According to FiinRatings, F88’s capital mobilization and liquidity have significantly improved compared to previous credit rating periods, supported by effective diversification of funding sources (private and public bond issuances, partnerships with international funds, and domestic financial institutions). The average cost of capital decreased to 14.7% in the first half of 2025 (from 15.6% in 2024), thanks to more favorable borrowing rates and a sharp reduction in hedging costs to 0.8% (down from 2-3% previously).

The credit rating score also reflects F88’s maintained leadership in the alternative lending sector, along with strong profitability and asset quality.

In the first nine months of the year, F88’s pre-tax profit doubled year-on-year, reaching 603 billion VND, equivalent to 90% of the annual plan (673 billion VND). The company’s Return on Equity (ROE) surged from 28.3% in the same period last year to 43% in Q3/2025, with EPS at 77,704 VND/share, corresponding to a P/E ratio of approximately 13 times.

F88 has expanded its network to 896 stores nationwide, forged partnerships with multiple strategic allies, and invested heavily in technology to enhance customer acquisition and conversion from offline to online channels, thereby broadening market coverage.

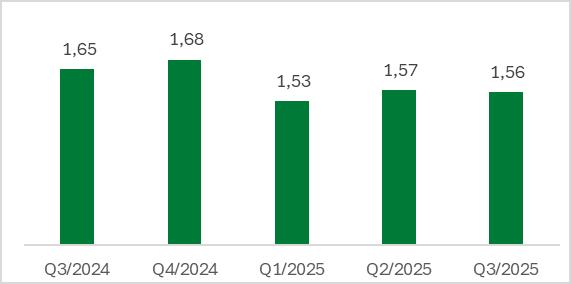

Unlike banks, which rely on customer deposits, F88’s primary funding sources are equity and debt (raised from international organizations, domestic financial institutions, and bond issuances). Debt accounts for 60-65% of total funding, while equity constitutes 35-40%, depending on the phase, resulting in a Debt-to-Equity ratio of 1.53 to 1.68 times.

F88’s Debt-to-Equity ratio from Q3/2024 to Q3/2025.

In the first nine months of 2025, F88 secured a landmark agreement to raise 30 million USD (approximately 780 billion VND) with a 2-3 year term from Lendable. This is the largest loan ever granted by the London-based international financial institution to a Vietnamese financial enterprise. Following this capital raise, F88’s total funding from Lendable reached nearly 70 million USD.

Previously, F88 raised trillions of VND from international organizations, recording outstanding loans of 2,487 billion VND, primarily from Puma Asia, Lendable, Indo-Pacific Liquidity Facility, and Lion Asia (as of September 2025).

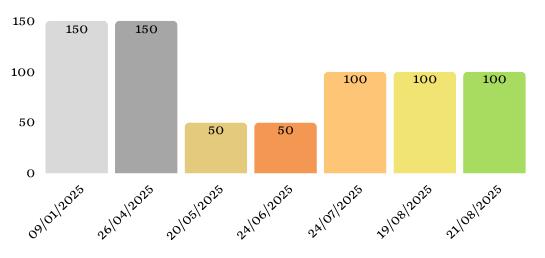

In bond issuance activities, F88 has established itself as a “trusted” issuer, completing disclosures for seven issuances since the beginning of 2025, totaling 700 billion VND. This brought F88’s total debt funding (including loans from financial institutions and bond issuances) to 3,448 billion VND, a 19% increase from the beginning of the year.

F88’s bond issuances disclosed by CBond since the beginning of the year (Unit: billion VND) (Source: CBond)

FiinRatings also highlights F88’s plan to issue public bonds in 2026.

Note that this public bond issuance can be seen as an “upgrade” for F88, as it requires compliance with stricter regulations to protect investor interests. The higher issuance conditions mean the company must demonstrate robust financial capabilities and strict regulatory adherence. In return, F88 gains significantly expanded access to public market funding, higher bond liquidity, and enhanced market reputation.

These factors have helped F88 maintain a stable capital base for its operations, ensuring strong liquidity. According to FiinRatings, F88 effectively employs long-term funding for short-term lending, optimizing capital efficiency and liquidity safety. The company also maintains a liquidity buffer equivalent to 2% of the previous year’s total assets to enhance market volatility resilience and risk management.

According to F88’s business results report, customer loan balances increased sharply by 40% from the beginning of the year, reaching 6,413 billion VND. Additionally, the company pursues a strategy of diversifying revenue streams through insurance and financial services.

F88’s credit rating upgrade is the result of its consistent transparency, effective operations, and solid reputation-building. Given the capital-intensive nature of its business, this upgrade provides a favorable foundation for F88 to continue raising funds through bond issuances and achieve better capital costs due to its higher credit rating.

Market Plunge: Stocks Tumble Nearly 95 Points, Leaving Investors Stunned

The stock market plummeted dramatically in the final minutes of the session, marking the steepest decline in history, with 150 stocks hitting their lower limit.

F88 Surges Ahead in Q3, Achieving 90% of 2025 Annual Profit Target

F88 Investment Corporation (F88) has unveiled remarkable Q3/2025 financial results, reporting pre-tax profits of VND 282 billion, doubling the figure from the same period last year. In the first nine months of 2025, F88’s cumulative profit reached VND 603 billion, a 2.5-fold increase year-on-year.