|

Source: VietstockFinance

|

At the close of the afternoon session, the VN-Index reached 1,687.06, up 8.56 points. The UPCoM-Index also saw a green trend, rising 1.22 points to 111.04. Meanwhile, the HNX-Index ended the day at 266.78, down 1.91 points.

Despite the VN-Index’s gain, the familiar pattern persisted, with most of the increase attributed to Vingroup ecosystem members.

Specifically, three notable stocks from this group—VIC (+5.91%), VHM (+1.77%), and VPL (+2.03%)—contributed significantly. With their massive market capitalization, these three stocks alone added 13.58 points to the VN-Index. In other words, without Vingroup’s contribution, the VN-Index would have closed in the red today.

This trend is further evident when examining market capitalization groups. Large-cap stocks rose 0.49%, while mid-cap and small-cap stocks increased by 0.05% and 0.1%, respectively.

Market-wide, 399 stocks advanced, compared to 327 decliners, with 874 remaining unchanged. Sector-wise, the divergence was pronounced. In banking, while HDB, SHB, STB, VCB, and LPB gained, TCB, VPB, ACB, CTG, and TPB retreated. A similar scenario played out in real estate, with notable declines in CEO (-4.46%), DIG (-2.89%), DXG (-2.2%), HDC (-3.5%), and PDR (-2.68%).

In the securities sector, red dominated, with SSI, VIX, SHS, VND, and VCI all declining, some sharply. Other key stocks also pressured the market, including FPT (-2.06%), GEX (-3.6%), MSN (-1.01%), and HPG (-0.75%).

Overall, the market’s reliance on “super pillars” for gains, while most investors face ongoing pressure, is a recurring theme in recent periods.

Liquidity totaled over 27 trillion VND today, with HOSE accounting for nearly 24.6 trillion VND, lower than the previous session and recent averages. This moderation is necessary after the market’s recent sharp declines, including the historic 95-point drop on October 20.

Morning Session: Vingroup Reverses, Market Closes Morning Up 12 Points

After early volatility, the market stabilized and improved. By the morning close, the VN-Index rose 11.99 points to 1,690.49. On the HNX, the HNX-Index dipped 0.02 points to 268.67, while the UPCoM-Index gained 1.25 points to 111.07.

Market-wide, 387 stocks advanced, including 20 at the upper limit, led by VSC and CTD. Conversely, 225 stocks declined, with 9 hitting the lower limit. Despite more gainers, pressure from banking, securities, real estate, and tech giants capped the market’s rise.

The market’s steady climb from mid-morning was fueled by Vingroup’s reversal, as VIC and VHM turned green, and VRE returned to reference. By session’s end, VIC and VHM added 4.9 and 2.54 points, respectively, to the VN-Index. Foreign investors continued selling, netting over 1.3 trillion VND, led by CTG (161 billion VND), VHM (89 billion VND), and SSI (84 billion VND).

10:40 AM: Tug-of-War for Points

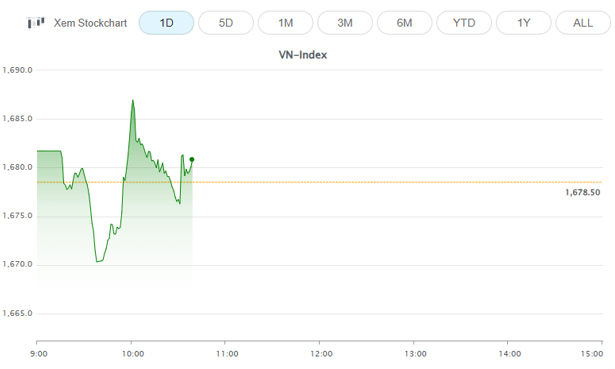

The market seesawed in the first half of the morning, fluctuating between 1,670 and 1,687 points.

|

VN-Index in flux

Source: VietstockFinance

|

This volatility was anticipated, even necessary, after recent freefalls. By 10:40 AM, the VN-Index traded near reference at 1,638.68. The HNX-Index rose 0.92 points to 269.61, and the UPCoM-Index gained 1.22 points to 111.04.

