Source: VietstockFinance

|

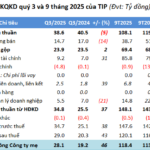

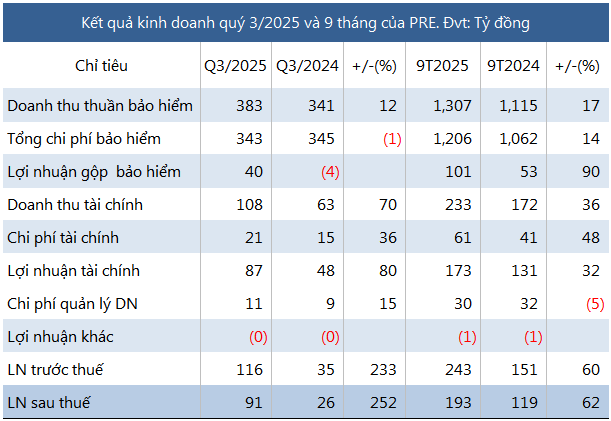

In Q3, PRE recorded reinsurance premium revenue of nearly VND 740 billion, a 27% increase year-over-year. Meanwhile, reinsurance cession costs rose by 7% to VND 345 billion, resulting in a 12% growth in net insurance revenue, reaching VND 383 billion.

Insurance operating expenses were well-managed, decreasing by 1% to VND 343 billion, primarily due to a 6% reduction in insurance commission costs to VND 153 billion. As a result, the reinsurance segment turned profitable, generating VND 40 billion in profit compared to a VND 4 billion loss in the same period last year.

| PRE’s Quarterly Net Profit |

Additionally, financial investment profits surged by 80%, offsetting a 15% increase in corporate management expenses. Overall, PRE achieved a record quarterly net profit of VND 91 billion.

For the first nine months of 2025, PRE reported VND 101 billion in gross profit from reinsurance, a 90% increase year-over-year. This growth was driven by a 10% rise in reinsurance premium revenue, with property insurance products contributing significantly to the revenue mix.

Financial activities were robust, with a 32% increase in profits to VND 173 billion, fueled by higher dividend income. Consequently, nine-month net profit reached VND 193 billion, up 62%.

For 2025, PRE targets pre-tax profits of over VND 244 billion, matching 2024 results. After nine months, the company has nearly achieved its annual goal, with a 99% completion rate.

As of Q3 2025, PRE‘s total assets reached nearly VND 8 trillion, a 19% increase year-to-date, primarily due to a 26% rise in short-term deposits to over VND 2.2 trillion.

Total liabilities exceeded VND 6.2 trillion, up 22%, with short-term insurance reserves accounting for the majority at over VND 4.6 trillion, a 12% increase.

Notably, PRE secured a new short-term loan of nearly VND 356 billion at the end of the quarter, guaranteed by time deposits totaling VND 304 billion at domestic commercial banks. This loan is intended to fund working capital for reinsurance operations.

– 4:28 PM, October 24, 2025

VICEM Bút Sơn Cement Turns Profitable in Q3 Through Waste Management Solutions

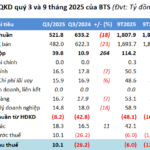

With over VND 18 billion in additional profits from waste treatment, VICEM But Son Cement turned a profit in Q3, reporting earnings of more than VND 10 billion. This marks the second consecutive profitable quarter after a 10-quarter loss streak. However, the company still faces accumulated losses of nearly VND 300 billion.

Phan Thiet – Phu Quy Route Drives SKG’s Q3 Profit Turnaround

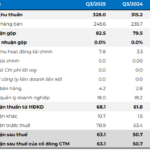

Superdong – Kien Giang JSC (HOSE: SKG) reported a Q3 profit of over VND 7.3 billion, a significant turnaround from the loss incurred in the same period last year. This impressive result was driven by a substantial increase in revenue across multiple routes, most notably the Phan Thiet – Phu Quy line.

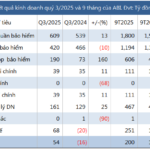

Agribank Insurance Turns Profitable in Q3

Following a third-quarter loss last year due to the impact of Typhoon Yagi, Vietnam Agricultural Bank Insurance Joint Stock Company (UPCoM: ABI) has rebounded to profitability in the third quarter of this year.