Over 2.31 billion shares of TCX, issued by TCBS Securities, were officially listed and traded on the Ho Chi Minh City Stock Exchange (HOSE) as of October 21.

According to Decision 87/QĐ-UCBK, a stock must meet the following criteria to qualify for margin trading:

A minimum listing period of 6 months on the exchange from the first trading day.

The latest annual audited financial report or a semi-annual reviewed or audited financial report with a fully accepted opinion from an auditing organization.

No legal violations, no accumulated losses, and timely disclosure of information.

Given that TCX was listed on HOSE on October 21 this year, it is expected to meet margin trading eligibility by April 2026, following the release of TCBS’s 2025 audited financial report and the completion of the required listing period. This milestone opens new opportunities for investors to enhance capital efficiency with leading securities stocks.

TCX’s Dual 2026 Milestones: Margin Trading Eligibility and VN30 Inclusion

The 6-month waiting period for TCX to qualify for margin trading aligns with HOSE’s VN30 index review cycle. The earliest TCX could be added to the VN30 is during the July 2026 review period.

TCBS Securities has already met key criteria such as listing status, free-float ratio, adjusted market capitalization, and asset size, though liquidity will be assessed during the 6 months post-listing.

Currently, four ETFs track the VN30 index: DCVN30, KIMVN30, MASVN30, and BVFVN30, with combined assets of nearly VND 9 trillion. These funds will automatically purchase TCX shares upon its inclusion in the VN30, significantly boosting liquidity.

Notably, the State Securities Commission’s approval of a 100% foreign ownership cap for TCX removes foreign room restrictions, facilitating international investment and enhancing the stock’s liquidity and market appeal.

TCBS Sustains Impressive Growth with Leading Positions Across Key Business Segments

Recently, TCBS reported pre-tax profits of VND 2,024 billion for Q3/2025, a record-high 85% increase, achieving nearly 90% of its annual target and maintaining market-leading profitability.

In Q3/2025, TCBS’s pre-tax profit reached VND 2,024 billion, up 85% year-on-year and the highest since its inception. For the first nine months, pre-tax profit totaled VND 5,067 billion, a 31% increase from 2024, meeting nearly 90% of the annual plan. Profit growth has been consistent: from an average of VND 750 billion per quarter in 2023 to VND 1,200 billion in 2024 and nearly VND 1,700 billion by Q3/2025.

TCBS’s capital strength is a key differentiator. Following a successful IPO of 231.15 million shares, its charter capital rose to over VND 23,113 billion, and equity to VND 42,478 billion. This expanded its margin lending limit to nearly VND 85,000 billion, with only 50% of the legal maximum utilized. This substantial buffer highlights TCBS’s robust capital position and liquidity support, positioning TCX for blue-chip status.

With increased capital and equity post-IPO, TCBS’s lending-to-equity ratio stands at 0.98, well below the SSC’s 2x limit, ensuring strong capital and safety for continued growth.