Total trading value exceeded 9.7 trillion VND, with HOSE at 8.9 trillion VND, similar to yesterday but below recent averages.

Pillar stocks remained divided. In banking, HDB (+3.85%) led, while TCB, CTG, and EIB fell. Securities followed suit, with VCI and ORS rising, but VIX, SSI, VND, and newcomer TCX declining. Real estate mirrored this, with pressure from VIC, VHM, and VRE.

Sixteen stocks hit their upper limits, led by CTD, which recently held its 2025 AGM. Chairman Bolat Dusenov noted, “When done right and focused on key factors, stock prices will reflect those efforts.” The meeting approved FY2026 plans (July 1, 2025 – June 30, 2026) targeting 30 trillion VND in revenue and 700 billion VND in post-tax profit, up 21% and 54%, respectively, from FY2025.

Opening: Large-Caps Pressure Early

After yesterday’s dramatic pullback, the market traded narrowly around reference, with green and red alternating. However, selling intensified post-9:30 AM.

By 9:40 AM, the VN-Index fell 8.78 points to 1,670.22, despite more gainers than losers.

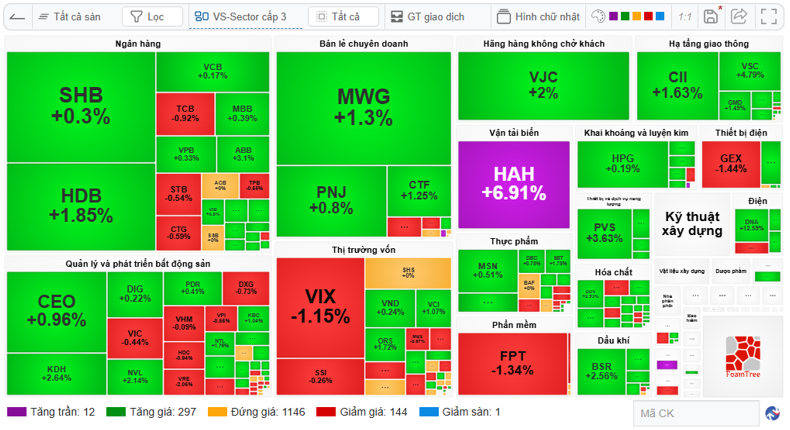

Pressure came from banking (TCB, VCB, CTG, VPB), real estate (VIC, VHM, VRE, DXG, DIG), securities (VIX, VND, SHS, HCM), and others like HPG, FPT, and GEX.

|

Market map at 9:40 AM

Source: VietstockFinance

|

Globally, Asian markets opened mixed. Hang Seng (-0.13%), Nikkei 225 (-1.27%), and Shanghai Composite (-0.82%) fell, while All Ordinaries (+0.13%) and Singapore Straits Times (+0.08%) rose.

Overnight, U.S. stocks declined on heightened U.S.-China trade concerns and disappointing earnings from Texas Instruments and Netflix. The Dow Jones shed 0.71% to 46,590.41; the S&P 500 lost 0.53% to 6,699.40; and the Nasdaq Composite dropped 0.93% to 22,740.40. At session lows, the Dow fell over 400 points (1%), with the S&P 500 and Nasdaq down 1.2% and 1.9%, respectively.

– 15:45 23/10/2025

How Do Investors Fare After a Memorable Stock Market Session?

Today (October 22nd), shares purchased at the market bottom during the VN-Index’s record 94-point plunge on October 20th have been credited to investor accounts and are now eligible for trading. However, hopes of quick profits through short-term trading have largely been unfulfilled for the majority.

Do Investors Profit or Lose When ‘Bottom Fishing’ in a Stock Market Plunge?

Today (October 22nd), shares purchased at the market bottom during the VN-Index’s record 94-point plunge on October 20th have been credited to investor accounts and are now eligible for trading. However, hopes of quick profits through short-term trading have largely been unfulfilled for the majority.

Measuring the “Impact” of the Pullback Near the 1,600-Point Mark

The Vietnamese stock market is currently experiencing a pullback after reaching an all-time high of nearly 1,800 points last week. Despite this, even stocks that consistently broke price records are now inflicting significant “damage,” leaving many investors facing losses or reduced profits.