|

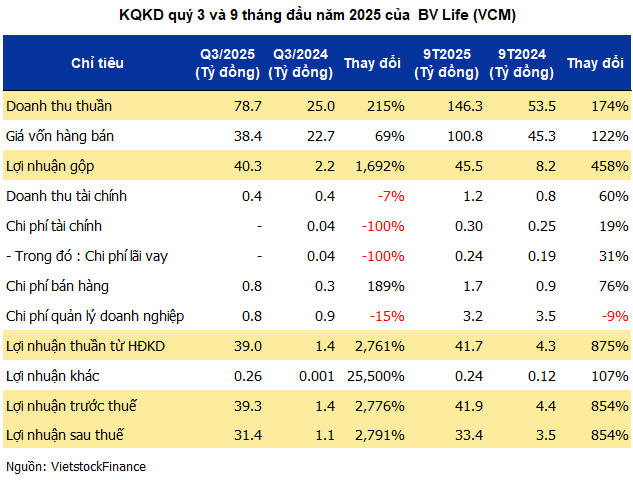

In Q3/2025, BV Life reported a net profit of over VND 31 billion, a staggering 2,800% increase compared to the same period last year, marking the highest profit in the company’s history. This result far surpasses previous years, with net profits of nearly VND 4 billion in 2024 and approximately VND 1 billion in 2023. Q3 revenue reached nearly VND 79 billion, a 215% year-over-year increase, and the highest in 15 years. Gross profit margin exceeded 51%, significantly up from 8.8% in the same quarter last year.

BV Life also eliminated interest expenses after settling nearly VND 1.5 billion in financial debt earlier this year, significantly improving Q3 performance. By the end of the period, the company was debt-free and increased bank deposits to VND 75 billion, a 37-fold increase from the beginning of the year. Interest income from deposits for the first 9 months reached over VND 1.2 billion, an 80% year-over-year increase.

Nine-month cumulative profit far exceeds annual plan

VCM’s total revenue for the first 9 months of the year surpassed VND 146 billion, a 174% year-over-year increase. Net profit exceeded VND 33 billion, an 854% increase, and 5.5 times the annual plan of VND 6 billion, while revenue achieved over 85% of the full-year target. The 9-month profit in 2025 is higher than the total profit from 2018 to 2024 combined.

According to the notes, the remarkable growth was primarily driven by the sale of investment real estate, specifically the 5th-floor office at 25T1 building (Trung Hòa – Cầu Giấy, Hanoi). This transaction contributed over VND 46 billion, accounting for 32% of the 9-month total revenue, with no such transaction recorded in the same period last year. Revenue from goods sales and machinery installation remained the primary income source, reaching over VND 95 billion, double the previous year.

On September 3, 2025, BV Life’s shareholders approved the sale of the 5th-floor office at 25T1 building, and by September 23, 2025, the company finalized the transfer to Mr. Chu Hải Vân and Ms. Thái Thị Hoa for over VND 50.7 billion (including VAT).

On the HNX, VCM shares remained stable on October 20, when the VN-Index dropped nearly 95 points, and then surged to the ceiling for three consecutive sessions from October 21-23, reaching a peak of VND 11,200 per share, the highest since November 2024. However, on October 24, the stock declined by nearly 3% to VND 10,900 per share. Despite this, VCM’s market price increased by 40% over the past month and over 28% in the past year. Trading volume remained low, averaging over 2,000 shares per session.

| VCM Stock Price Movement Over the Past Year |

– 15:31 24/10/2025

Phú Bài Fiber Swings to Profit, Q3 Earnings Hit Record High

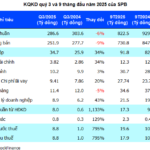

Despite a 6% decline in revenue, Phu Bai Fiber Joint Stock Company (UPCoM: SPB) reported its highest-ever quarterly profit in Q3/2025. This remarkable achievement was driven by improved gross margins and reduced production costs, enabling the company to officially eliminate accumulated losses as of September 2025.

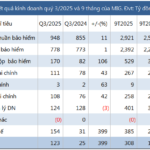

Military Insurance Reports Q3 Profits Five Times Higher Than Previous Year

Fueled by robust growth in both its insurance and financial services sectors, Military Insurance Corporation (MIC, HOSE: MIG) reported a surge in Q3 2025 profits.

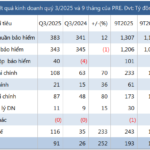

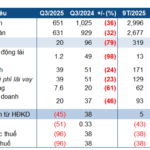

Unprecedented Milestone: Stock Group Achieves Record-Breaking $810 Million Pre-Tax Profit in Q3

The third quarter of 2025 marks a historic milestone as the stock market’s profits surged by 171%, fueled by vibrant liquidity and record-high margin debt levels.