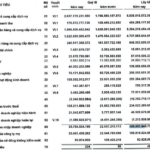

Mobile World Investment Corporation (stock code: MWG) has released its Q3/2025 financial report, boasting a net revenue of VND 39,853 billion, a nearly 17% increase compared to the same period in 2024, marking the highest figure since its establishment. The trend of quarterly revenue growth has been consistent since the beginning of 2023.

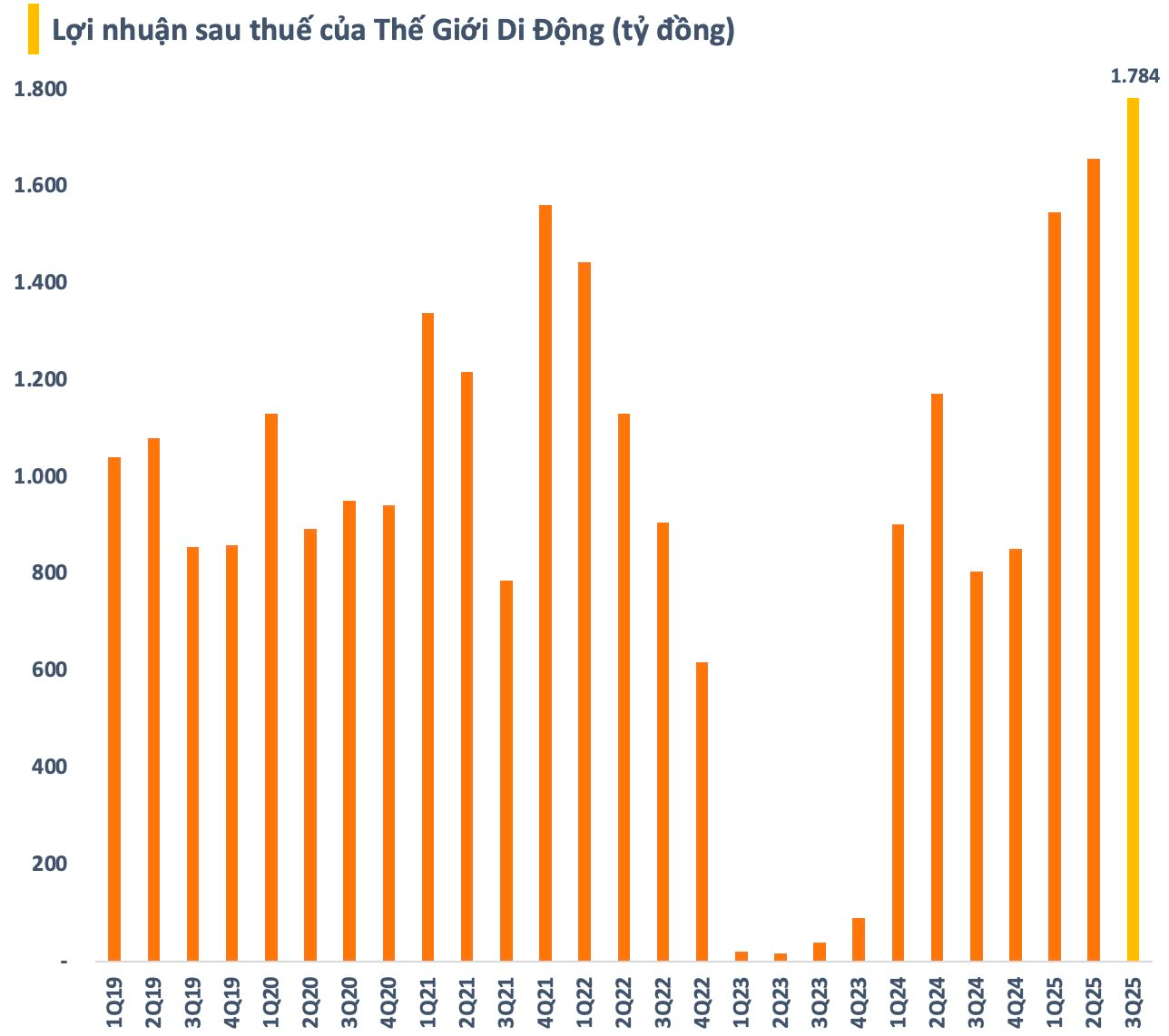

After deducting costs and recognizing profits from associates, MWG’s Q3 net profit reached a record high of VND 1,784 billion, up 121% year-over-year and 8% from the previous quarter. This marks the third consecutive quarter of profit growth for Mr. Nguyen Duc Tai’s retail enterprise.

