The State Bank of Vietnam, Branch 2, has issued a warning to commercial banks in Ho Chi Minh City and Dong Nai regarding the risks associated with lending for deposit payments. This advisory comes in response to numerous citizen complaints about banks financing deposit payments as per agreements with real estate consulting and brokerage firms.

Citizens have expressed frustration, alleging that commercial banks have committed violations in the credit approval process for such purposes. Based on citizen feedback, case handling, and similar incidents reported by authorities, the State Bank of Vietnam, Branch 2, has identified significant risks and consequences tied to these lending practices.

Previously, the People’s Court of District 7 in Ho Chi Minh City issued a ruling (pending legal effect due to appeals) stating that agreements regarding deposit terms, schedules, payment methods, and handling of deposits violate legal provisions. Consequently, such agreements are deemed void under Articles 117 and 123 of the 2015 Civil Code.

Banks in Ho Chi Minh City and Dong Nai are instructed to halt lending for deposit payments until official conclusions are reached by competent authorities.

On October 7, 2025, the Ho Chi Minh City Department of Construction imposed administrative penalties on a consulting and brokerage firm for engaging in real estate transactions without meeting legal requirements or authorization.

Additionally, the department issued Document No. 11.410 on October 10, 2025, mandating compliance with real estate information disclosure laws. This includes prohibiting real estate businesses from authorizing third parties to sign deposit, purchase, transfer, or lease agreements for properties or construction projects.

“In cases where agreements are deemed unlawful and void, commercial banks face substantial legal risks, disputes, and challenges in debt recovery and asset management,” the State Bank of Vietnam, Branch 2, warned.

Banks Must Closely Monitor Official Conclusions

Additional risks include bad debt, credit losses, financial harm, operational issues, and reputational damage.

The State Bank of Vietnam, Branch 2, urges commercial banks to closely monitor rulings from courts and relevant agencies regarding agreements between customers and consulting or brokerage firms. This will enable banks to resolve disputes promptly and in accordance with the law.

Banks currently involved in deposit payment loans are advised to collaborate with customers, consulting firms, brokers, and project developers to protect customer rights and prevent mass complaints or escalated disputes.

“Suspend all lending for deposit payments under such agreements until official conclusions are issued by competent authorities. If authorities determine the agreements are lawful, banks should establish specific lending procedures to mitigate risks,” the State Bank of Vietnam, Branch 2, emphasized.

Unlocking the Risks: The Perils of Real Estate Deposit Loans via ‘Agreement Documents’

The State Bank of Vietnam has warned that lending for real estate deposit payments based on “Agreement Documents” carries significant legal risks.

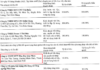

Three Cases of Deposit Insurance Payouts

According to the Governor of the State Bank of Vietnam, Nguyen Thi Hong, one of the significant new provisions in the draft is the regulation of the timing for insurance premium obligations to arise. This enables regulatory authorities to proactively manage risks and enhance protection for depositors.