Vicem Ha Tien Cement Joint Stock Company (Vicem Ha Tien, stock code: HT1) has recently released its consolidated financial report for Q3/2025.

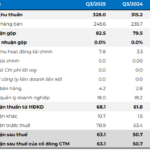

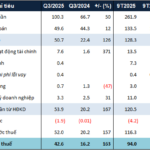

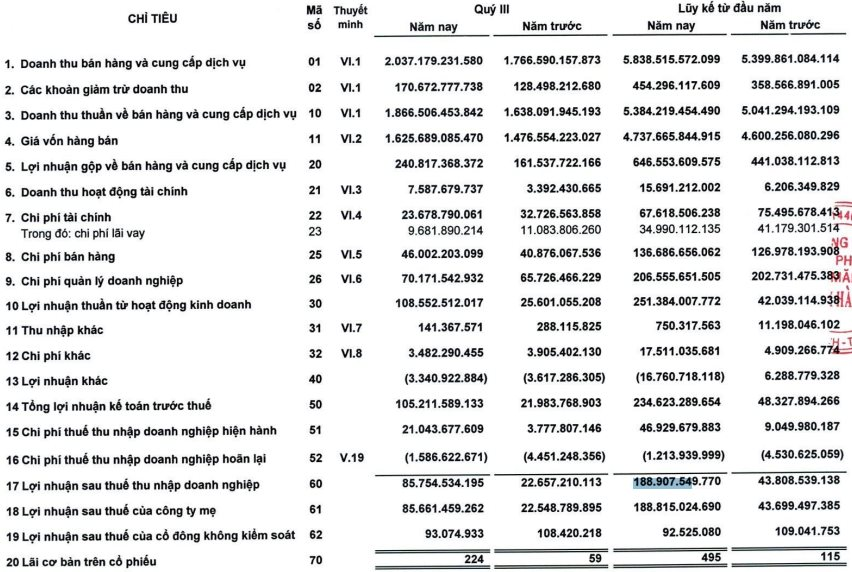

The company’s net revenue reached VND 1,867 billion, marking a nearly 14% increase compared to the same period last year. While the cost of goods sold rose at a slower pace than revenue, gross profit surged by 49% year-on-year, hitting nearly VND 241 billion.

During the quarter, financial activities contributed nearly VND 8 billion to Vicem Ha Tien’s revenue, a 124% increase year-on-year. Selling expenses and administrative expenses rose by 12% and 7% respectively, totaling VND 46 billion and VND 70 billion.

As a result, the company’s after-tax profit for Q3/2025 reached nearly VND 86 billion, a staggering 280% increase compared to the same period in 2024.

According to HT1’s explanatory statement, the primary drivers of this performance were an 18% increase in cement sales volume in Q3/2025 compared to the previous year, coupled with reduced production costs due to tighter cost controls and lower raw material prices. Additionally, the company boosted income from capital recovery fees for the project to construct a road connecting Nguyen Duy Trinh Street and Phu Huu Industrial Park in Ho Chi Minh City.

For the first nine months of 2025, Vicem Ha Tien’s net revenue reached VND 5,384 billion, a modest 7% increase year-on-year. After-tax profit stood at nearly VND 189 billion, four times higher than the same period last year.

In 2025, HT1 set a target after-tax profit of VND 184 billion. After just nine months, the company has already surpassed this goal.

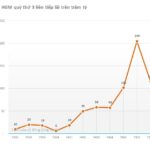

On the stock market, following the announcement of its impressive earnings, HT1 shares surged to their ceiling price on October 22, reaching VND 20,100 per share. This marks the highest price level for HT1 in 3.5 years, since April 2022.

VLB Stone Mining Giant Surpasses 43% Profit Target in 9 Months

Biên Hòa Construction and Building Materials Production JSC (UPCoM: VLB) has announced robust Q3 2025 financial results, showcasing a 20% year-over-year profit surge.

Surpassing 9-Month Profit Targets: L14’s Strategic Reserve Discount Investment Reintegration

Despite a staggering 95% plunge in net revenue, Licogi 14 Joint Stock Company (HNX: L14) has defied expectations by reporting a year-on-year increase in after-tax profit.