In the first nine months, MWG recorded a net revenue of VND 113,607 billion and a net profit of VND 4,989 billion, up 14% and 73% respectively compared to the same period in 2024. With these results, the retailer has achieved 76% of its annual revenue target and surpassed its profit goal by 3%.

For 2025, MWG aims for a revenue of VND 150,000 billion and a net profit of VND 4,850 billion, representing a 12% and 30% increase respectively from 2024. Since the beginning of the year, the company’s leadership has demonstrated a strong commitment to early goal achievement, as evidenced by Mr. Doan Van Hieu Em’s statement: “2025 Goal – October Completion – Year-End Excellence.” From a profit perspective, MWG has not only met but exceeded expectations.

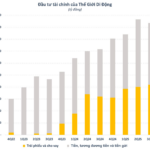

In the first nine months, The Gioi Di Dong and Dien May Xanh (TGDĐ/ĐMX) chains, managed by MWG’s subsidiary Mobile World JSC (MW), reported positive results. This success is attributed to a quality-focused growth strategy, emphasizing superior services, lifetime support, and comprehensive financial solutions.

Specifically, MWG’s electronics and home appliances segment achieved a revenue of VND 76,500 billion, a nearly 15% increase year-over-year, despite a slow market recovery and a decrease in the average number of stores. This positive outcome is primarily due to revenue growth in existing stores, driven by a focus on services and comprehensive financial solutions for customers.

