Amidst a volatile market characterized by successive fluctuations, investors are finding a “bright spot” in stocks with positive third-quarter earnings reports. The financial reporting season has just begun, but several stocks have already seen significant surges, driven by expectations of exceptional profits. Numerous companies have reported earnings doubling or more, becoming focal points for investment and driving substantial stock price increases.

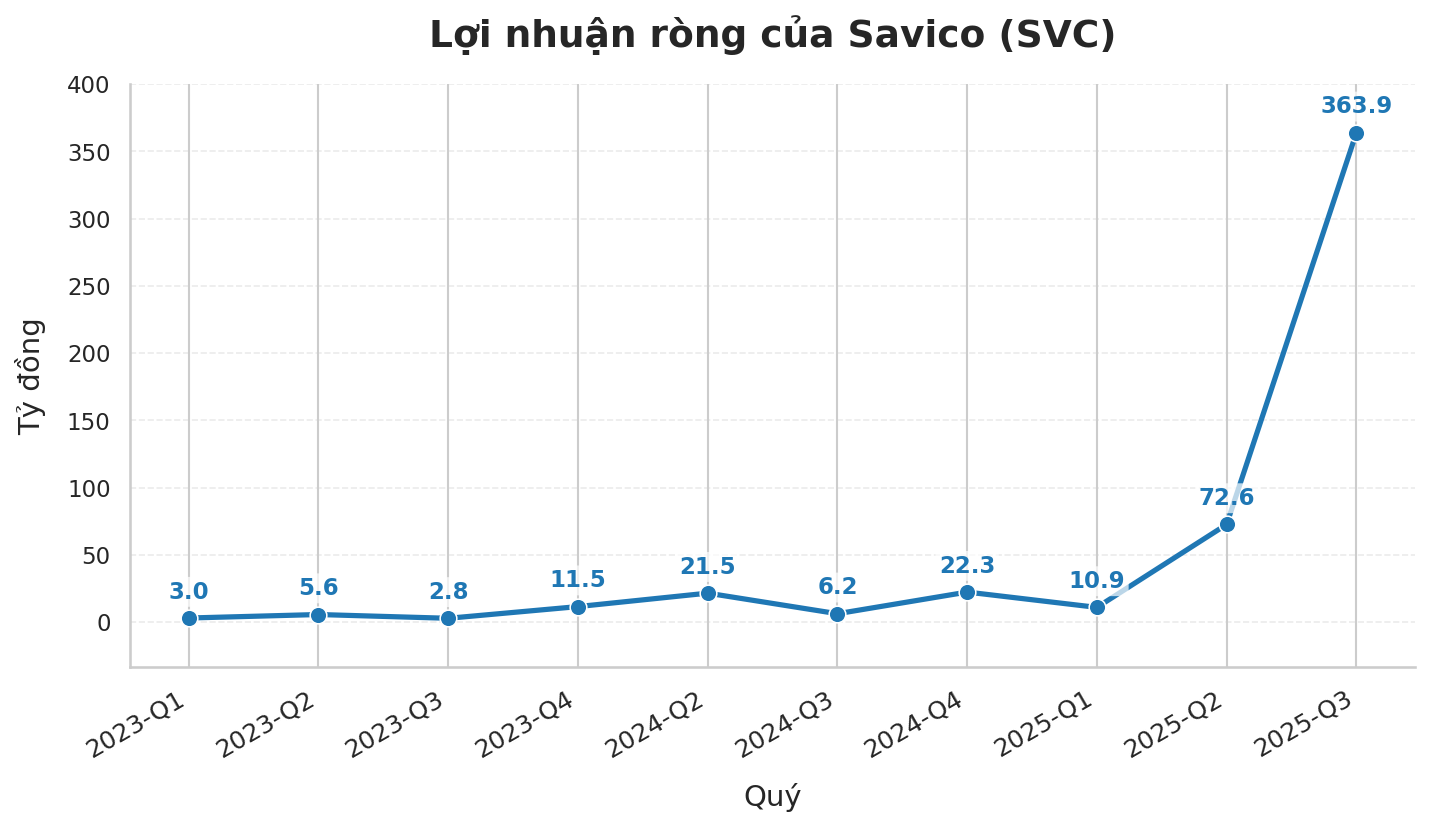

On the HoSE, SVC shares of Saigon General Service Corporation (Savico) have been the most notable, with five consecutive sessions hitting the upper limit, pushing the price to 27,900 VND/share—the highest in over two years. Remarkably, SVC’s surge occurred immediately after the company announced its Q3/2025 financial report, showing a post-tax profit of 364 billion VND, a nearly 5,800% increase year-over-year. This not only marks a record increase but also the highest quarterly profit in Savico’s history.

According to the company, this exceptional performance stems from the recovery of the automobile market and an expanded distribution network. However, the primary driver of the profit surge was the financial segment, with financial revenue in the quarter reaching 669 billion VND, 33 times higher than the 20 billion VND in Q3/2024. Over 537 billion VND came from investment sales profits.

Similarly, NT2 shares of Nhon Trach 2 PetroPower JSC have seen significant movement, driven by positive earnings expectations. On October 22nd, NT2 surged 6.5% to 22,750 VND/share after reporting Q3 net revenue of 1,928 billion VND, a 13% increase year-over-year, and post-tax profit of 214 billion VND—nearly five times higher than the same period last year. For the first nine months, NT2 recorded net revenue of over 5,436 billion VND, up 31%, and post-tax profit of 577 billion VND, 69 times higher than the 8 billion VND in the same period of 2024.

Likewise, HT1 shares of Vicem Ha Tien Cement JSC hit the upper limit on October 22nd, marking three consecutive sessions of gains and pushing the price to 20,100 VND/share, the highest in 3.5 years.

This surge followed Vicem Ha Tien’s Q3 revenue announcement of 1,867 billion VND, up nearly 14% year-over-year, with post-tax profit reaching nearly 86 billion VND, a 280% increase. The revival of the construction materials sector, fueled by public investment and real estate market recovery, is significantly boosting cement stocks.

In the same vein, HLC shares of Ha Lam Coal JSC have seen three consecutive sessions of strong gains, including two upper limit sessions. The current price stands at 14,300 VND/share, the highest in over three years. The company reported pre-tax profit for Q3 at 91 billion VND, a 539% increase year-over-year.

Overall, amidst market volatility and heightened investor caution, funds are gravitating toward stocks with positive Q3 earnings as a short-term anchor.

Investors are optimistic that the “Q3 earnings wave” will continue to support the market in the short term, particularly for companies with strong fundamentals. However, experts caution against the risks of over-exuberance, which could lead to investors buying at high prices in a market with significant volatility and potential profit-taking pressures.

Additionally, while many companies have reported positive results from core operations, some extraordinary profits stem from financial gains, asset transfers, provision reversals, or one-time benefits. Investors must carefully analyze profit structures to distinguish between sustainable growth and short-term boosts.

Daily Stock Pick: How Much Profit Can You Make Investing in Bầu Hiển’s SHB?

It took over 11 years for the investment strategy in SHB to start yielding profits, and to date, after 16 years, the returns stand at approximately 326%.

“Exclusive Insights: Two Investment ‘Sharks’ Discuss Stocks vs. Real Estate Amid VN-Index’s Historic Crash and Year-End Investment Trends”

In just a few months, the investment landscape has witnessed a dramatic shift: stock markets soared to new highs only to plummet nearly 100 points, gold surged exponentially, and real estate began showing signs of recovery. As 2025 draws to a close, amidst the turbulent market waves, investors once again face the age-old question: which asset—gold, stocks, or real estate—truly serves as the safest haven?