Following a recovery session amidst intense selling pressure, the market opened on November 22 with high polarization and low liquidity. However, strong selling pressure pushed the VN-Index back to lower levels, though it later rebounded effectively. By the close, the VN-Index gained 15.07 points (+0.91%), reaching 1,678.50 points. Foreign trading activity remained a downside, with net selling of VND 1,834 billion across the market.

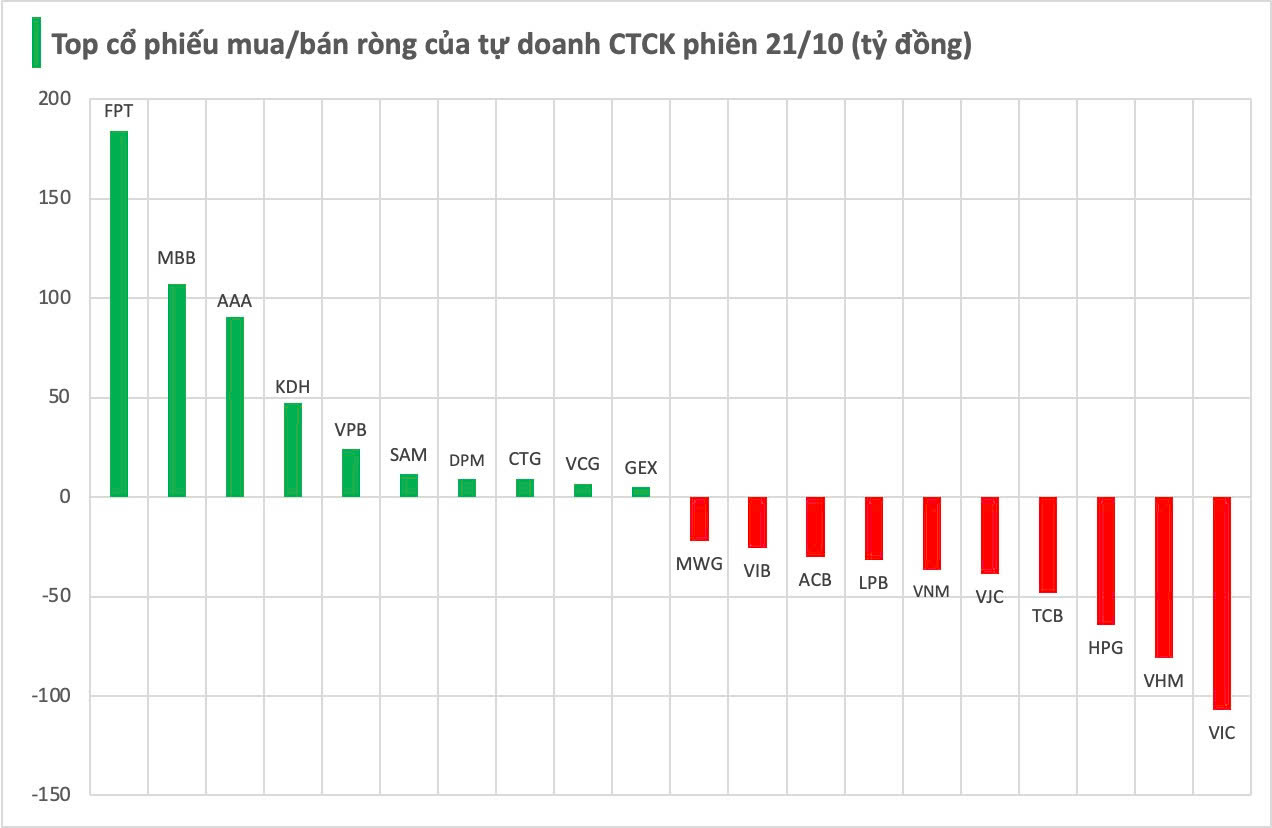

Securities firms’ proprietary trading desks net sold VND 177 billion on HOSE.

Specifically, securities firms were the heaviest net sellers in VIC, with a value of -VND 107 billion, followed by VHM (-VND 81 billion), HPG (-VND 64 billion), TCB (-VND 48 billion), and VJC (-VND 39 billion). Other stocks also saw notable net selling, including VNM (-VND 36 billion), LPB (-VND 32 billion), ACB (-VND 30 billion), VIB (-VND 26 billion), and MWG (-VND 22 billion).

On the flip side, FPT shares were the most heavily bought, with a net value of VND 184 billion. This was followed by MBB (VND 107 billion), AAA (VND 91 billion), KDH (VND 47 billion), VPB (VND 24 billion), SAM (VND 12 billion), DPM (VND 9 billion), CTG (VND 9 billion), VCG (VND 7 billion), and GEX (VND 5 billion).

Measuring the “Impact” of the Pullback Near the 1,600-Point Mark

The Vietnamese stock market is currently experiencing a pullback after reaching an all-time high of nearly 1,800 points last week. Despite this, even stocks that consistently broke price records are now inflicting significant “damage,” leaving many investors facing losses or reduced profits.

Vietstock Daily 24/10/2025: Cautious Sentiment Persists

The VN-Index extended its recovery streak to a third consecutive session, yet it remains below the Middle line of the Bollinger Bands, setting up a critical short-term test for the index. Trading volume continued to decline, falling below the 20-session average, indicating investors remain cautious amid the current rebound. The August 2025 low (around 1,605–1,630 points) is expected to serve as strong support should selling pressure resume in the near term.

The Steepest Stock Market Plunge in History: Unraveling the Causes Behind the Dramatic Crash

The trading session on October 20th marked the most significant single-day decline in the history of Vietnam’s stock market, with the VN-Index plunging dramatically. Analysts suggest the market’s reaction was unexpectedly severe, surpassing even the most pessimistic forecasts. However, investors should avoid panic; this downturn presents a strategic opportunity for portfolio restructuring, particularly for those who remain calm and hold sufficient cash reserves.