACB received the Digital Pioneer 2025 award for implementing new digital solutions in Vietnam and the Innovative White-Label Airlines Card Commercial Launch in Vietnam 2025 by VISA. These accolades highlight ACB’s commitment to leveraging technology to address modern customer needs and behaviors.

At the Vietnam Outstanding Banking Awards (VOBA) 2025, ACB was recognized as the “Outstanding Retail Bank” and awarded for “Innovative Products and Services,” underscoring its relentless efforts to enhance service quality and drive innovation.

Profit Exceeds 16 Trillion VND, High Efficiency, and Cost Control

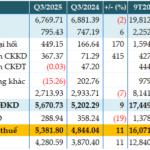

In Q3/2025, ACB reported pre-tax profit of 5.4 trillion VND, an 11% increase year-on-year; cumulative nine-month profit surpassed 16 trillion VND, up 5%. This growth is fueled by a 36% rise in non-interest income and effective cost management, with a CIR ratio of 32%, reflecting digitalization efforts and operational efficiency.

Subsidiaries within the ecosystem also contributed significantly: ACBS achieved pre-tax profit of 895 billion VND, up 34%, with margin lending growing 87% to over 16 trillion VND. ACBL, ACBA, and ACBC collectively contributed 6% to consolidated profit, reinforcing ACB’s progress toward becoming an “Efficient Financial Group” capable of delivering comprehensive value to customers, shareholders, and the market.

Effective Risk Management, Aligning Sustainable Growth with Social Responsibility

In its sustainable development strategy, ACB prioritizes risk management to ensure safe growth and long-term value for customers and shareholders. By integrating technology into risk management, ACB not only ensures compliance but also enhances operational efficiency, enabling the development of modern financial products and personalized services for sustainable market expansion.

ACB recently completed the Internal Ratings-Based (IRB) capital framework for credit risk, including both Foundation IRB (FIRB) and Advanced IRB (AIRB), positioning itself as a leader in adopting Basel standards in Vietnam. The bank was also awarded “Best Bank for Risk Management Vietnam 2025” by Global Banking & Finance Review (UK).

This foundation supports ACB’s consistent growth and enables meaningful contributions to society and the community.

Mr. Tu Tien Phat, CEO of ACB, stated, “True sustainable development for a bank lies in balancing effective risk management with creating tangible societal value. For ACB, growth is not just about numbers but about harmonizing efficiency, safety, and responsibility.”

ACB is also featured in the PRIVATE 100 list of Vietnam’s top tax-contributing private enterprises. The bank continues to support key government resolutions, such as Resolution 68 on private sector development and Resolution 57 on national innovation. Through initiatives in digital transformation, education funding, and university partnerships, ACB contributes to building a skilled workforce for a sustainable and competitive economy.

With impressive financial results, superior risk management, and unwavering social responsibility, ACB remains committed to its strategic vision: becoming an efficient financial group, delivering personalized solutions through seamless, technology-driven experiences powered by data and AI.

ACB Reports 11% Rise in Q3 Pre-Tax Profit as Bad Debt Improves

Asian Commercial Bank (HOSE: ACB) reported a pre-tax profit of nearly VND 5,382 billion in Q3/2025, marking an 11% year-on-year increase. This growth was driven by higher non-interest income and effective cost-cutting measures. Notably, the bank’s non-performing loans (NPLs) decreased by 15% compared to the beginning of the year, reflecting improved asset quality.

Global Money Transfers: The Ultimate Financial Solution for World Citizens

ACB offers swift, secure, and cost-effective financial solutions for overseas money transfers from Vietnam, catering to diverse needs such as studying abroad, immigration, family support, and gifting. With competitive exchange rates and a trusted network spanning over 70 countries, we ensure your transactions are optimized and worry-free.

Quy Nhơn Iconic: Phát Đạt Completes Financial Obligations

Phat Dat Real Estate Development Corporation (HOSE: PDR) has successfully fulfilled all financial obligations for the land allocation decision of the Quy Nhon Iconic project. This significant legal milestone underscores Phat Dat’s credibility and execution capabilities during its organizational restructuring phase.