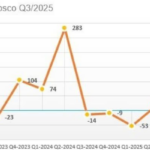

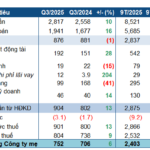

Ha Bac Nitrogenous Fertilizer and Chemicals Joint Stock Company (DHB) has released its Q3 2025 financial report, revealing a significant 36% year-over-year decline in net revenue to VND 651 billion.

The cost of goods sold stood at VND 631 billion, a 32% decrease. Gross profit plummeted by 79%, dropping from VND 96 billion to a mere VND 20 billion.

Financial revenue saw a drastic 98% reduction compared to Q3 2024, amounting to just over VND 1 billion. Financial expenses decreased by 24% to VND 39 billion, selling expenses dropped by 61% to over VND 7 billion, and administrative expenses fell by 46% to nearly VND 20 billion.

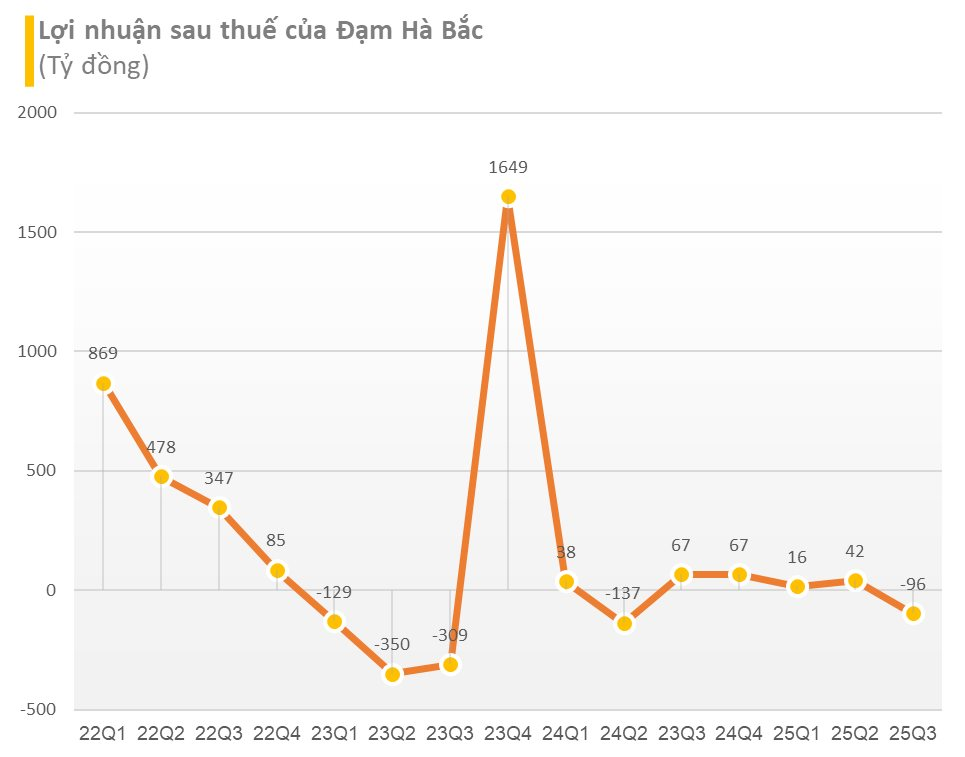

As a result, DHB reported a post-tax loss of VND 96 billion in Q3 2025, a stark contrast to the VND 38 billion profit in the same period last year.

DHB attributed the VND 96 billion loss to production challenges caused by aging equipment requiring extensive maintenance. The company halted operations for a prolonged period to overhaul its entire production line, perform intermediate repairs on proprietary equipment, and replace or upgrade the air separation unit in the Gas Production Workshop. This extended downtime reduced production capacity, leading to lower output.

Despite a favorable global urea market with rising prices, DHB’s sales revenue declined sharply due to reduced production volumes. Consequently, the company’s operational efficiency significantly decreased compared to Q3 2024.

For the first nine months of the year, net revenue reached VND 2,996 billion, a slight 0.1% increase year-over-year. The post-tax loss was VND 38 billion, an improvement from the VND 61 billion loss in the same period last year.

As of September 30, 2025, DHB’s accumulated losses totaled VND 2,142 billion.

By the end of September 2025, the company’s total assets were VND 5,549 billion, an 11% decrease from the beginning of the year. Total liabilities fell by 12% to VND 4,969 billion, while equity decreased by 6% to VND 580 billion.

Chairman Tram Be’s Hospital: Post-Tax Profit Triples, Leveraging Sixfold Surge in Preferential Loans from HFIC

Triều An Hospital’s Q3 2025 financial report reveals robust business growth. A significant surge in outstanding loans indicates a concentrated cash flow allocation towards a large-scale medical equipment investment project.

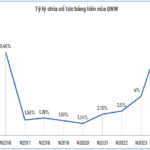

BAOVIET Bank: Positive Credit Growth in the First Nine Months

With a modern retail banking development strategy deeply rooted in digital transformation, BAOVIET Bank (BAOVIET Bank Joint Stock Commercial Bank) achieved impressive business results in the first nine months of 2025. The bank recorded reasonable credit growth, strengthened risk management efficiency, and positive profit growth compared to the same period last year.

BAOVIET Bank: Positive Credit Growth in the First Nine Months

With a modern retail banking development strategy deeply rooted in digital transformation, BAOVIET Bank (BAOVIET Bank Joint Stock Commercial Bank) achieved impressive business results in the first nine months of 2025. The bank recorded reasonable credit growth, strengthened risk management efficiency, and positive profit growth compared to the same period last year.