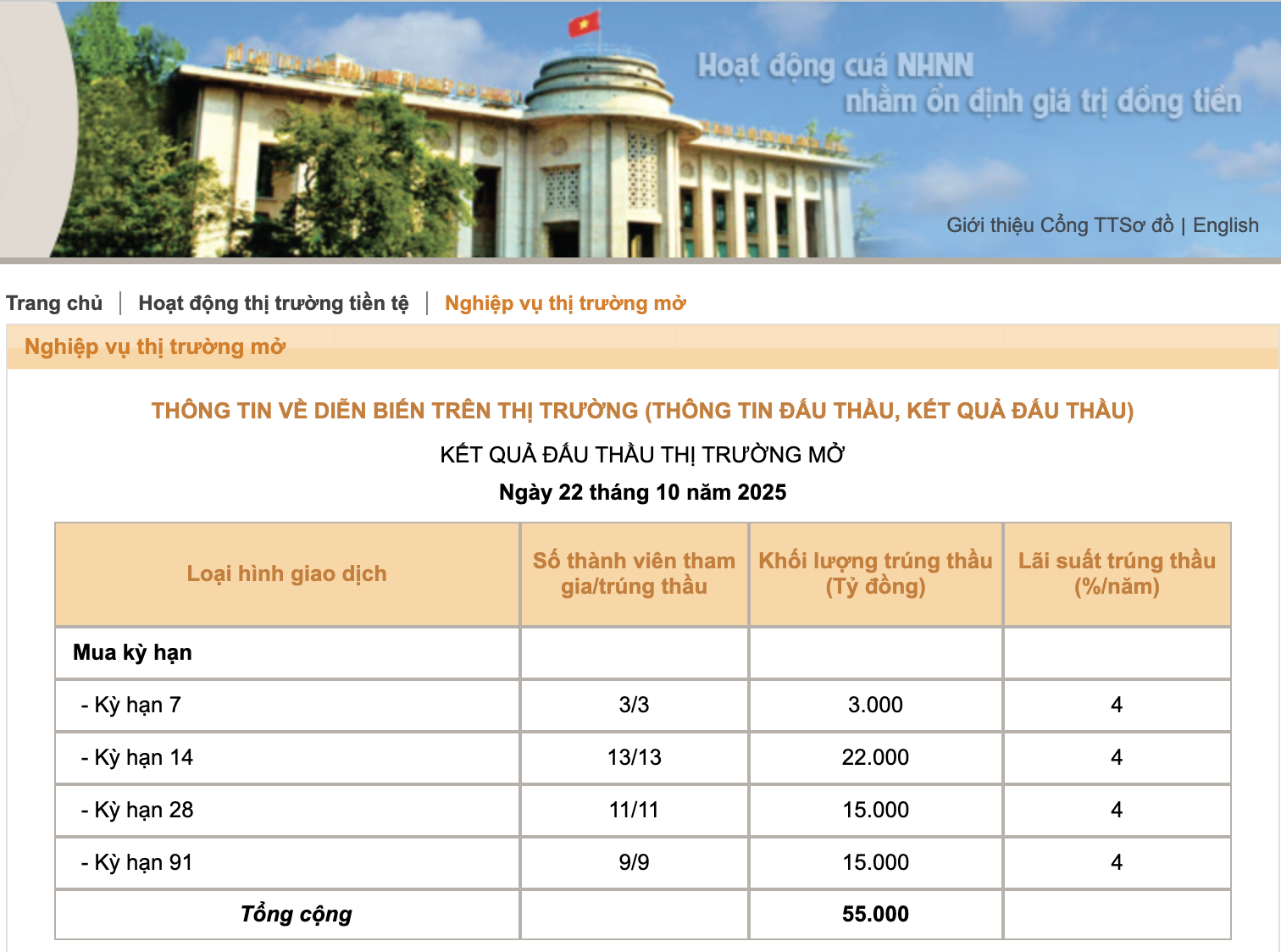

On October 22, the State Bank of Vietnam (SBV) significantly increased the bidding scale on the Open Market Operation (OMO) channel, maintaining the interest rate at 4.0% per annum. As a result, VND 3,000 billion was successfully bid for a 7-day term, VND 22,000 billion for a 14-day term, VND 15,000 billion for a 28-day term, and VND 15,000 billion for a 91-day term. In total, the SBV lent nearly VND 55,000 billion to the banking system via the OMO channel during the October 22 session. Simultaneously, the regulator did not issue any new treasury bills.

After offsetting VND 9,000 billion from maturing OMO loans, the SBV injected a net liquidity of VND 46,000 billion into the market—the highest level since June 30. This brought the total outstanding OMO to VND 208,630 billion, the highest since late August.

However, unlike previous liquidity support rounds, the 91-day loans in the October 22 session reached VND 15,000 billion, accounting for over one-fourth of the total OMO bids and marking the highest level in recent years. This indicates a growing demand for long-term liquidity among banks.

Previously, with OMO bids primarily in the 7–28 day range, the SBV’s liquidity support for banks was short-term (under one month). However, with the 91-day term, these loans will not mature until late January 2026.