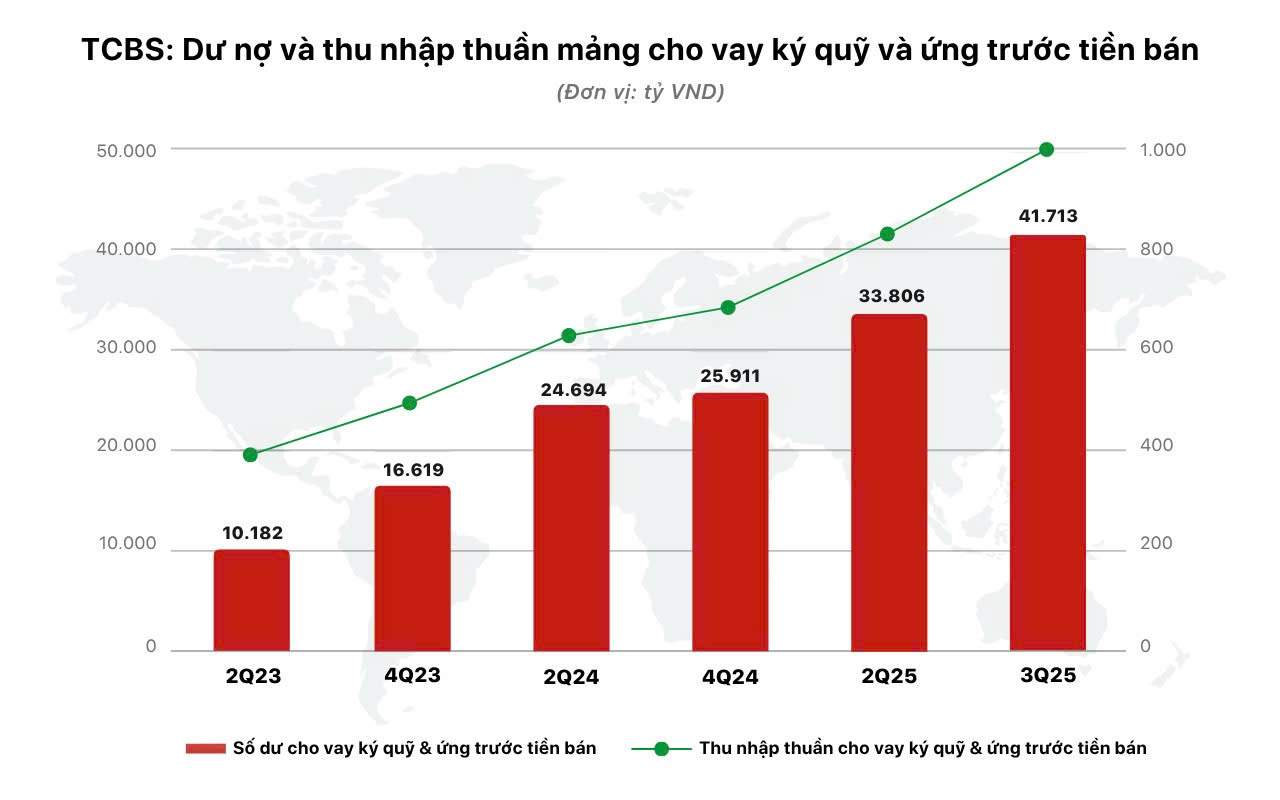

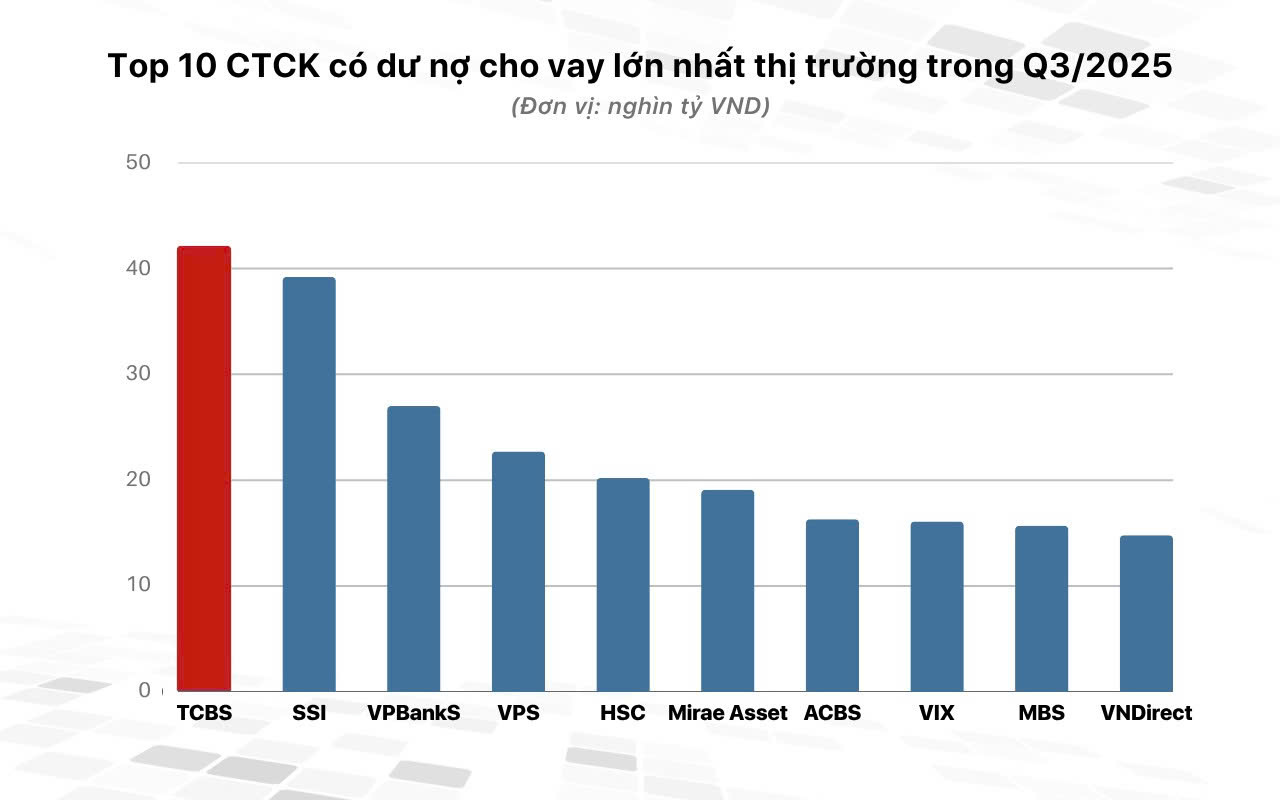

As of Q3/2025, securities companies’ total lending (margin and advance payments) reached VND 383,000 billion (~USD 14.5 billion), up VND 80,000 billion from Q2, with margin lending at VND 370,000 billion, up 27%, driving a 280-point VN-Index rise.

TCBS leads with over VND 40,000 billion in lending, up VND 8,000 billion from Q2, and holds the top market share in margin lending. It also ranks among the top 3 brokers on HOSE (7.75% market share) and top 2 on HNX (8.81%), with 11 consecutive quarters of growth.

TCBS has proposed a 2024 dividend of 5% in cash and 20% in shares, with the record date set for October 30.

TCBS (TCX) Lists and Officially Trades Over 2.31 Million Shares on October 21st

On October 21, 2025, the Ho Chi Minh City Stock Exchange (HOSE) hosted the listing ceremony for Technocom Securities Joint Stock Company – TCBS (stock code: TCX), officially launching over 2.31 billion TCX shares for trading on the HOSE platform.

Foreign Block Continues Net Selling Spree as VN-Index Plunges to Record Low, One Stock Dumped for Nearly 700 Billion VND

Foreign investors’ trading activity emerged as a notable drawback, as they engaged in net selling across the entire market, amounting to a significant value of 2.042 trillion VND.