I. FUTURES CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

VN30 futures contracts surged during the October 23, 2025 trading session. Specifically, 41I1FB000 (I1FB000) climbed 0.91% to 1,943.5 points; VN30F2512 (F2512) rose 0.97% to 1,939 points; 41I1G3000 (G3000) gained 2.23% to 1,923.5 points; and 41I1G6000 (I1G6000) increased 0.94% to 1,928 points. The underlying index, VN30-Index, closed at 1,945.78 points.

Additionally, VN100 futures contracts also rallied on October 23, 2025. Notably, 41I2FB000 (I2FB000) advanced 0.63% to 1,855.1 points; 41I2FC000 (I2FC000) jumped 1.56% to 1,852.9 points; 41I2G3000 (I2G3000) rose 1.38% to 1,838.3 points; and 41I2G6000 (I2G6000) climbed 1.81% to 1,836 points. The VN100-Index closed at 1,854.2 points.

During the October 23, 2025 session, 41I1FB000 fluctuated around the reference level for most of the day after opening. However, buying pressure gradually dominated, pushing the contract slightly higher by the end of the morning session. This sideways movement continued into the afternoon, with buyers maintaining control until the close. Consequently, the contract ended the day in positive territory, gaining 17.5 points.

Intraday Chart of 41I1FB000

Source: https://stockchart.vietstock.vn/

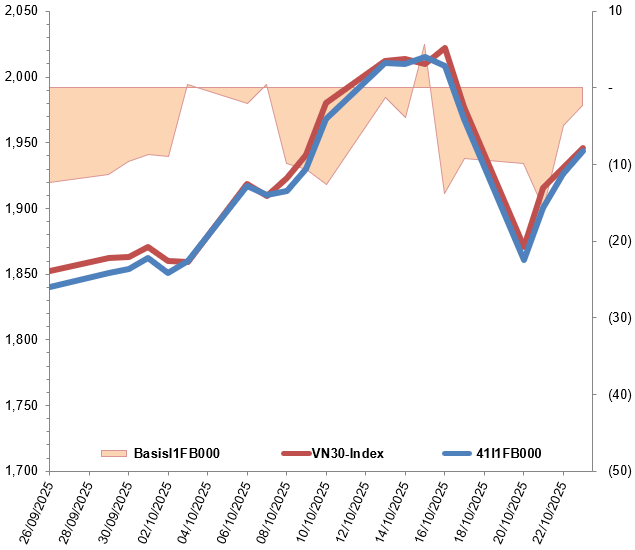

At the close, the basis of the 41I1FB000 contract narrowed compared to the previous session, reaching -2.28 points. This indicates a less pessimistic sentiment among investors.

Movement of 41I1FB000 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated as follows: Basis = Futures Contract Price – VN30-Index

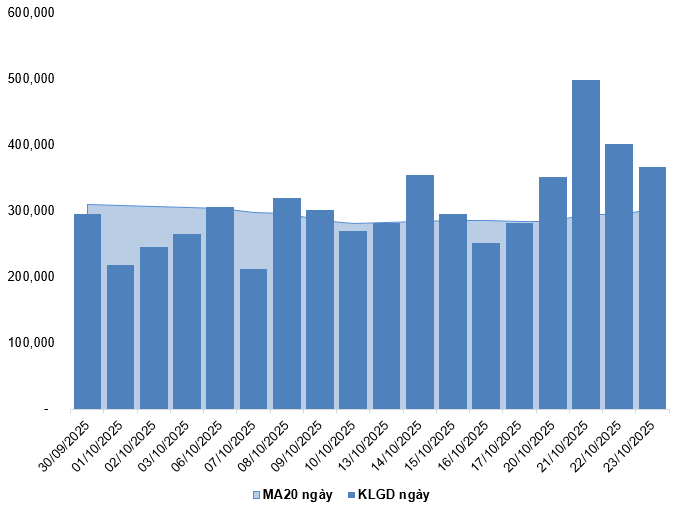

Trading volume and value in the derivatives market decreased by 8.74% and 6.64%, respectively, compared to the October 22, 2025 session. Specifically, I1FB000 trading volume fell 8.71% to 365,736 contracts. I2FB000 trading volume rose 23.66% to 277 contracts.

Foreign investors turned net buyers, with a total net purchase volume of 1,424 contracts on October 23, 2025.

Daily Trading Volume Trends in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

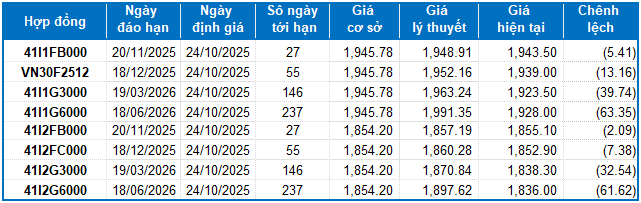

I.2. Futures Contract Valuation

Based on the fair pricing method as of October 24, 2025, the reasonable price range for actively traded futures contracts is as follows:

Summary Table of Derivatives Valuation for VN30-Index and VN100-Index

Source: VietstockFinance

Note: Opportunity costs in the pricing model are adjusted to align with the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with maturity adjustments for each futures contract.

I.3. Technical Analysis of VN30-Index

On October 23, 2025, the VN30-Index edged higher, forming a Spinning Top candlestick pattern. Trading volume continued to decline, falling below the 20-session average, reflecting investor hesitation. The index is currently retesting the medium-term uptrend line, while the Stochastic Oscillator and MACD indicators remain weak after previously signaling a sell, suggesting short-term correction risks persist.

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

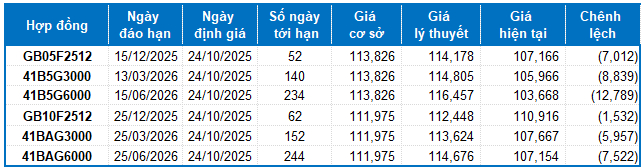

II. FUTURES CONTRACTS OF THE BOND MARKET

Based on the fair pricing method as of October 24, 2025, the reasonable price range for actively traded government bond futures contracts is as follows:

Summary Table of Government Bond Futures Valuation

Source: VietstockFinance

Note: Opportunity costs in the pricing model are adjusted to align with the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with maturity adjustments for each futures contract.

According to the above valuation, contracts GB05F2512, 41B5G3000, 41B5G6000, GB10F2512, 41BAG3000, and 41BAG6000 are currently attractively priced. Investors should focus on these futures contracts and consider buying in the near term, as they present excellent value in the market.

Economic Analysis & Market Strategy Department, Vietstock Advisory Division

– 18:28 23/10/2025

Technical Analysis for the Afternoon Session of October 21: Continued Adjustment

The VN-Index persists in its corrective phase, testing the August 2025 lows. Meanwhile, the HNX-Index is trending downward, clinging to the Lower Band of the Bollinger Bands.

Technical Analysis Afternoon Session 20/10: Re-testing Critical Support Levels

The VN-Index underwent a significant correction, retesting the critical support zone of 1,700-1,711 points. The Middle line of the Bollinger Bands, positioned closely to this area, is anticipated to provide robust support. Meanwhile, the HNX-Index experienced a modest rebound, continuing its short-term sideways consolidation phase.