Source: VietstockFinance

|

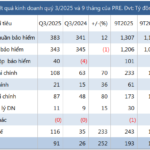

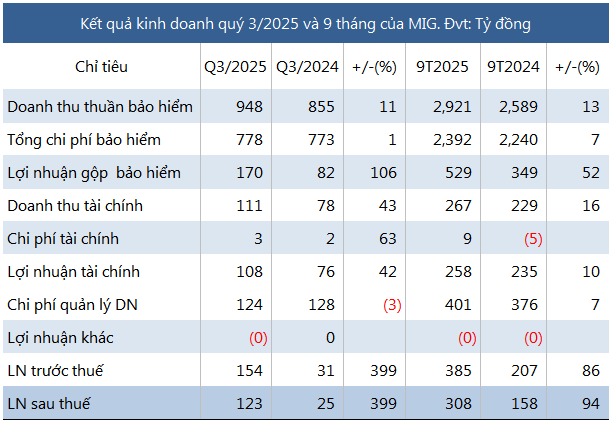

According to the Q3 2025 financial report, insurance business operations generated VND 170 billion in gross profit, a 2.1-fold increase year-over-year. This was driven by insurance premium revenue reaching nearly VND 1,249 billion (up 19%), while compensation expenses decreased by 20% to VND 204 billion.

Financial activities also showed improvement, with gross profit rising by 42% to VND 108 billion. Coupled with a 3% reduction in business management costs to VND 124 billion, MIG recorded a net profit of VND 123 billion, five times higher than the same period last year.

For the first nine months of the year, net profit reached VND 308 billion, a 94% increase year-over-year. The insurance segment remained the primary driver, with profits up 52% to VND 529 billion. Meanwhile, the financial segment grew by 10%, achieving VND 258 billion in gross profit, primarily from deposit interest and investment commissions.

Compared to the 2025 profit target of nearly VND 540 billion (a 75% increase from the previous year), MIG has achieved 71% of its plan after nine months.

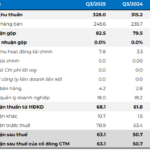

As of the end of Q3 2025, MIG’s total assets exceeded VND 10,600 billion, an 8% increase from the beginning of the year. Short-term financial investments rose by 15% to VND 4,738 billion, accounting for 44% of total assets. This includes VND 3,538 billion in deposits (up 15%) and VND 1,200 billion in investment commissions (up 16%).

Liabilities reached over VND 8,050 billion, a 4% increase, with short-term insurance reserves accounting for 59%, equivalent to nearly VND 4,780 billion, a slight 2% decrease from the beginning of the year.

– 15:03 23/10/2025

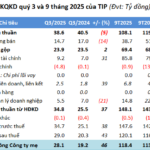

Q3 TIP Profit Surges by 46%

TIP’s Q3 net profit surged 46%, driven by financial investment provision reversals. The company has achieved 70% of its annual plan in the first nine months.

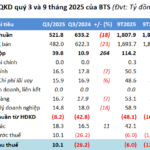

VICEM Bút Sơn Cement Turns Profitable in Q3 Through Waste Management Solutions

With over VND 18 billion in additional profits from waste treatment, VICEM But Son Cement turned a profit in Q3, reporting earnings of more than VND 10 billion. This marks the second consecutive profitable quarter after a 10-quarter loss streak. However, the company still faces accumulated losses of nearly VND 300 billion.

Khang Dien Real Estate Has Yet to Fully Utilize Capital Raised from 2024 ESOP Share Offering

As of October 20, 2025, Khang Dien House has utilized over VND 89.6 billion out of the total VND 183.6 billion raised from the 2024 ESOP share offering, leaving nearly VND 94 billion yet to be allocated.