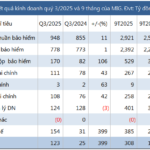

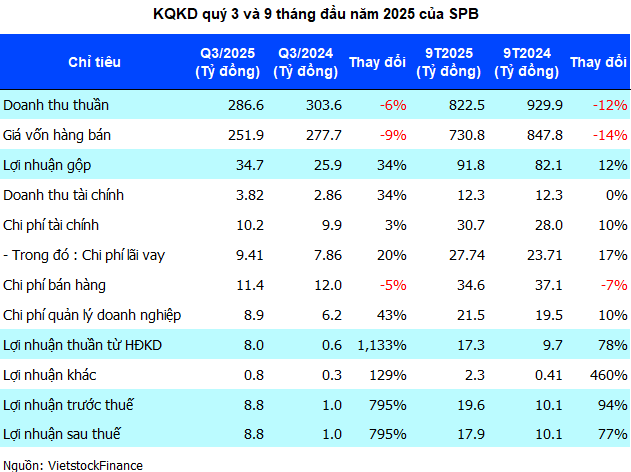

| SPB’s Quarterly Business Results |

In Q3/2025, SPB recorded a net revenue of nearly VND 287 billion, a 6% decrease compared to the same period last year. However, its net profit reached a historic high of nearly VND 9 billion, surging by 795%. The gross profit margin significantly improved to over 12%, up from 8.5% in the same period of 2024, thanks to a faster reduction in production costs than revenue.

According to the company, this improvement stems from the decline in international cotton prices and SPB’s proactive optimization of consumption norms, spinning process innovations, and reduced production waste. These measures substantially lowered the average production cost per unit, expanding profit margins despite a slight revenue decline.

|

Nine-Month Accumulated Profit Surpasses Entire Previous Year

In the first nine months of 2025, SPB’s revenue decreased by 12% to VND 822.5 billion, but net profit soared by 77% year-on-year, reaching nearly VND 18 billion. This figure has already surpassed the full-year 2024 profit of VND 15 billion and marks a significant turnaround from the record loss of VND 40 billion in 2023.

Thanks to these results, SPB officially eliminated all accumulated losses as of September 30, 2025, with retained earnings at the end of the period exceeding VND 735 million. The company achieved 71% of its revenue target and 67% of its profit goal for 2025.

| SPB’s Business Results from 2016 to 9M2025 |

Increase in Inventory and Debt

As of September 30, 2025, SPB’s total assets reached over VND 1,004 billion, an 11% increase from the beginning of the year. Inventory accounted for more than VND 321 billion, up by 15%, with raw materials making up nearly VND 238 billion. Bank deposits stood at nearly VND 21 billion, eight times higher than at the start of the year.

Conversely, the company increased its borrowing, with total debt reaching VND 648.5 billion, a 13% rise from the beginning of the year. Interest expenses for the nine months totaled nearly VND 28 billion, up 17% year-on-year.

On the UPCoM market, SPB shares remain illiquid, stagnant at VND 15,000 per share over the past three weeks, marking a 38% decline over the past year.

| SPB Stock Price Trends Over the Past Year |

– 13:48 23/10/2025

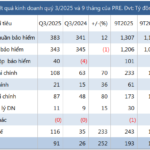

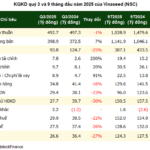

Vinaseed’s Gross Profit Hits Historic Low as Inventory Surges Past 1 Trillion VND

Amidst seasonal fluctuations and escalating financial costs, Vinaseed Group (HOSE: NSC) reported its weakest quarterly performance since 2020, with gross profit margins plummeting to a record low of 19%. Simultaneously, inventory levels surged past the 1,000 billion VND mark, exacerbating the company’s financial challenges.

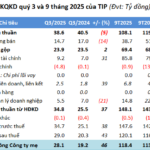

VICEM Bút Sơn Cement Turns Profitable in Q3 Through Waste Management Solutions

With over VND 18 billion in additional profits from waste treatment, VICEM But Son Cement turned a profit in Q3, reporting earnings of more than VND 10 billion. This marks the second consecutive profitable quarter after a 10-quarter loss streak. However, the company still faces accumulated losses of nearly VND 300 billion.