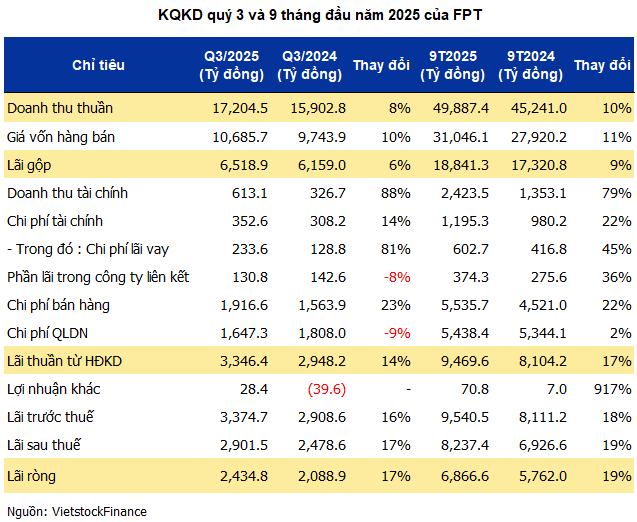

FPT continues its impressive growth trajectory, reporting a net profit of nearly VND 2.435 trillion in Q3/2025, a 17% increase compared to the same period in 2024. This marks the second consecutive quarter of record-breaking profits. Revenue for Q3 reached over VND 17.205 trillion, reflecting an 8% growth.

|

Notably, the financial segment significantly contributed to FPT’s Q3 performance, generating revenue of over VND 613 billion, an 88% surge. Over the first nine months, financial revenue totaled nearly VND 2.424 trillion, up 79% year-on-year. Interest income alone accounted for VND 1.235 trillion, representing over 51% of total financial revenue. On average, FPT earned more than VND 4.5 billion daily from bank deposits.

As of September 2025, FPT’s bank deposits reached nearly VND 37,000 billion (approximately USD 1.4 billion), a VND 5,900 billion (19%) increase since the beginning of the year. This marks the highest level in the corporation’s history.

Rapid debt growth, with interest expenses nearing VND 603 billion

Alongside its financial expansion, FPT’s total debt rose to nearly VND 19,600 billion, a VND 4,600 billion (31%) increase year-to-date. Short-term debt accounted for over VND 16,900 billion. In terms of currency structure, FPT borrowed VND 14,184 billion (up 12%), JPY 2,912 billion (doubling since the start of the year), and USD 2,488 billion (tripling). Interest expenses for the nine months reached nearly VND 603 billion, a 45% increase, averaging over VND 2.2 billion daily.

Record-breaking 9-month results, stock surges

For the first nine months, FPT recorded VND 49,887 billion in revenue and VND 6,867 billion in net profit, up 10% and 19% respectively. The company achieved 66% of its annual revenue target and 71% of its profit goal, both record highs for a 9-month period.

On the stock market, FPT shares rebounded strongly after a prolonged decline since the beginning of the year. From below VND 90,000 per share, the stock hit its upper limit of VND 93,000 on October 21, its first ceiling price since April. It continued to recover to VND 97,300 by October 24, a 10% increase in just one week. However, the share price remains 15% lower than a year ago.

| FPT’s stock price performance over the past year |

Foreign investment returned strongly, with foreign investors net buying VND 1,241 billion of FPT shares last week, and proprietary trading desks net buying VND 391 billion. However, year-to-date, FPT remains the most sold stock by foreign investors among large-cap stocks, with net outflows exceeding VND 16,000 billion.

– 14:45 24/10/2025

Market Pulse 23/10: Vingroup Once Again “Rescues” the Market

The afternoon session on October 23rd saw the VN-Index continue its volatile trend. At one point, it seemed poised to reclaim the 1,700-point mark, but mounting pressures forced the index to retreat, closing at 1,687 points. Despite the gains, the rally was largely driven by the influence of the Vingroup conglomerate.

How Do Investors Fare After a Memorable Stock Market Session?

Today (October 22nd), shares purchased at the market bottom during the VN-Index’s record 94-point plunge on October 20th have been credited to investor accounts and are now eligible for trading. However, hopes of quick profits through short-term trading have largely been unfulfilled for the majority.