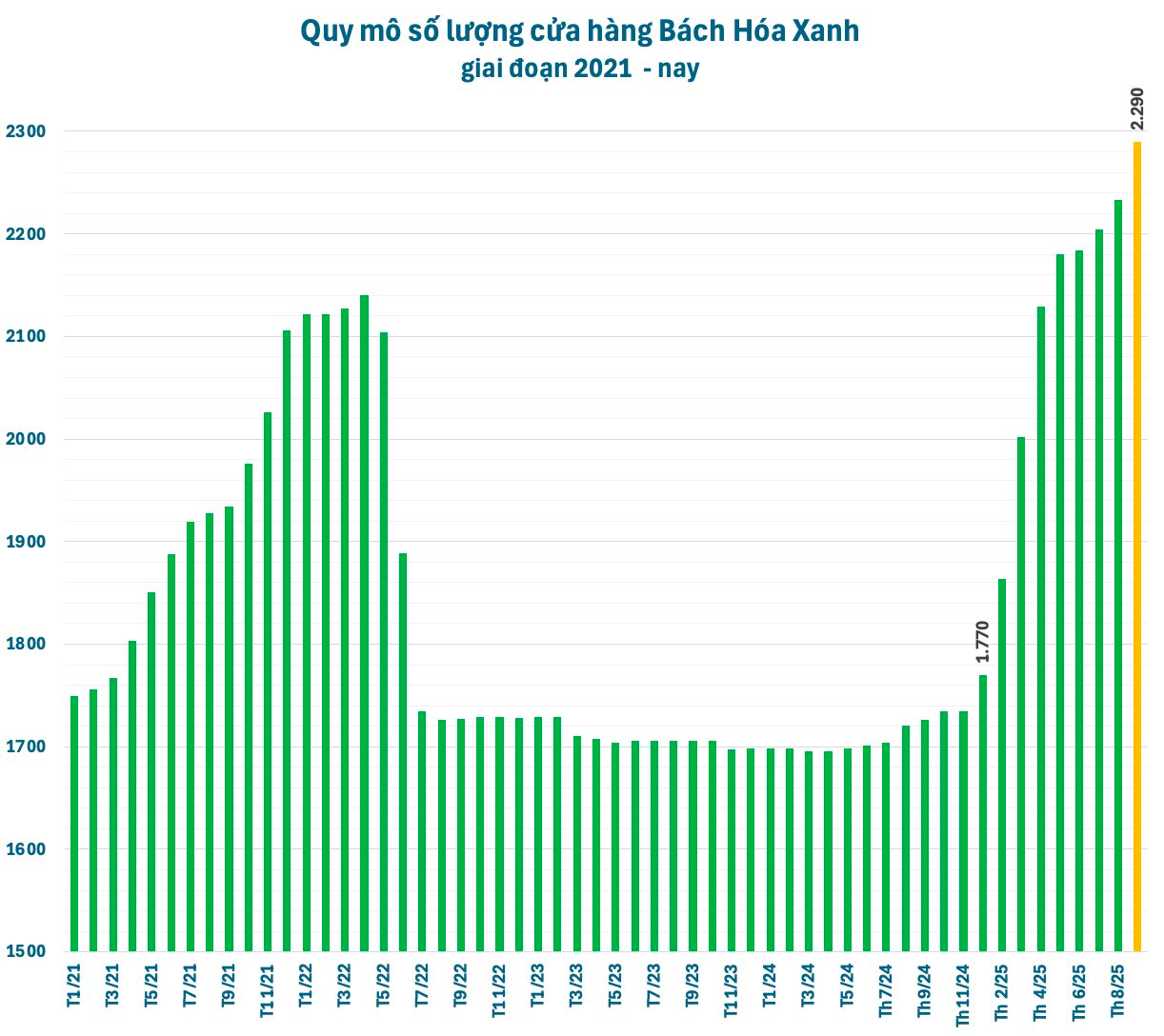

Bach Hoa Xanh (BHX), MWG’s grocery chain, reported a nine-month cumulative revenue of VND 34,400 billion, up 14% year-over-year. However, its growth rate has slowed in recent months. According to MWG, BHX’s operational efficiency improved in Q3/2025 compared to Q2/2025, thanks to cost optimization and loss control measures.

As of September, BHX has opened 520 new stores this year, bringing the total to 2,290, with over 50% of new stores located in the Central region. These new stores have achieved positive profits at the store level after deducting all direct operating and logistics costs. In Q4/2025, BHX plans to continue its selective expansion in new provinces and regions where it already has a presence.

Notably, Mr. Nguyen Duc Tai’s supermarket chain has begun recruiting staff to expand into the Northern market. At the Q2 Investor Meeting, MWG’s CEO, Mr. Vu Dang Linh, announced that 2026 will be a pivotal year as BHX officially enters the North. He also revealed an ambitious plan to open 1,000 new Bach Hoa Xanh stores annually starting next year.

Alongside EraBlue, the An Khang pharmacy chain also showed positive developments, with an average monthly revenue per store of VND 540 million, marking three consecutive months of growth. The chain is expected to further improve store-level efficiency, aiming to contribute profits to the group.

AvaKids recorded double-digit revenue growth in the first nine months compared to the same period last year, with an average monthly revenue per store of VND 1.8 billion. Total revenue in Q3/2025 increased by 10% from the previous quarter and over 30% year-over-year. The chain has achieved profitability at the company level and continues to improve its financial performance month-over-month.

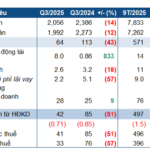

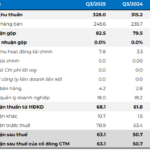

Quảng Ninh Thermal Power Profits Halved Due to Electricity Price Adjustments

Quảng Ninh Thermal Power JSC (UPCoM: QTP) reported a 57% year-over-year decline in profit for Q3 2025. The primary driver of this downturn was a decrease in electricity selling prices, which led to a contraction in revenue.