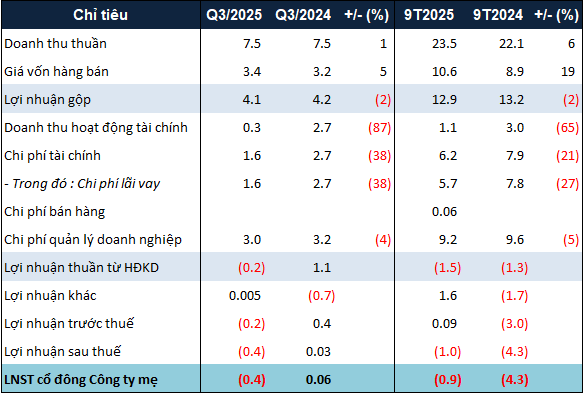

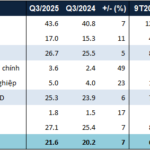

Financial revenue plummeted by 87% to VND 349 million, a stark contrast to the nearly VND 3 billion recorded in the same period last year due to other financial income.

While revenue remained stagnant, the cost of goods sold increased by 5%, resulting in a slight 2% dip in gross profit to over VND 4 billion. However, interest expenses and management costs decreased by 38% and 4%, respectively, totaling nearly VND 2 billion and VND 3 billion.

Despite these reductions, the revenue generated during the period was insufficient to offset the expenses, leading to a net loss of nearly VND 400 million for Eximland. This brings the total loss for the first nine months of the year to over VND 923 million.

|

Eximland’s Business Results for the First Nine Months of 2025. Unit: Billion VND

Source: VietstockFinance

|

As of September 30, 2025, Eximland’s total assets stood at over VND 666 billion, a 4% decrease from the beginning of the year. This decline is primarily attributed to the absence of VND 93 billion in short-term receivables from Mr. Lâm Duy Tân. Conversely, short-term cash holdings surged from VND 648 million to nearly VND 71 billion.

Liabilities decreased by 20% to over VND 112 billion. Short-term debt decreased by 21% to more than VND 67 billion, while other short-term payables dropped by 29% to nearly VND 15 billion. This reduction is mainly due to the elimination of nearly VND 3 billion in seniority bonuses for employees and a decrease in dividends payable from VND 10 billion to nearly VND 7 billion.

– 5:28 PM, October 24, 2025

Stock on HOSE Surges to Upper Limit for Four Consecutive Sessions Following a 5,800% Q3 Profit Surge

Notably, SVC has witnessed a near-doubling in price over the past 5 months, marking its highest level in over 2 years (since August 2023).