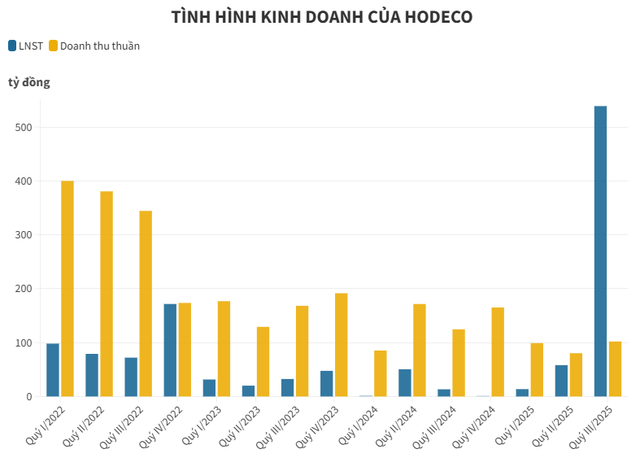

Hodeco (HDC), a leading real estate developer in Ba Ria – Vung Tau, has released its Q3 2025 financial report. Despite a 18% drop in net revenue to VND 102 billion compared to the same period last year, the company’s gross profit plummeted by 70% to VND 17 billion due to a 25% surge in cost of goods sold. This resulted in a sharp decline in gross profit margin from 46% to 16.67%.

A significant highlight was the skyrocketing financial revenue, which jumped from VND 2.7 billion to VND 700 billion, primarily driven by the sale of shares in Ocean Entertainment Construction Investment JSC (Ocean JSC), a Hodeco affiliate and developer of the Antares Ocean Tourism Complex. The buyer is Tan Cuong Consulting, Investment, and Trading JSC and/or its designated entities.

This transaction marked a historic milestone for Hodeco, with Q3 net profit reaching VND 538 billion, a staggering 40-fold increase year-over-year.

For the first nine months of 2025, Hodeco’s net revenue decreased by 26% to VND 281 billion, yet net profit soared ninefold to VND 610 billion. Although revenue reached only 19% of the annual target, the company surpassed its profit goal by 144%.

At the 2025 Extraordinary Shareholders’ Meeting in late September, Hodeco’s leadership attributed this remarkable growth to the Antares Ocean Tourism Complex sale.

Additionally, Hodeco is finalizing the transfer of the Thong Nhat Apartment project in Vung Tau City to HUB. Once completed, HUB will take over development, and Hodeco will recognize the revenue and profit in 2026.

Hodeco acknowledged a sluggish sales performance in the first nine months, with revenue generated only from the Ngoc Tuoc 2 villas and Phase 1 of The Light City.

However, in Q4 2025, the company plans to launch new phases of The Light City and the CC1 – Ecotown Phu My social housing project, aiming to stabilize core revenue streams.

As of September 30, 2025, Hodeco’s total assets reached VND 5.4 trillion, an 11% increase from the beginning of the year. Cash and cash equivalents surged 28-fold to VND 280 billion.

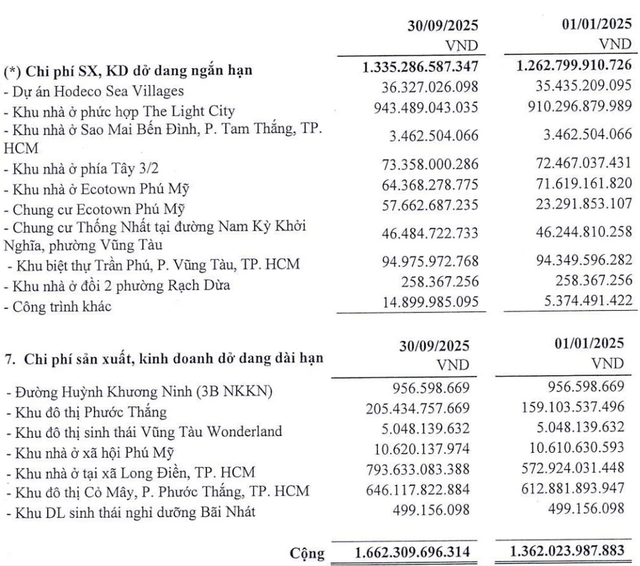

Short-term receivables rose by 45% to VND 1.346 trillion, while inventory increased slightly by 5% to VND 1.433 trillion, primarily comprising VND 1.335 trillion in work-in-progress costs for key projects such as The Light City (VND 943 billion), Hodeco Sea Villages (VND 36 billion), Tran Phu Villas (VND 95 billion), Ecotown Phu My Housing (VND 64 billion), and Ecotown Phu My Apartments (VND 57 billion).

Hodeco’s short-term and long-term work-in-progress costs as of Q3 2025.

Furthermore, long-term work-in-progress construction costs totaled VND 1.662 trillion, a 22% increase, focused on Co May Urban Area (VND 646 billion), Long Dien Social Housing in HCMC (VND 793 billion), and Phuoc Thang Urban Area (VND 205 billion).

On the financing side, Hodeco’s total liabilities stood at VND 2.523 trillion, a 3% decrease from the beginning of the year. Short-term loans decreased by 26% to VND 868 billion, mainly comprising a VND 696 billion 6–12 month loan and VND 172 billion in maturing long-term debt. Conversely, long-term loans increased by 79% to VND 757 billion, including a VND 266 billion 3–6 year bank loan and VND 491 billion in corporate bonds maturing in 2028.

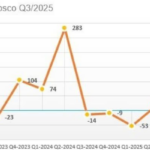

“Former ‘Steel Fist’ Reports Nearly 100 Billion VND Loss in Q3/2025 Due to Prolonged Shutdowns, Accumulated Losses Exceed 2.1 Trillion VND”

Over the first nine months, net revenue reached VND 2.996 trillion, a slight increase of 0.1% compared to the same period last year. The post-tax loss was VND 38 billion, an improvement from the VND 61 billion loss recorded in the same period last year.

BAOVIET Bank: Positive Credit Growth in the First Nine Months

With a modern retail banking development strategy deeply rooted in digital transformation, BAOVIET Bank (BAOVIET Bank Joint Stock Commercial Bank) achieved impressive business results in the first nine months of 2025. The bank recorded reasonable credit growth, strengthened risk management efficiency, and positive profit growth compared to the same period last year.