Consistently Setting Records in International Capital Mobilization

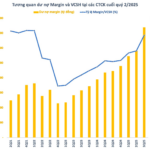

By the end of Q3/2025, the total margin lending debt across the market surpassed VND 380,000 billion, leaving many firms struggling with depleted credit limits. Simultaneously, investment banking (IB) activities, such as advising on bond issuances, equity capital, and M&A, continued to experience robust growth.

These sectors demand substantial, long-term capital with reasonable costs. Therefore, the ability to access low-interest capital is a decisive factor enabling securities companies to offer more competitive services and rapidly expand their market share.

In this context, VPBank Securities JSC (VPBankS) has consistently set records with large-scale international capital mobilization deals. Despite being in operation for only three years, VPBankS is expected to raise USD 400 million in bilateral and syndicated loans in 2025, led by Sumitomo Mitsui Banking Corporation (SMBC).

In late October 2025, VPBankS successfully mobilized a USD 200 million syndicated loan, arranged by SMBC. Earlier, in May 2025, VPBankS also secured a USD 125 million loan, also led by SMBC.

At the seminar “VPBankS – Harmonizing Prosperity, Leading with Confidence,” Mr. Vu Huu Dien, Board Member and CEO of VPBankS, attributed the company’s exceptional capital mobilization capabilities to its position within the ecosystem of Vietnam Prosperity Joint Stock Commercial Bank (VPBank; HOSE: VPB) and SMBC.

“In the first half of 2025, SMBC facilitated VPBankS in raising USD 150 million. In the second half, SMBC will support an additional USD 250 million. For the entire year, the company will mobilize USD 400 million in international capital,” he shared.

“A securities company only three years old raising USD 400 million in international capital within a year is almost unimaginable. Yet, VPBankS achieved this due to its position within the VPBank and SMBC ecosystems,” the CEO of VPBankS emphasized.

Diverse Funding Sources, Optimized Costs, and Sustainable Competitive Advantage

In the market, most independent securities companies rely on a single funding source, typically high-cost bank loans. In contrast, VPBankS, as the only securities company within the VPBank and SMBC ecosystems, has access to diverse capital sources, longer tenors, and costs among the lowest in the market.

The CEO of VPBankS explained, “If dependent on domestic banks, securities companies usually secure loans with tenors of 3–6 months. Through SMBC, VPBankS can access tenors from 6 months to a year or longer. Longer tenors ensure better liquidity for VPBankS compared to other securities firms.”

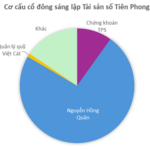

VPBankS implements a mobilization strategy based on three pillars: domestic commercial banks, international capital supported by VPBank and SMBC, and other funding channels.

For domestic commercial bank funding, according to Mr. Dien, VPBankS’ position within the VPBank ecosystem, with its substantial capital, strong growth, and robust business model, allows it to borrow at highly competitive rates. The total credit limit for the company exceeds VND 35,000 billion, with approximately VND 25,000 billion currently utilized. As the equity capital scale continues to strengthen, the company will have a more robust counterpart, enabling further expansion of credit limits with increasingly optimized capital costs.

In international funding, VPBankS receives comprehensive support from its strategic partner, SMBC. SMBC’s extensive multinational network, multi-sector strategy, and strong international reputation help VPBankS access competitive foreign capital. This liquidity is expected to provide the company with a distinct advantage in its next growth phase.

Additionally, VPBankS seeks capital through corporate bond issuances to diversify its capital structure and enhance long-term financial strategy flexibility.

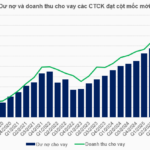

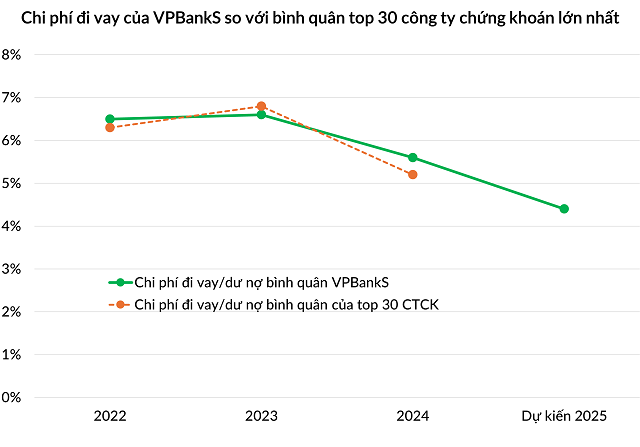

Thanks to its diverse mobilization strategy, VPBankS’ average borrowing cost in 2025 is projected to be 100–150 basis points lower than the average of the top 30 largest securities companies.

VPBankS’ borrowing costs are lower than the securities industry average. (Image: VPBankS).

|

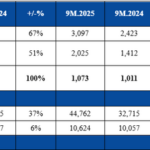

The mobilized capital will enable VPBankS to strengthen its core business areas, particularly investment banking (IB) and margin lending. Specifically, in the IB sector, VPBankS recorded total transaction values exceeding VND 34,500 billion in the first nine months, generating revenue of approximately VND 1,000 billion, ranking second in the market.

In margin lending, the company offers a flexible product portfolio with competitive interest rates (Margin package at 6.6%/year) and high credit limits (VIP Margin package with a limit of VND 50 billion). As a result, VPBankS’ margin debt grew nearly threefold compared to the beginning of the year, reaching nearly VND 27,000 billion, placing it in the top three in the securities industry. With equity capital exceeding VND 20,000 billion, the company still has a lending limit of over VND 13,500 billion as of Q3/2025 and can expand to approximately VND 40,000 billion post-IPO.

|

Investors can register and deposit for VPBankS’ IPO shares from October 10 to October 31, 2025; the deposit equals 10% of the total registered value. Shares are distributed directly by VPBankS and through three agents: Vietcap Securities, SSI Securities, and SHS Securities, along with 12 units supporting the offering and share registration. Following the IPO, VPBankS plans to list its shares on HOSE in December 2025. |

– 09:45 23/10/2025

Billions Invested: Securities Firms Establish Digital Asset Companies

Unveiling on October 14th, Digital Asset Corporation emerges as a newly established entity with a robust charter capital of 120 billion VND.

Margin Debt Surpasses 384 Trillion VND, Ample Room for Growth Remains

Amidst a robust market uptrend and significantly heightened liquidity, margin debt in the securities sector surged to a record high of over 384 trillion VND by the end of Q3. This momentum propelled securities firms to achieve a substantial increase in lending revenue, reaching nearly 9.4 trillion VND during the same quarter.