The SBV has consistently maintained a net liquidity injection since the beginning of 2025, with a significant expansion since late June.

According to the SBV, implementing open market operations aims to lower interbank market interest rates, ensuring timely and sufficient liquidity for banks. This enables banks to access low-cost capital from the SBV, facilitating further reductions in lending rates in line with government directives.

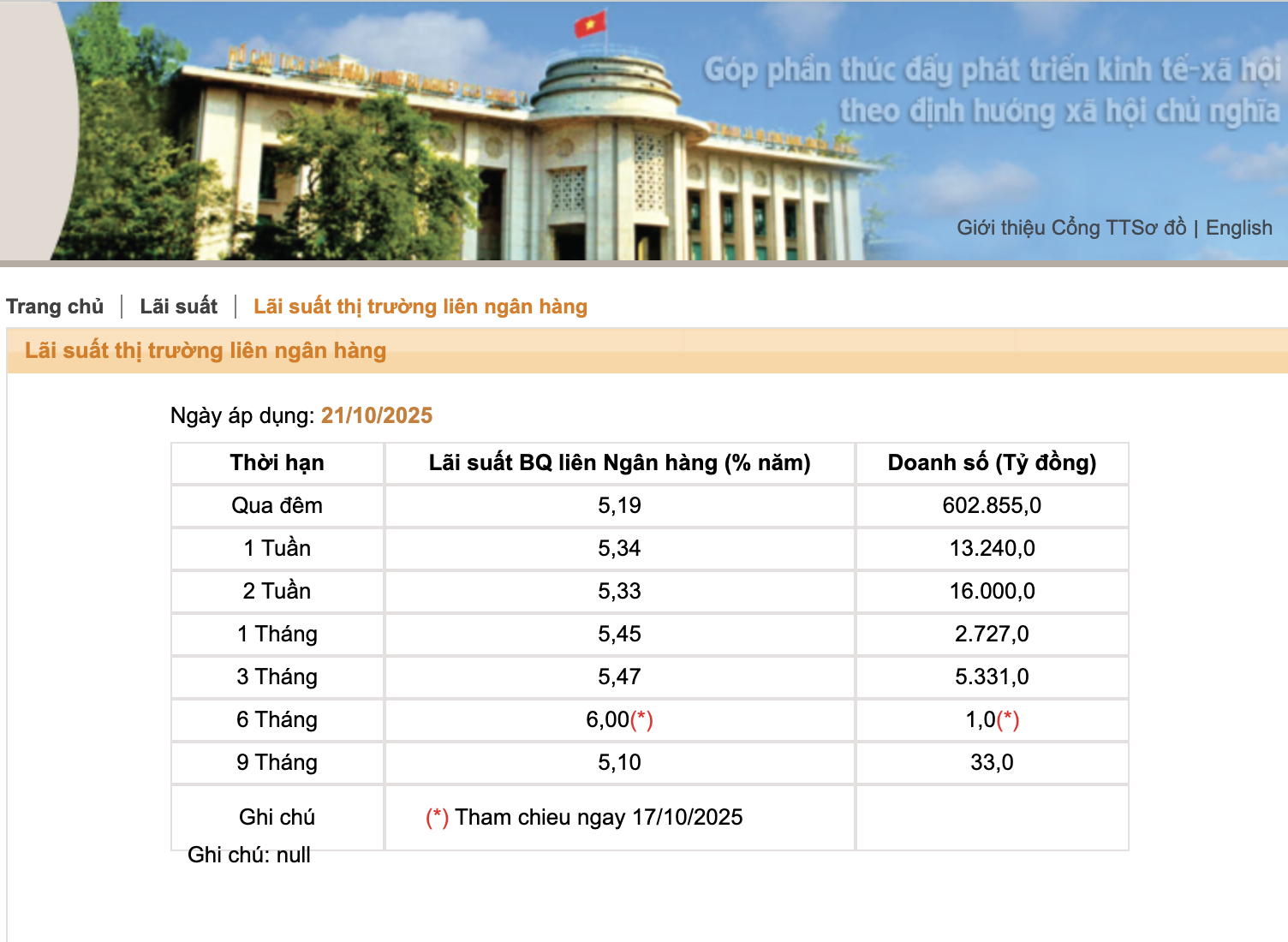

The SBV’s liquidity support also occurs amid rising interbank interest rates in recent weeks. On October 21, the average VND interbank rate exceeded 5% across all terms, with the overnight rate—accounting for approximately 90% of transaction value—consistently above 5% per annum in October.

Banks Tighten Real Estate Deposit Loans to Protect Citizens

According to experts, tightening regulations on real estate deposit loans through written agreements safeguards both citizens and investors from fraudulent projects.

Three Cases of Deposit Insurance Payouts

According to the Governor of the State Bank of Vietnam, Nguyen Thi Hong, one of the significant new provisions in the draft is the regulation of the timing for insurance premium obligations to arise. This enables regulatory authorities to proactively manage risks and enhance protection for depositors.

USD Freely Traded Rates Surge Unexpectedly on October 22nd Afternoon

The USD exchange rate in the open market has surged past the 27,000 VND mark, significantly outpacing the rates offered by commercial banks.